The upcoming week will be quite dull for the euro. Firstly, take note that market activity has been quite weak in recent months. The last 2-3 working days were just exceptions because the news background was very strong on those days, and market participants had to "step on it," so to speak. Secondly, all the most interesting events have already passed this month. We've seen three central bank meetings and learned about inflation data. Thirdly, the news background in the European Union over the next five days will be very weak.

In general, there's nothing to highlight. On Monday, European Central Bank President Christine Lagarde will speak, and on Tuesday, ECB Chief Economist Philip Lane will speak. And that's it. What can we expect from Lagarde on Monday? In my opinion, she won't announce anything new to the market. Most likely, we'll hear the standard set of phrases about how "inflation in the Eurozone will continue to decline," "at some point in the future, it will be appropriate to start lowering interest rates," "more evidence is needed to maintain the downward trajectory towards 2% inflation," "some risks to consumer prices persist," and "the potential rate cut in June will depend on economic data." The market already knows all of this, and Lagarde won't be able to convey anything more significant.

The same applies to Lane's speech. If there is no new economic data since the ECB meeting, then what will the members of the Governing Council comment on?

On the one hand, such a weak news background is bad. On the other hand, it's actually a good thing because nothing will interfere with the market operating solely based on wave analysis. Undoubtedly, not all market participants study waves, but waves are the foundation of the market, not some separate trading system. They show what is happening at the moment. Accordingly, the market can trade in accordance with the wave pattern, even without realizing it. I expect the euro to fall. A successful attempt to break the 1.0788 level, which equates to 76.4% Fibonacci, will indicate that the market is ready to sell.

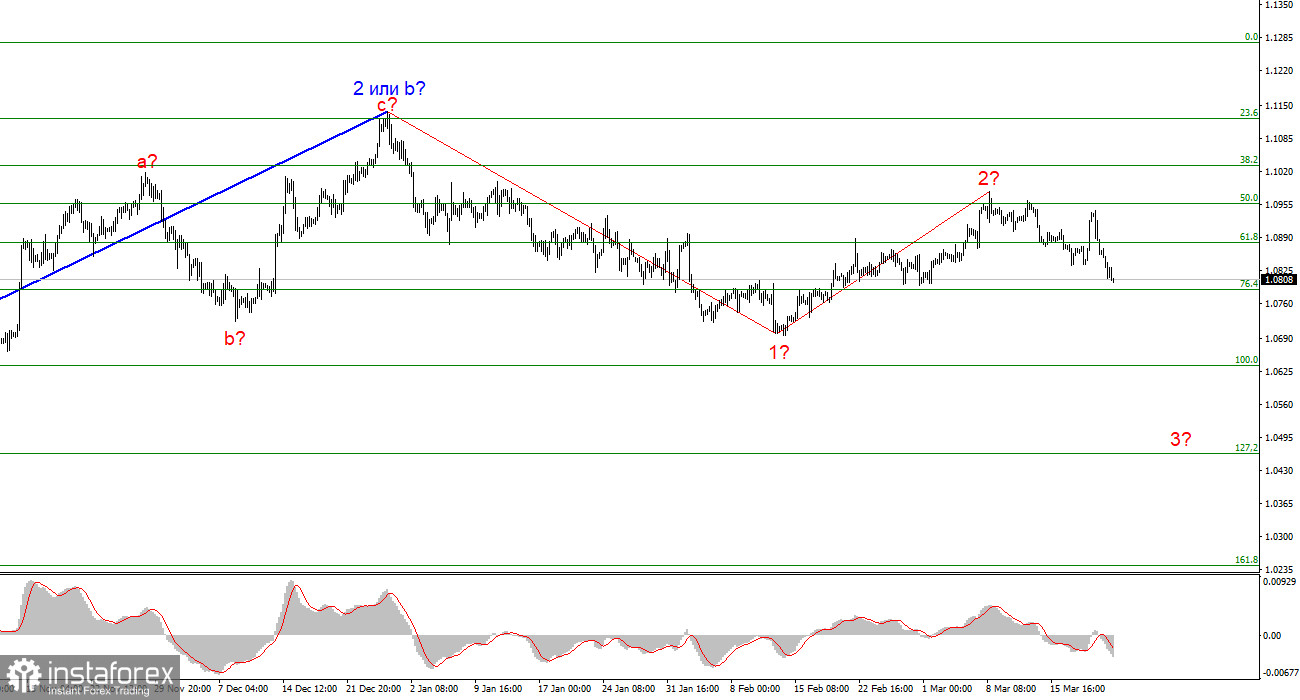

Wave analysis for EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that a bearish wave set is being formed. Wave 2 or b is complete, so in the near future, I expect an impulsive downward wave 3 or c to form with a significant decline in the instrument. An internal corrective wave is currently being formed, which could have already ended. I am considering short positions with targets near the 1.0462 mark, which corresponds to 127.2% according to Fibonacci.

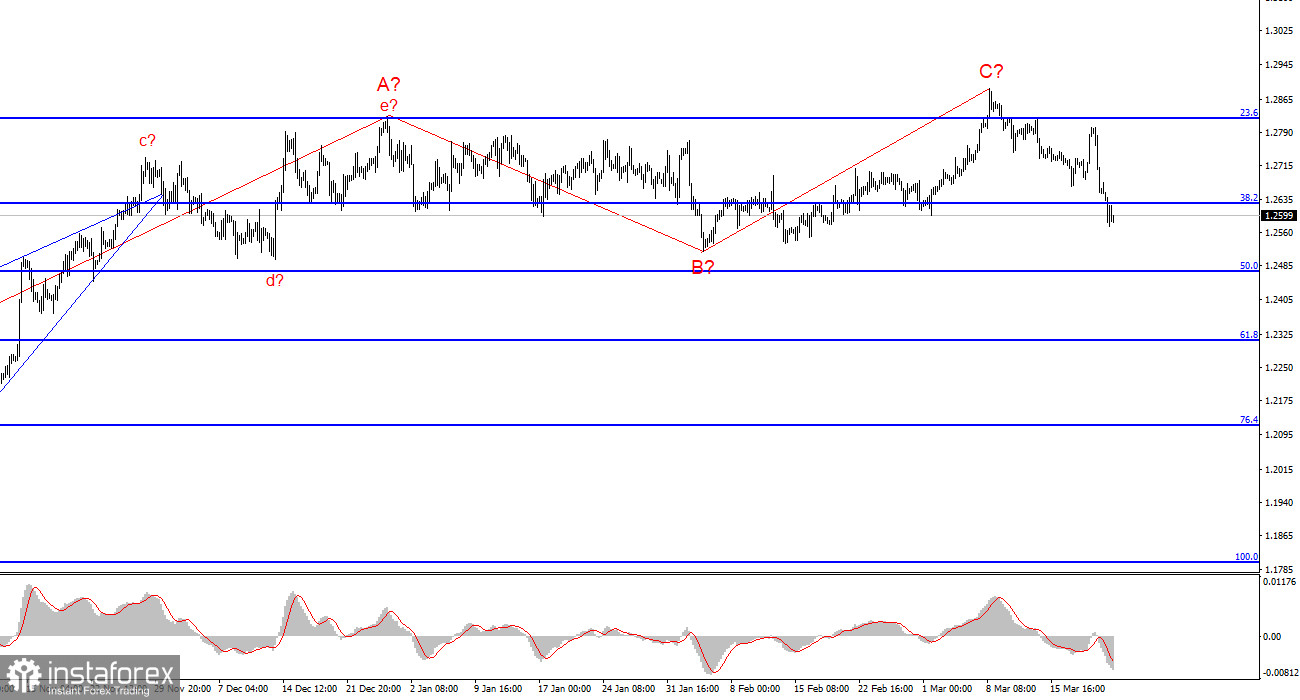

Wave analysis for GBP/USD:

The wave pattern of the GBP/USD instrument suggests a decline. I am considering selling the instrument with targets below the 1.2039 level, because I believe that wave 3 or c will start sooner or later. However, unless wave 2 or b ends, the instrument can still rise to the level of 1.3140, which corresponds to 100.0% Fibonacci. The construction of wave 3 or c may have already started, but the quotes haven't moved far away from the peaks, so we cannot confirm this.

Key principles of my analysis:

Wave structures should be simple and understandable. Complex structures are difficult to work with, and they often bring changes.

If you are not confident about the market's movement, it would be better not to enter it.

We cannot guarantee the direction of movement. Don't forget about Stop Loss orders.

Wave analysis can be combined with other types of analysis and trading strategies.