Will verbal interventions help the yen? After it became known that the Bank of Japan intends to move towards normalizing monetary policy at a turtle's pace, USD/JPY bulls got down to business. They brought the pair closer to October 2022 levels within arm's reach, which are the highest in 32 years. Official Tokyo couldn't tolerate this, hinting at intervening in the Forex market. Will the government's rhetoric stop buyers of the analyzed pair?

According to Masato Kanda, Japan's Vice Minister of Finance for International Affairs, USD/JPY has experienced fluctuations of 4% in just the past couple of weeks. This looks strange and does not reflect the fundamentals. The movements of the yen are speculative in nature, and the government is ready to react accordingly. Finance Minister Shunichi Suzuki did not rule out any measures to restrain the weakness of the Japanese currency. Excessive volatility disrupts business plans, which harms the economy.

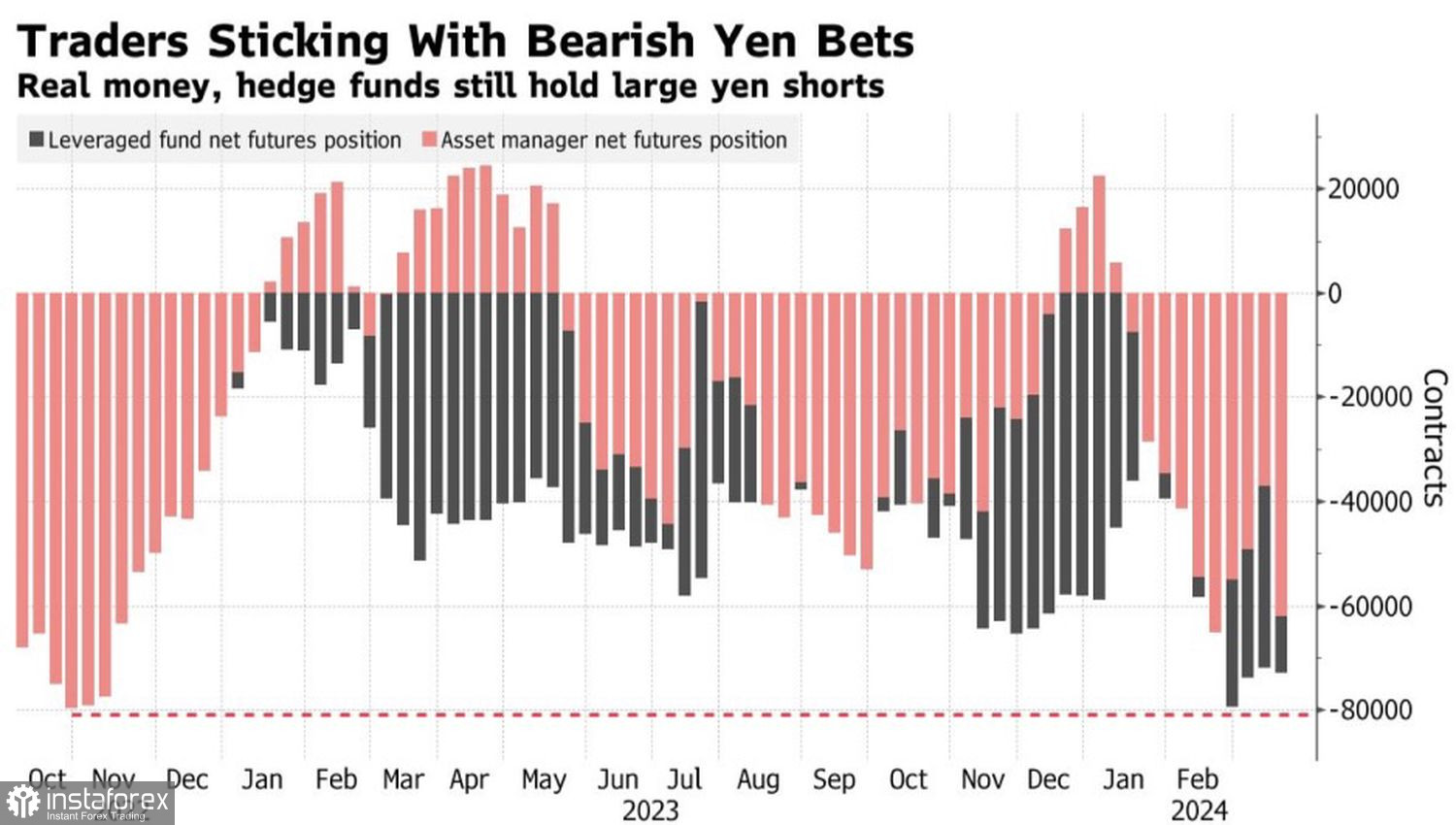

Dynamics of Speculative Positions on the Yen

Investors consider the level of 152 for USD/JPY as a kind of red line, crossing which will replace verbal interventions with currency interventions. Meanwhile, speculators are ready to test the resolve of official Tokyo. Both asset managers and hedge funds are increasing their shorts on the yen, and the cost of hedging associated risks has soared to its highest level since January 2022.

Thus, the confrontation between the markets and the authorities is about to reach its peak, but in reality, a more significant factor for USD/JPY is when exactly the Bank of Japan will continue the cycle of normalizing monetary policy. Judging by the acceleration of consumer prices from 2.2% to 2.8% in February, it has all the necessary grounds for this. Although core inflation slowed from 3.5% to 3.2%, it is still at elevated levels.

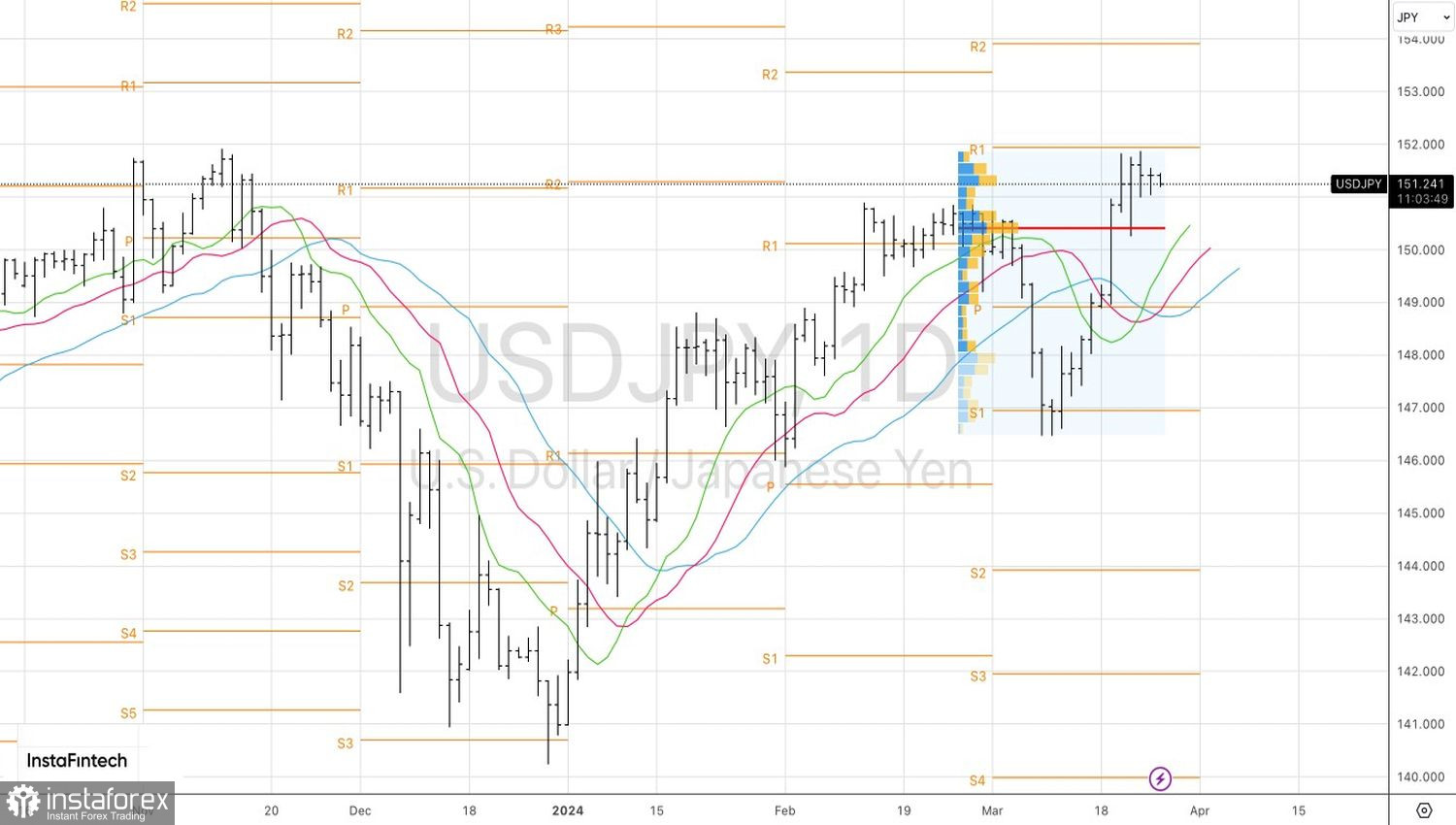

Dynamics of USD/JPY and the Cost of Hedging the Risks of a Weakening Yen

According to 62% of 47 Bloomberg experts, the BoJ will raise the overnight rate for the second time from June to October. 26% forecast this will happen in the second month of autumn, while 23% prefer July. The consensus estimate assumes that borrowing costs will rise from zero to 0.25% by the end of 2024.

USD/JPY purchases are also supported by investors' doubts that the Fed will cut the federal funds rate three times this year. Despite the fact that the FOMC forecast median points to this, 9 out of 19 Committee members see two or fewer steps towards monetary expansion, which supports the U.S. dollar against major world currencies. Bloomberg experts expecting borrowing costs to drop from 5.5% to 5% are also inclined to the same opinion.

Technically, on the daily chart of USD/JPY, an internal doji bar was formed. It is being played out by supplying deferred purchase orders for the pair from 151.55 and selling from 151.05. The strategy can be repeated 1-2 times upon closing with a stop order.