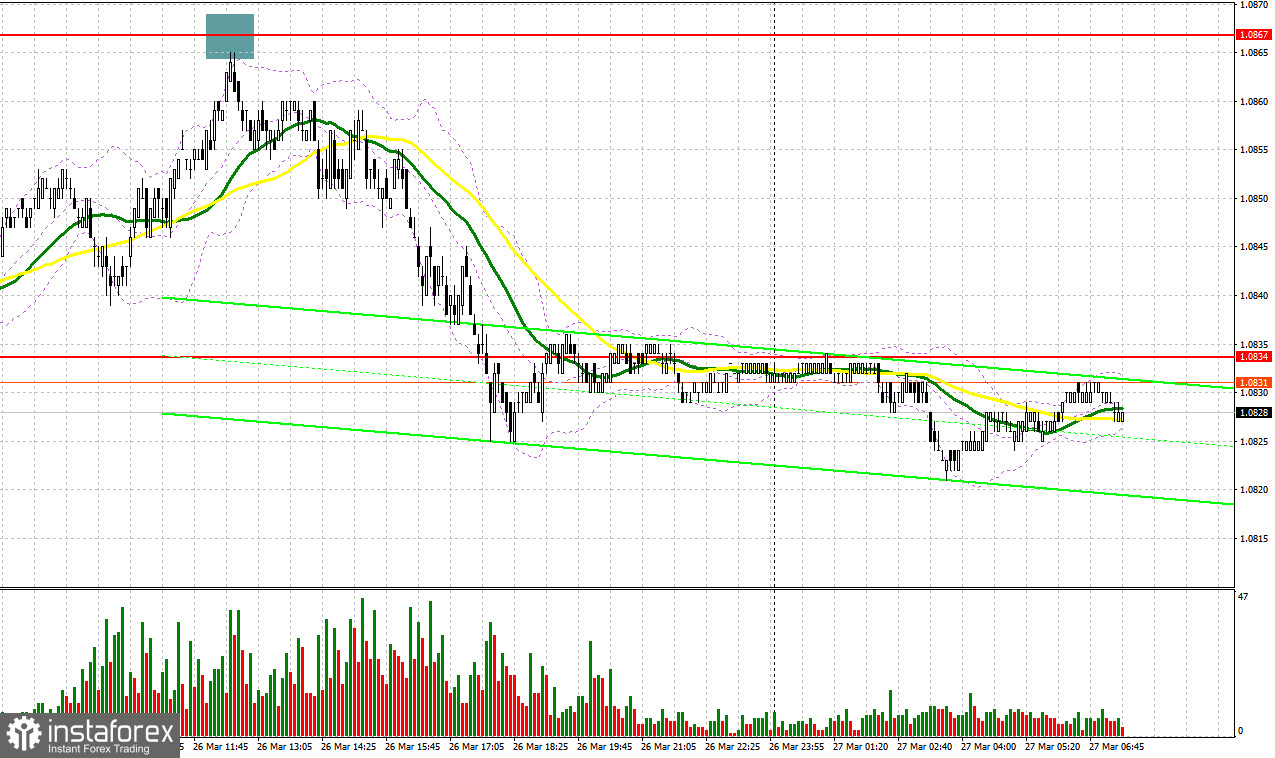

Yesterday, only one signal to enter the market was generated. Let's take a look at the 5-minute chart and figure out what happened there. In my previous forecast, I paid attention to the level of 1.0834 and planned to make decisions on entering the market from there. EUR/USD actually declined, but no false breakout formed there. For this reason, no suitable entry points into the market were created. In the afternoon, growth to the area of 1.0867 allowed us to enter the market with short positions. As a result, the currency pair fell by 30 pips.

What is needed to open long positions on EUR/USD

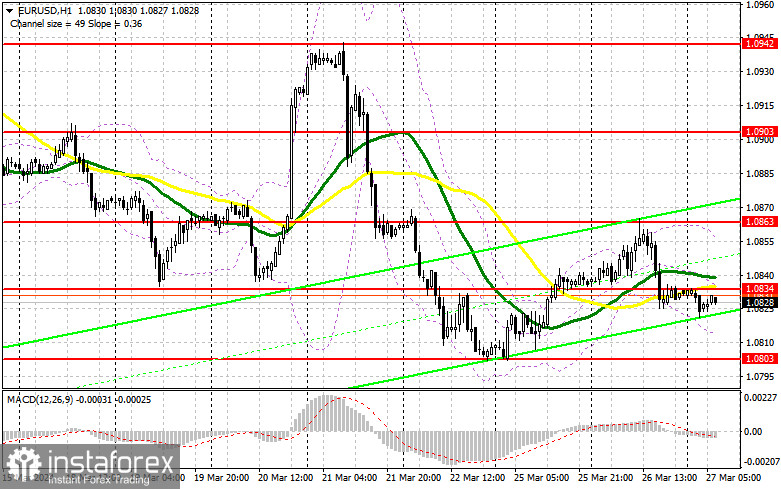

Solid data from the US released yesterday, in particular the fact that consumer confidence remained at the same level despite stubborn inflation, returned pressure on the euro and encouraged the strengthening of the US dollar. The same trend may continue today. In the first half of the day, several ECB policymakers, namely, Piero Cipollone and Frank Elderson, are due to speak. The dovish tone of policymakers may entail a sell-off of the euro and buying the US dollar. Weak data on the consumer confidence indicator for the Eurozone will have the same effect. Spain's CPI will not play any role in determining the direction of the instrument. I would prefer to act against the bearish trend, which can continue its development at any time, during a decline, after a false breakout in the support area of 1.0803. Only this will be a suitable option for buying in anticipation of a correction to the area of 1.0834 which acts as resistance formed yesterday, where moving averages are located, playing on the side of sellers. A breakout and update from top to bottom of this range will lead to a strengthening of EUR/USD with a chance of a breakout of 1.0863. The farthest target will be a high of 1.0903, where I will take profit. Bearing in mind a further decline in EUR/USD and lack of activity in the area of 1.0803 in the first half of the day, selling pressure on the euro will only escalate, which will lead to a further fall with the prospect of updating 1.0763. I plan to enter the market there only after a false breakout. I will open long positions immediately during a dip at 1.0735, reckoning an upward correction of 30-35 pips within the day.

What is needed to open short positions on EUR/USD

The euro's recovery is coming to an end. In case of another growth of EUR/USD in the first half of the day, the focus will be shifted to protecting the nearest resistance at 1.0834, where a false breakout together with the dovish speech of ECB representatives will prove the presence of large sellers in the market and will provide a good entry point into short positions with the prospect of updating new support 1.0803. A breakout and consolidation below this range, as well as a reverse test from bottom to top, will provide another selling point followed by a drop of the pair to the area of 1.0763, where buyers will enter the market more actively. The lowest target will be at least 1.0735, where I will take profits. If EUR/USD moves upward in the first half of the day and if there are no bears at 1.0834, the buyers will have a chance to lock the instrument in a sideways channel. In this case, I will postpone selling until the test of the next resistance 1.0863. I will also sell there, but only after unsuccessful consolidation. I plan to open short positions immediately during a rebound from 1.0903, reckoning a downward intraday correction of 30-35 pips.

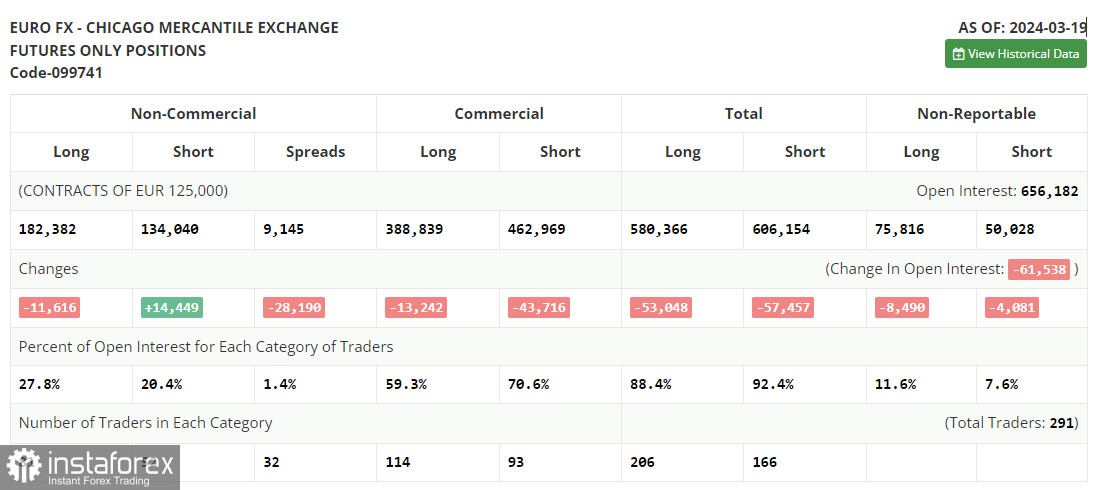

The COT (Commitment of Traders) report for March 19 showed a decrease in long positions and an increase in short positions. Given the past meeting of the Federal Reserve when the ongoing monetary policy was maintained without changes, such trading sentiment on EUR/USD is not surprising. Meanwhile, ECB policymakers are regularly hinting at a steady slowdown in inflation in the Eurozone. This will allow the regulator to come close to easing monetary policy by the summer. For this reason, I bet on further development of the bullish trend in the US dollar and a decline in the euro. The COT report showed that long non-commercial positions fell by 11,616 to 182,382, while short non-commercial positions jumped by 14,449 to 134,040. As a result, the spread between long and short positions narrowed by 28,190.

Indicators' signals

Moving averages

The instrument is trading below the 30 and 50-day moving averages. It indicates a further decline in EUR/USD.

Note: The period and prices of the moving averages are considered by the analyst on the 1-hour chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

In case EUR/USD goes down, the indicator's lower border at about 1.0815 will act as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.