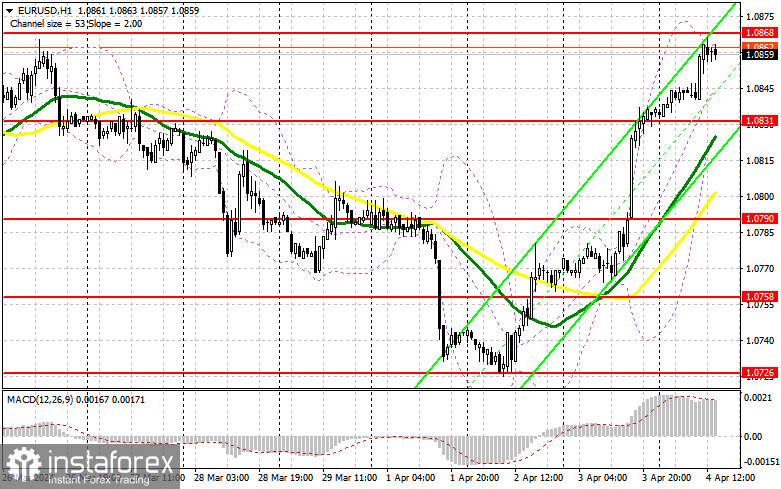

In my morning forecast, I paid attention to the 1.0863 level and planned to make decisions on entering the market from it. Let's look at the 5-minute chart and figure out what happened there. The growth and formation of a false breakdown there at this level gave an excellent entry point into short positions, but due to good data on the eurozone, it never came to a major drop in the pair. For this reason, I decided to exit the market and slightly revise the technical picture for the afternoon.

To open long positions on EURUSD, you need:

Pretty good data on PMI indices for the services sector of the eurozone countries, especially Germany, allowed euro buyers to maintain their positions in the market, which saved the pair from a major sell-off, which I mentioned in the morning forecast. But we have another series of important reports ahead that can affect the market direction, but this time for the United States. Figures are expected for the weekly number of initial applications for unemployment benefits and the foreign trade balance. Weak data is a reason to buy the euro further along a new upward trend. We will also have presentations by FOMC members in the person of Austan D. Goolsby, Loretta Mester and Thomas Barkin. The harsh tone of politicians in the style of "wait and see" can bring back pressure on the euro, which I'm going to use. I plan to act on a decline after the formation of a false breakdown in the area of the new support of 1.0831, formed following the results of yesterday. There are also moving averages that play on the buyers' side. Only this will be a suitable option for purchases based on a repeated resistance test of 1.0868, above which it has not yet been possible to get out. A breakout and a top-down update of this range will lead to a strengthening of the pair with a chance of a breakthrough to 1.0903. The farthest target will be a maximum of 1.0942, where I will record profits. With the option of a decrease in EUR/USD and a lack of activity around 1.0831 in the afternoon, the pressure on the euro will only increase, which will lead to a fall with the prospect of an update to 1.0790, where I expect the manifestation of larger buyers. I plan to enter the market there only after the formation of a false breakdown. I will open long positions immediately for a rebound from 1.0758 with the aim of an upward correction of 30-35 points within the day.

To open short positions on EURUSD, you need:

The sellers of the euro had a chance, but they did not take full advantage of it. Now it is best to shift the focus to the new resistance of 1.0868 and to its protection after the release of statistics on the United States, which has not particularly pleased traders lately. Only strong data and the formation of a false breakdown in the area of 1.0868 will allow you to get a sell signal, which will lead to the pair falling to the area of 1.0831. A breakout and consolidation below this range, as well as a reverse test from the bottom up, will give another selling point with the collapse of the pair to the area of 1.0790, where buyers will begin to act more actively. The farthest target will be a minimum of 1.0758, where I will record profits. In the case of an upward movement of EUR/USD in the afternoon, as well as the absence of bears at 1.0868, which is more likely, buyers will get a chance to further build an uptrend. In this case, I will postpone sales until the test of the next resistance of 1.0903. I will also sell there, but only after an unsuccessful consolidation. I plan to open short positions immediately on a bounce from 1.0942 with a target of a 30-35 point downward correction.

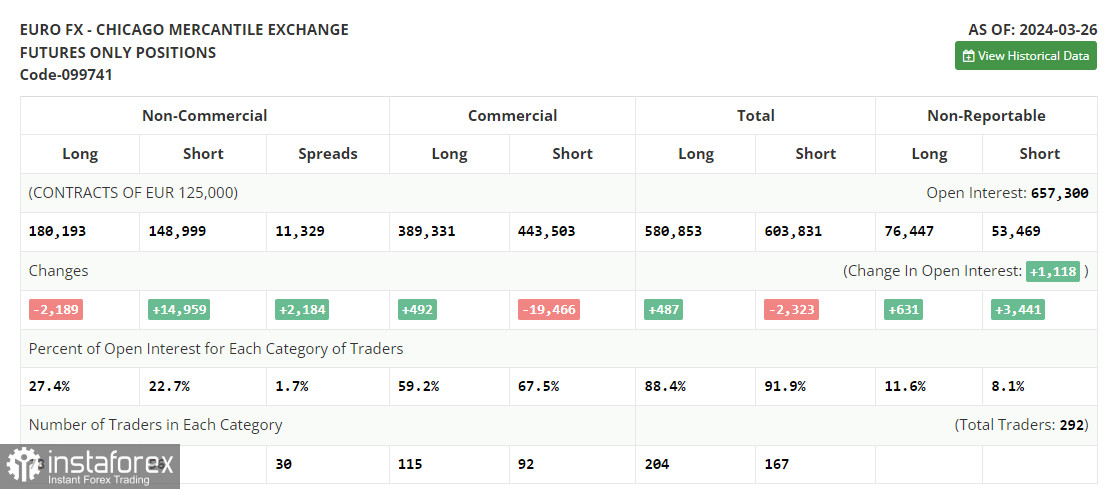

In the COT report (Commitment of Traders) for March 26th, there was a decrease in long positions and an increase in short positions. Despite the recent Federal Reserve meeting and the dovish tone of committee members, no one is ready to abandon the sale of risk assets until US inflation returns to decline, as seen from the report. Given the recent statements from European Central Bank representatives, increasingly hinting at active inflation reduction in the eurozone and a possible quick abandonment of high-interest rates, the euro has no chances left. For this reason, I'm betting on further development of the bullish trend for the US dollar and a decline in the euro. The COT report indicates that non-commercial long positions fell by 2,189 to 180,193, while non-commercial short positions jumped by 14,959 to 148,999. As a result, the spread between long and short positions increased by 2,184.

Indicator Signals:

Moving Averages

Trading is conducted above the 30 and 50-day moving averages, indicating a rise in the euro.

Note: The author considers the period and prices of moving averages on the hourly chart H1, and they differ from the general definition of classical daily moving averages on the daily chart D1.

Bollinger Bands

In case of a decline, the lower boundary of the indicator at around 1.0815 will act as support.

Description of Indicators:

- Moving Average (determines the current trend by smoothing out volatility and noise). Period – 50. Marked on the chart in yellow.

- Moving Average (determines the current trend by smoothing out volatility and noise). Period – 30. Marked on the chart in green.

- MACD Indicator (Moving Average Convergence/Divergence). Fast EMA – period 12. Slow EMA – period 26. SMA – period 9.

- Bollinger Bands. Period – 20.

- Non-commercial traders – speculators, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open positions of non-commercial traders.

- The total non-commercial net position is the difference between the short and long positions of non-commercial traders.