The EUR/USD currency pair traded very calmly on Tuesday, although a significant amount of macroeconomic statistics was scheduled for the day. However, we warned yesterday that all reports of the day are secondary. They can provoke a local market reaction of 20–30–40 points but cannot globally influence market sentiment. And the market sentiment now is clearly "bearish." It should have been so for the past 4-5 months. And it has been so since last summer. It is enough to look at the 24-hour TF and see it yourself.

Last summer, a peak was set around the level of 1.1275. Since then, we have seen a strong downward impulse, followed by a fairly strong upward correction, which many traders mistakenly took for the resumption of the global uptrend. However, we have repeatedly said that a corresponding fundamental background is required for a global trend. Not macroeconomic reports, the nature of which changes from month to month, but rather a fundamental background. Therefore, over the past months, we have constantly reiterated that the fundamental background supports only the US dollar.

The foundation is like the Titanic in the Atlantic Ocean. It must change its course slowly and briskly. Even a slight deviation from the course takes quite a lot of time. It may seem to someone that we say the same thing every day: the dollar should rise, and the euro should fall. However, what else can be said if such a foundation has formed at this time?

Moreover, the macroeconomic background also supports only the dollar. Reports in the European Union have long left much to be desired. The EU economy has been showing almost zero growth for several quarters. At the same time, the American economy is pleasing us practically every month with high indicators of labor market conditions, unemployment, business activity, and GDP.

Moreover, if, at the beginning of the year, the European currency could show growth based on market expectations of the Fed's swift transition to a "dovish" monetary policy, now many major banks openly state that the first-rate cut could well happen in December 2024 or 2025. And what other conclusions can be drawn if inflation in the US rises and exceeds the target level by almost two times?

Technically, the dollar is also on the side. On the daily TF, it is seen that the price is below all lines of the Ichimoku indicator. Yesterday, it tested the level of 1.0608, which equals 38.2% according to Fibonacci. Thus, an upward correction is possible, but the trend has been downward for almost a year. Therefore, in any case, we continue to expect only a decline from the pair. When the Fed is close to lowering rates for the first time, the American currency will depreciate. But until then, the ECB may lower its rates two or three times, significantly increasing the divergence with the Fed's rates. And the EUR/USD currency pair may have time to fall to price parity. We do not believe the euro should always be worth exactly 1 dollar. The euro should fall to this level, and then a new fundamental background may cause the currency of the European Union to rise.

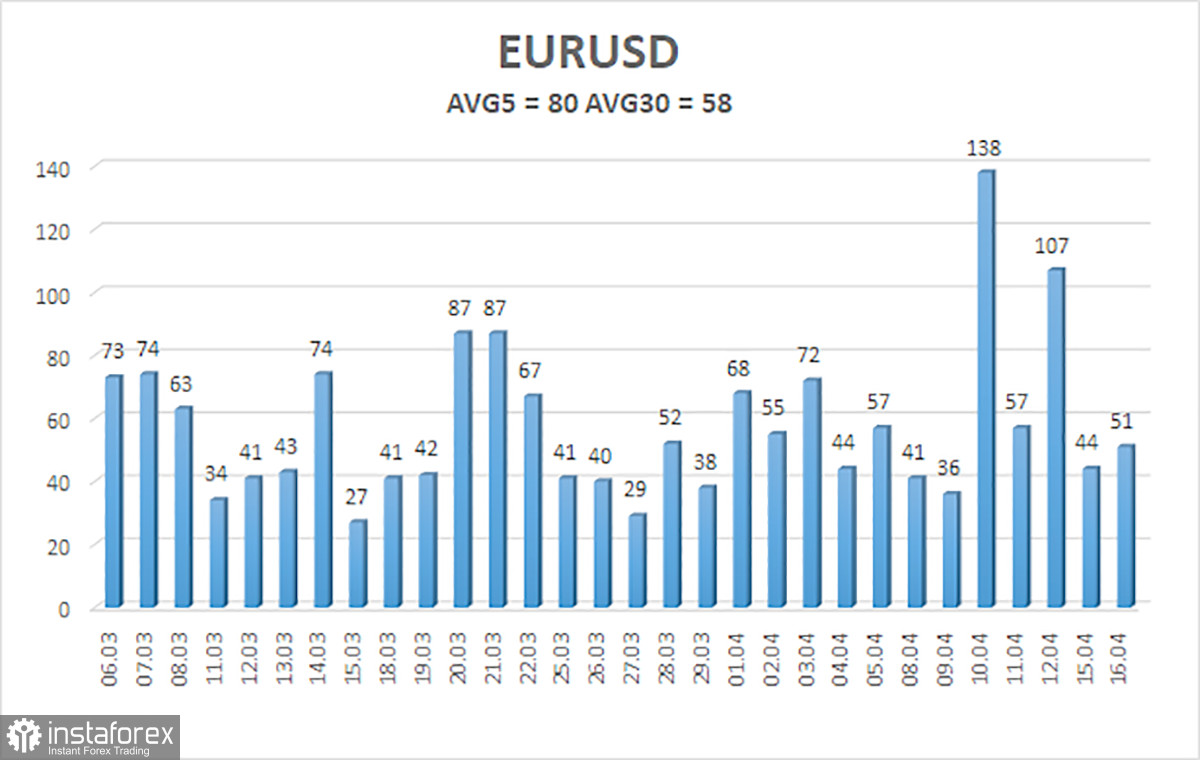

The average volatility of the EUR/USD currency pair over the past five trading days as of April 17 is 80 points and is characterized as "average." We expect movement of the pair between the levels of 1.0559 and 1.0719 on Wednesday. The senior linear regression channel is still sideways, but the downward trend persists. The CCI indicator has entered the oversold zone, but we expect only a small upward correction. And it may start after a few days.

Nearest support levels:

S1 – 1.0620

S2 – 1.0559

S3 – 1.0498

Nearest resistance levels:

R1 – 1.0681

R2 – 1.0742

R3 – 1.0803

Trading recommendations:

As we expected, the EUR/USD pair has resumed its downward trend. The European currency should continue to decline in almost any case, so we continue to consider sales with targets at 1.0559 and 1.0498. We consider purchases impractical even if the price consolidates above the moving average line. The fundamental background is that growth can only be expected from the dollar.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. The trend is strong now if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel the pair will spend the next day based on current volatility indicators.

CCI indicator - its entry into the oversold zone (below -250) or the overbought zone (above +250) means a trend reversal towards the opposite side is approaching.