Trade analysis and tips for trading the Japanese yen

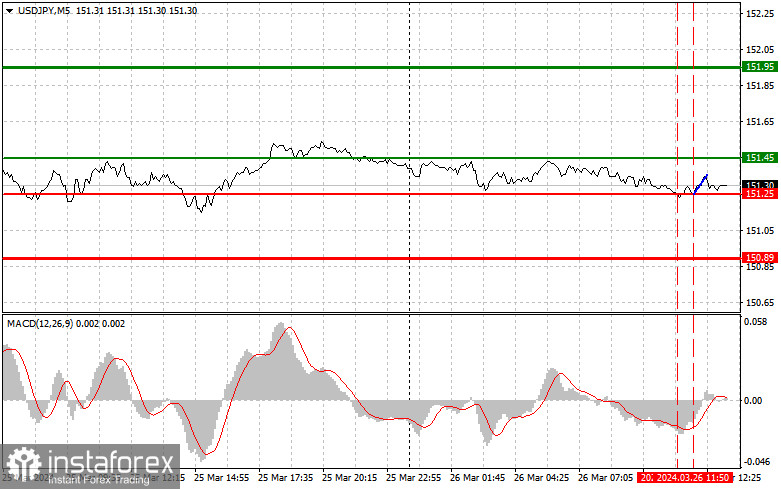

The first test of the price at 151.25 occurred when the MACD had significantly declined from the zero mark, and selling the dollar against the trend on this setup was not particularly desirable. After a short period, another test took place at 151.25, and the MACD was already recovering from the oversold zone, allowing entry into buying the dollar. At the time of writing the article, there was no significant growth, but the chances remain as trading continues in a sideways channel. Much depends on US statistics: changes in durable goods orders, the housing price index, and the consumer confidence indicator will determine the direction of the pair. Weak data is a reason to sell the dollar, while strong reports can support the bullish trend in the market. As for the intraday strategy, I will rely more on scenarios #1 and #2.

Buy Signal

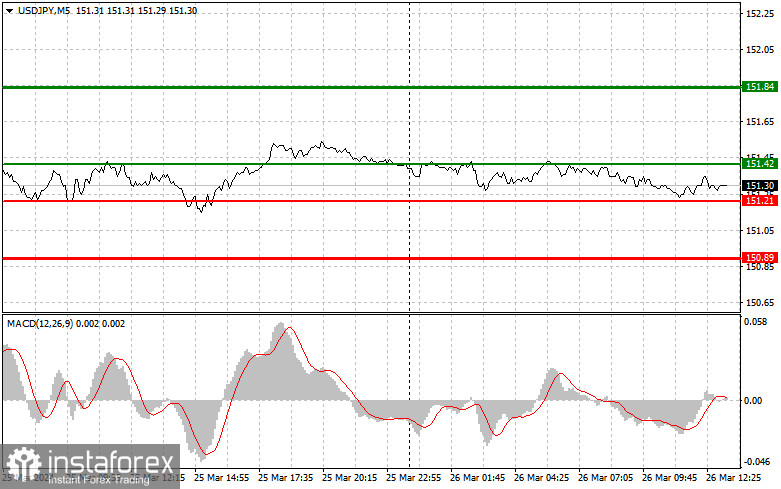

Scenario #1: Today, I plan to buy USD/JPY when the entry point reaches around 151.42 (green line on the chart) with a target for growth to the level of 151.84 (thicker green line on the chart). At 151.84, I will exit purchases and open sales in the opposite direction (expecting a movement of 30-35 points in the opposite direction from the level). Counting on the pair's rise today will be a continuation of the uptrend. Important! Before buying, make sure that the MACD indicator is above the zero mark and is just starting to rise from it.

Scenario #2: I also plan to buy USD/JPY today in case of two consecutive tests of the price at 151.21 when the MACD indicator is in the oversold area. This will limit the downward potential of the pair and lead to a market reversal upwards. Expect a rise to the opposite levels of 151.42 and 151.84.

Sell Signal

Scenario #1: Today, I plan to sell USD/JPY after updating the level of 151.21 (red line on the chart), which will lead to a rapid decline in the pair. The key target for sellers will be the level of 150.89, where I will exit sales and also open purchases in the opposite direction (expecting a movement of 20–25 points in the opposite direction from the level). Pressure on the pair will return in the case of weak statistics from the US and an unsuccessful attempt to break above the local maximum. Important! Before selling, make sure that the MACD indicator is below the zero mark and is just starting to decline from it.

Scenario #2: I also plan to sell USD/JPY today in case of two consecutive tests of the price at 151.42 when the MACD indicator is in the overbought area. This will limit the upward potential of the pair and lead to a downward market reversal. Expect a decline to the opposite levels of 151.21 and 150.89.

On the Chart:

Thin green line - entry price for buying the trading instrument.

Thick green line - the expected price where you can set Take Profit or manually take profits, as further growth above this level is unlikely.

Thin red line - entry price for selling the trading instrument.

Thick red line - expected price where you can set Take Profit or manually take profits, as further decline below this level is unlikely.

MACD indicator. When entering the market, it is important to follow the overbought and oversold zones.

Important. Beginner traders in the forex market should be very cautious when making entry decisions. It's best to stay out of the market before major fundamental reports to avoid being caught in sharp exchange rate fluctuations. If you decide to trade during news releases, always place stop orders to minimize losses. You need to set stop orders to lose your entire deposit quickly, especially if you don't use money management and trade large volumes.

And remember, successful trading requires a clear trading plan, like the one I presented above. Spontaneous trading decisions based on the current market situation are initially a losing strategy for an intraday trader.