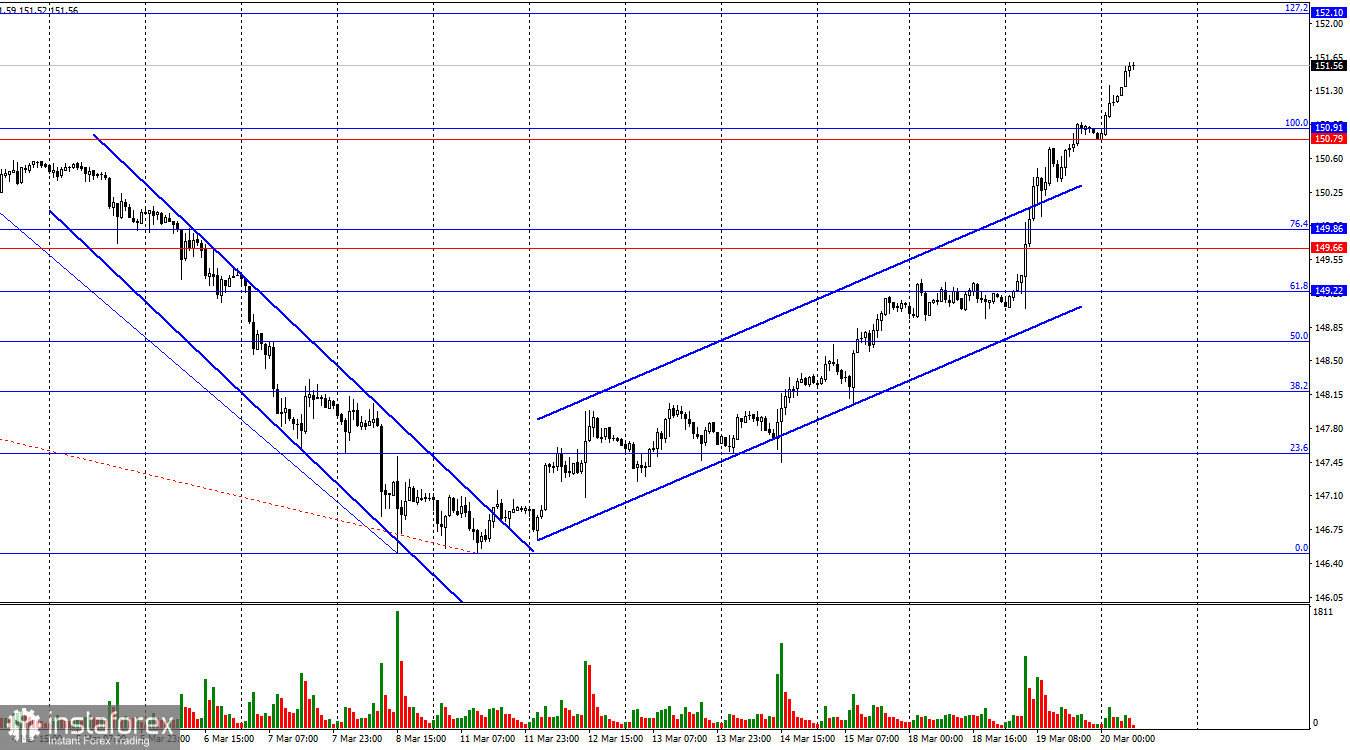

On the hourly chart, the USD/JPY pair continued its upward movement on Tuesday and consolidated first above the resistance zone of 149.66–149.86, and then above the zone of 150.79–150.91. Thus, the upward movement may continue today toward the corrective level of 127.2%–152.10. The strength of the US dollar's rise is so significant that quotes have moved above even the ascending trend corridor, which characterizes traders' sentiment as "bullish."

The wave situation recently does not raise questions. Exactly three waves were formed downward (one of them corrective), so a new "bullish" trend may be forming at the moment. The new upward wave easily surpassed the peak of the previous wave, so I have no reason to talk about the end of the "bullish" trend. For signs of its completion to appear, a new downward wave is required, which will break the low of March 11th. Or the next upward wave should not surpass the last peak, which has not even been formed yet, as the current wave is not complete.

On Tuesday night, the Bank of Japan held a meeting during which the decision to raise the interest rate from 0.1% to 0% was made. Despite the "hawkish" nature of the decision, the Japanese yen did not receive support from traders. The problem for the Japanese yen became the continuation of the accommodative policy of the Bank of Japan, aimed at increasing the money supply. In simpler terms, as the money supply grows, the yen depreciates, according to the law of supply and demand. The Bank of Japan also indicated that further monetary policy tightening is expected, but the current rate is much lower than in the United States. This is the main reason for the weakness of the yen against the dollar. Also, Japan practices currency interventions to stabilize the exchange rate. In the near future, the Bank of Japan may start implementing them as the yen continues to plummet.

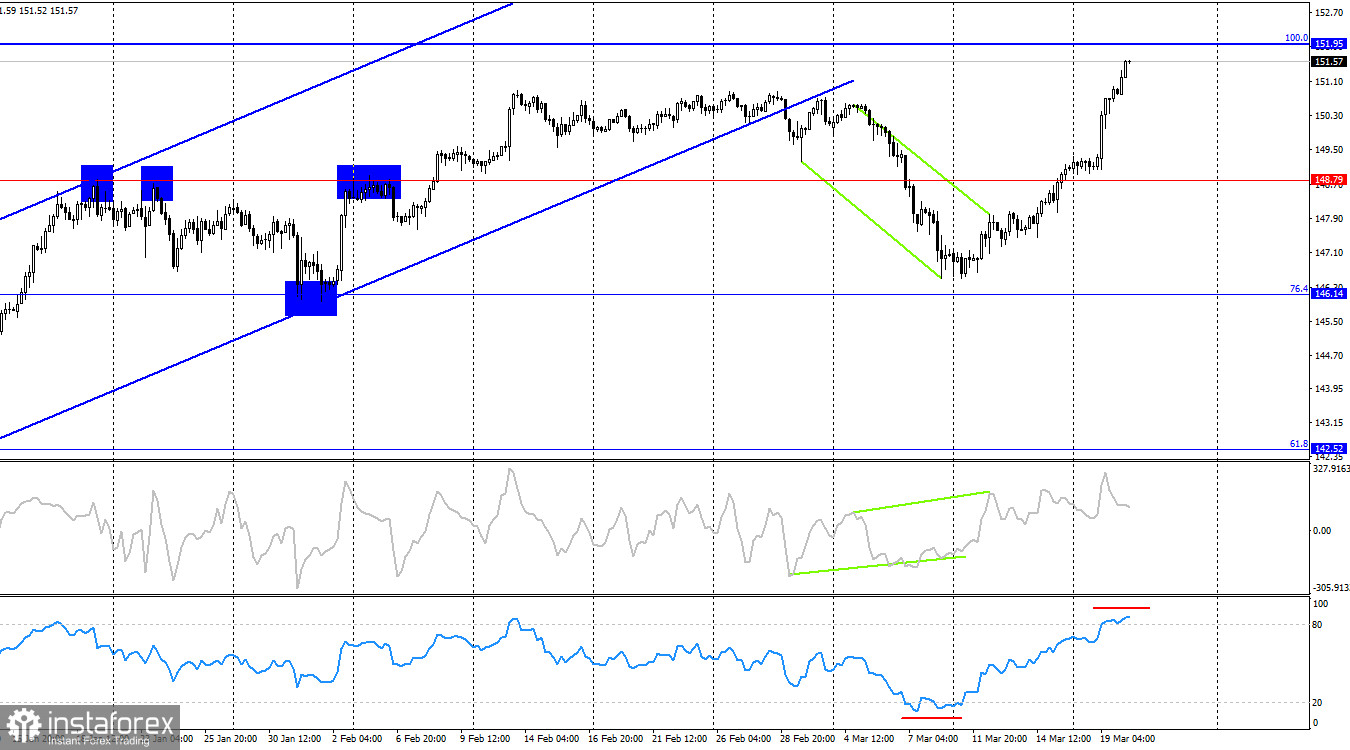

On the 4-hour chart, the pair has made a new reversal in favor of the US dollar and consolidated above the level of 148.79. Thus, the upward movement may continue towards the next corrective level of 100.0% at 151.95, which we are observing now. After consolidating below the ascending trend corridor, bears were in a more advantageous position for a couple of days, but on the hourly chart, bulls are leading, supported by the information background. If the pair's rate is fixed above the level of 151.95, the probability of further growth towards the next Fibonacci level of 127.2% at 158.66 will increase.

Commitments of Traders (COT) report:

The sentiment of the "Non-commercial" trader category became slightly less "bearish" over the last reporting week. The number of long contracts held by speculators increased by 252 units, while the number of short contracts decreased by 16,269 units. The overall sentiment of major players remains "bearish," and the advantage of sellers is enormous. There is almost a threefold gap between the number of long and short contracts: 55,000 against 157,000.

In my opinion, the yen still has excellent prospects for further decline, but the strong gap between long and short contracts may also indicate the proximity of the end of the "bearish" trend for the Japanese currency. In other words, bullish speculators may start retreating from the market. On the 4-hour chart, we already see an important break of the "bullish" trend, but in the short term, the dollar may continue to rise.

News Calendar for the US and Japan:

US – Fed Interest Rate Decision (18:00 UTC).

US – Fed Economic Projections (18:00 UTC).

US – Fed Rate Forecasts (18:00 UTC).

US – Fed Press Conference (18:30 UTC).

Japan – Trade Balance (23:50 UTC).

On Wednesday, the economic events calendar contains several entries that are more likely to support the dollar. The bulls may continue to attack today. The impact of the information background on market sentiment for the remaining part of the day can be very strong.

Forecast for USD/JPY and Trader Recommendations:

Today, the yen can be considered on the rebound from the levels of 151.95 on the 4-hour chart or from 152.10 on the hourly chart with a target of 150.90. Purchases were possible when closing above the level of 148.55 on the hourly chart and when closing above the level of 148.79 on the 4-hour chart with targets at 149.66 and 150.89. Both targets have been hit, and the upward movement continues; purchases can be maintained with a target of 151.95. Fixing above this level will allow holding purchases with targets at 152.10 and 153.63.