In my morning forecast, I pointed out the level of 1.0790 and planned to make decisions regarding market entry based on it. Let's look at the 5-minute chart and analyze what happened there. Growth occurred, but we never reached the formation of a false breakout. Despite the released statistics on the Eurozone, volatility remained extremely low, which prevented us from finding suitable entry points into the market. The technical picture remained unchanged for the second half of the day.

For opening long positions on EUR/USD, the following is required:

The released data on the slowdown in inflation growth in the Eurozone to 2.4% from 2.6% in February of this year was completely ignored by traders. But in fairness, it should be noted that these data also significantly limited the pair's upward potential observed since yesterday. Ahead, I expect a series of reports on changes in employment in the US from ADP and the ISM Non-Manufacturing PMI. A strong labor market will benefit the dollar, as will a strong services sector, which has been driving the entire economy lately. Also, we should remember the speeches of another series of FOMC representatives, namely Austan D. Goolsbee and Michael S. Barr. The day will end with the beloved chairman of the Federal Reserve Board, Jerome Powell, whose statements could lead the euro back to growth—especially considering Powell's recent tendency towards accommodating policies. I plan to act on the decline after the formation of a false breakout around the new support level of 1.0758, formed based on yesterday's results. There are also moving averages playing in favor of buyers. This will be a suitable option for purchases aiming for a correction to the 1.0790 area. Breaking and updating this range from top to bottom will strengthen the pair, with a chance of surging to 1.0826. The ultimate target will be a maximum of 1.0863, where I will take a profit. In the case of a decline in EUR/USD and the absence of activity around 1.0758 in the second half of the day, the pressure on the euro will only intensify, leading to further decline with the prospect of revisiting 1.0726. I plan to enter the market there only after the formation of a false breakout. I will consider opening long positions immediately on a rebound from 1.0696, with a target of a 30-35 point upward correction within the day.

For opening short positions on EUR/USD, the following is required:

Euro sellers had a chance, but they have yet to use it. Apparently, traders are still wary of the soft rhetoric from the Fed representatives yesterday. Given the lack of volatility, it's best to act on sales on the rise at more attractive prices. The formation of a false breakout around 1.0790, together with Powell's ambiguous message, will demonstrate the presence of large sellers in the market, providing a good entry point for short positions with the prospect of revisiting support at 1.0758. Breaking and holding below this range, as well as a reverse test from bottom to top, will provide another selling point with a pair downturn towards 1.0726—weekly lows, where buyers will become more active. The ultimate target will be a minimum of 1.0696, where I will take a profit. In the event of an upward movement in EUR/USD in the second half of the day, as well as the absence of bears at 1.0790, buyers will have a chance to build an upward correction. In this case, I will postpone sales until testing the next resistance at 1.0826. I will also sell there, but only after an unsuccessful consolidation. I plan to open short positions immediately on a rebound from 1.0863, with a target of a 30-35 point downward correction.

Indicator Signals:

Moving Averages

Trading is above the 30 and 50-day moving averages, indicating euro growth.

Note: The author considers the period and prices of moving averages on the hourly chart (H1) and differs from the general definition of classical daily moving averages on the daily chart (D1).

Bollinger Bands

In case of a decline, the lower boundary of the indicator, around 1.0758, will act as support.

Indicator Description

• Moving Average (determines the current trend by smoothing volatility and noise). Period 50. Marked on the chart in yellow.

• Moving Average (determines the current trend by smoothing volatility and noise). Period 30. Marked on the chart in green.

• MACD Indicator (Moving Average Convergence/Divergence). Fast EMA period 12. Slow EMA period 26. SMA period 9.

• Bollinger Bands. Period 20.

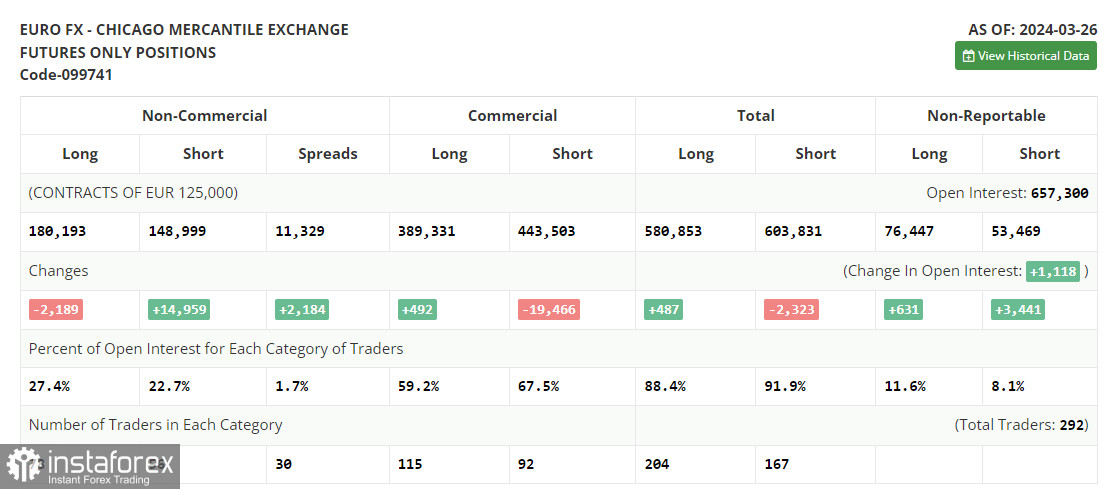

• Non-commercial traders - speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

• Long non-commercial positions represent the total long open positions of non-commercial traders.

• Short non-commercial positions represent the total short open position of non-commercial traders.

• The total non-commercial net position is the difference between the short and long positions of non-commercial traders.