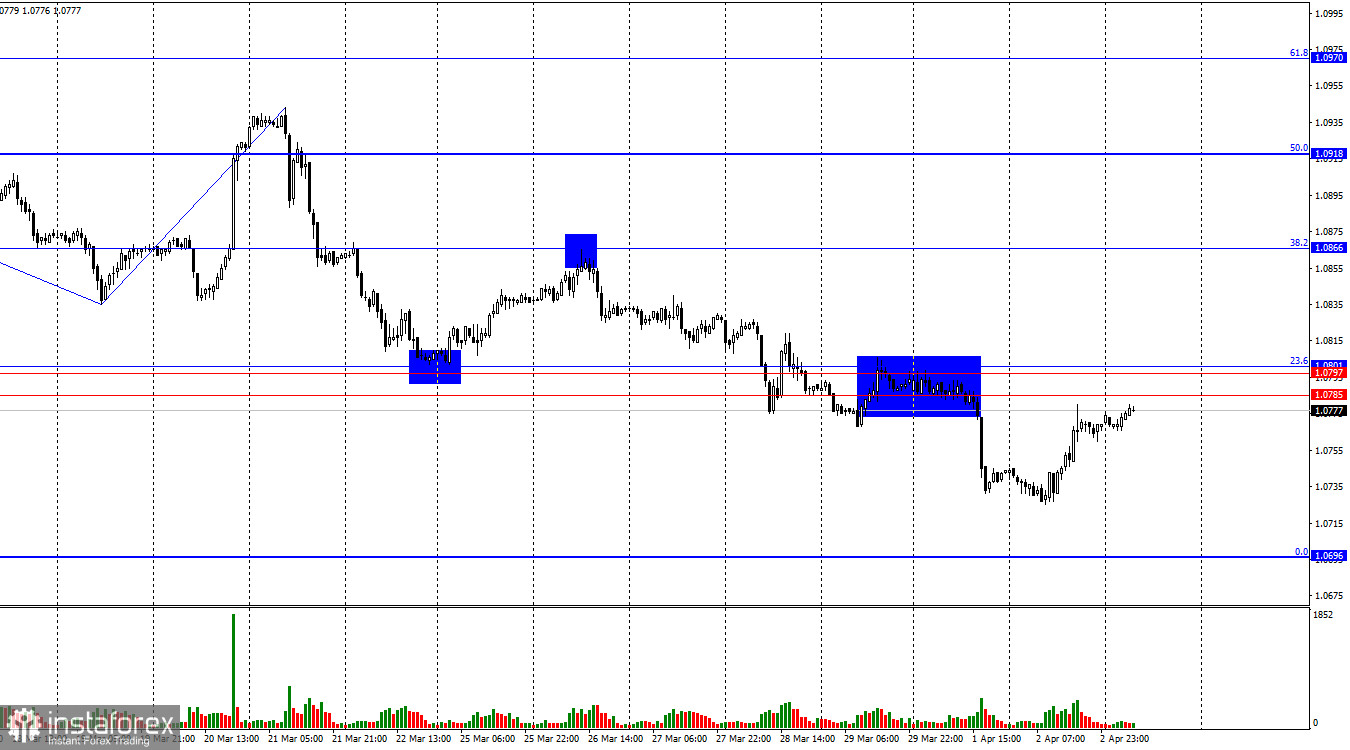

The EUR/USD pair executed a reversal in favor of the European currency on Tuesday and returned to the resistance zone of 1.0785–1.0801. A rebound of quotes from this zone today will again work in favor of the US dollar, with some decline towards the corrective level of 0.0%–1.0896. Consolidation of the pair's rate above the zone of 1.0785–1.0801 will increase the probability of further euro growth towards the next corrective level of 38.2%–1.0866.

The wave situation remains quite clear. The last completed upward wave failed to break the peak of the previous wave (from March 8), and the next downward wave broke the low of the previous wave (from March 19) and continues to form. Thus, we are currently dealing with a "bearish" trend, and at the moment there is no sign of its completion. For such a sign to appear, the new upward wave must break the current last peak (from March 21). For this to happen, bulls need to raise the pair by another 170 pips. Until that moment, I expect the decline in quotes to continue.

The news background on Tuesday was as interesting as on Monday, but with a "minus" sign for the dollar. In fact, I don't see any reports that could have caused the euro to rise on Tuesday. Inflation in Germany fell to 2.2% y/y, as traders expected. The JOLTS report on job openings in the US turned out to be higher than the market expected. The decline in inflation in Germany means that the ECB is getting one step closer to lowering rates in June. Thus, this report should have rather supported bearish traders. Only two reports were published, and both supported the US dollar. But we saw the euro rise. Today, the decline of the European currency may resume as bulls correct the pair upward.

On the 4-hour chart, the pair broke through the Fibonacci level of 38.2%–1.0765 and may continue the downward process toward the next corrective level of 23.6%–1.0644. There are no imminent divergences observed with any indicator today. A stop or reversal in favor of the euro may occur only around the level of 1.0696, which is the low from February 14.

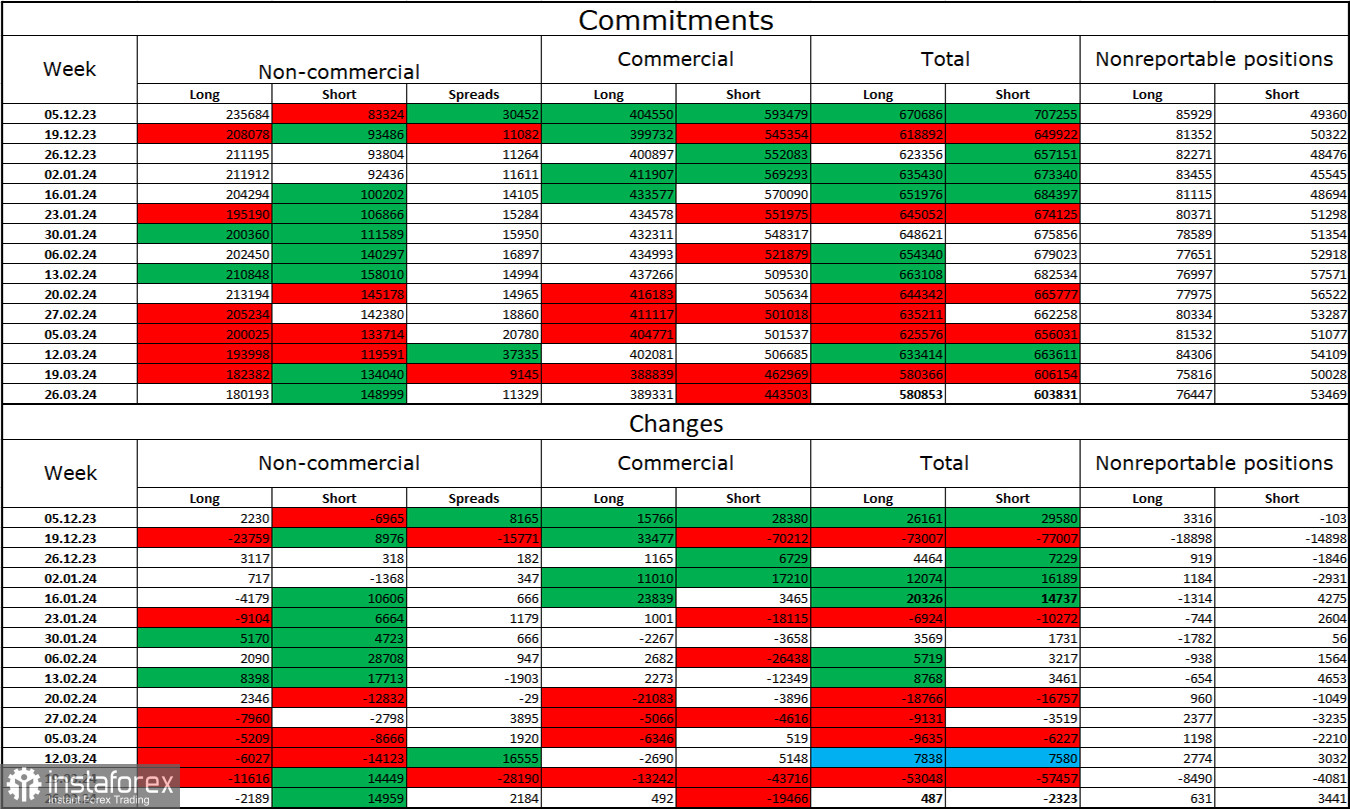

Commitments of Traders (COT) report:

During the last reporting week, speculators closed 2189 long contracts and opened 14959 short contracts. The sentiment of the "non-commercial" group remains "bullish" but continues to weaken rapidly. The total number of long contracts held by speculators is now 180 thousand, and short contracts – 149 thousand. I still believe that the situation will continue to change in favor of bears. In the second column, we see that the number of short positions has increased from 83 thousand to 149 thousand over the past 2.5 months. Over the same period, the number of long positions decreased from 235 thousand to 180 thousand. Bulls have dominated the market for too long, and now they need a strong news background to resume the "bullish" trend. In the near future, I don't see such a background.

News Calendar for the US and the EU:

EU – Consumer Price Index (09:00 UTC).

EU – Unemployment Rate (09:00 UTC).

US – ADP Nonfarm Employment Change (12:15 UTC).

US – ISM Non-Manufacturing PMI (13:45 UTC).

US – ISM Non-Manufacturing PMI (14:00 UTC).

US – Speech by Federal Reserve Chairman Jerome Powell (16:10 UTC).

On April 3, the economic events calendar contains several important entries, including inflation, the ISM index, and Powell's speech. The impact of the news background on traders' sentiment can be strong.

Forecast for EUR/USD and trader recommendations:

Sales of the pair were possible on a rebound from the support zone of 1.0785–1.0801 on the hourly chart with a target of 1.0696. Today, it is possible to open sales again on a rebound from this zone. Purchases of the pair are possible when consolidating above the zone of 1.0785–1.0801 on the hourly chart with a target of 1.0866.