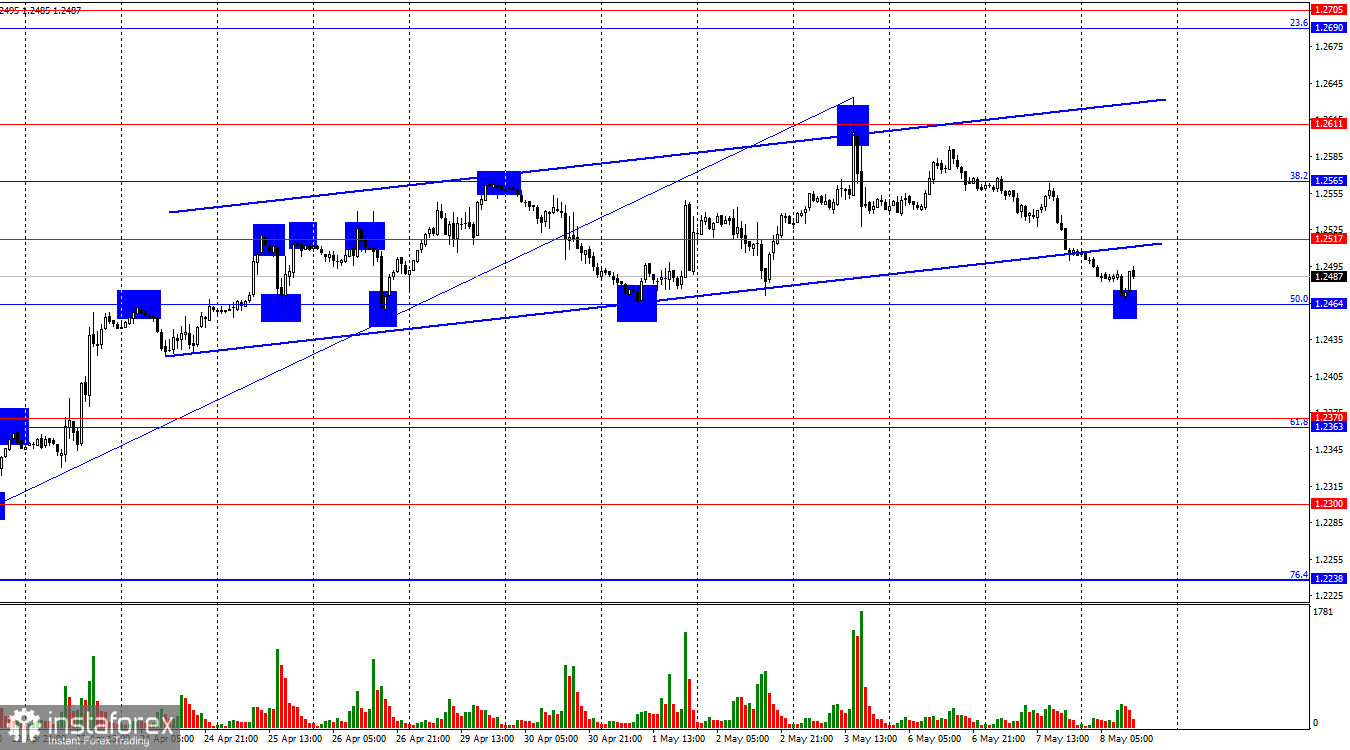

On the hourly chart, the GBP/USD pair continued its decline on Tuesday and confirmed consolidation below the ascending trend channel. Bulls lost their advantage on the hourly chart, and bears continue to maintain it on the 4-hour chart. Thus, the British pound has every reason to continue falling against the dollar. The rebound of quotes from the Fibonacci level of 50.0% (1.2464) allowed the pair to show a slight increase, but I expect consolidation below this level, which will allow counting on further decline towards the corrective level of 61.8% (1.2363).

The wave situation remains unchanged. The last completed upward wave did not surpass the peak of the previous wave, and the new downward wave is still too weak to break the low of April 22. Thus, the trend for the GBP/USD pair remains "bearish," and there are currently no signs of its completion. The first sign of bulls turning aggressive could be the breakthrough of the peak on May 3. A new downward wave, if it turns out to be weak and does not break the low of April 22, could also indicate a trend reversal. Waves in recent months have been quite large, so it is necessary to reduce the scale of the hourly chart to understand the current trend clearly.

On Monday, Tuesday, and Wednesday, there was no news from the UK or the US. However, this Thursday, the Bank of England meeting will conclude, and this event could leave a mark on the GBP/USD pair charts. Currently, traders do not believe that the rate will be cut. There are no grounds for this. Inflation in the UK continues to decline, but it is still too high for the regulator to take action. Most likely, the easing of monetary policy will begin in the autumn of 2024, but only if inflation continues to slow down. And we know that the opposite could also happen, as is currently the case in the US.

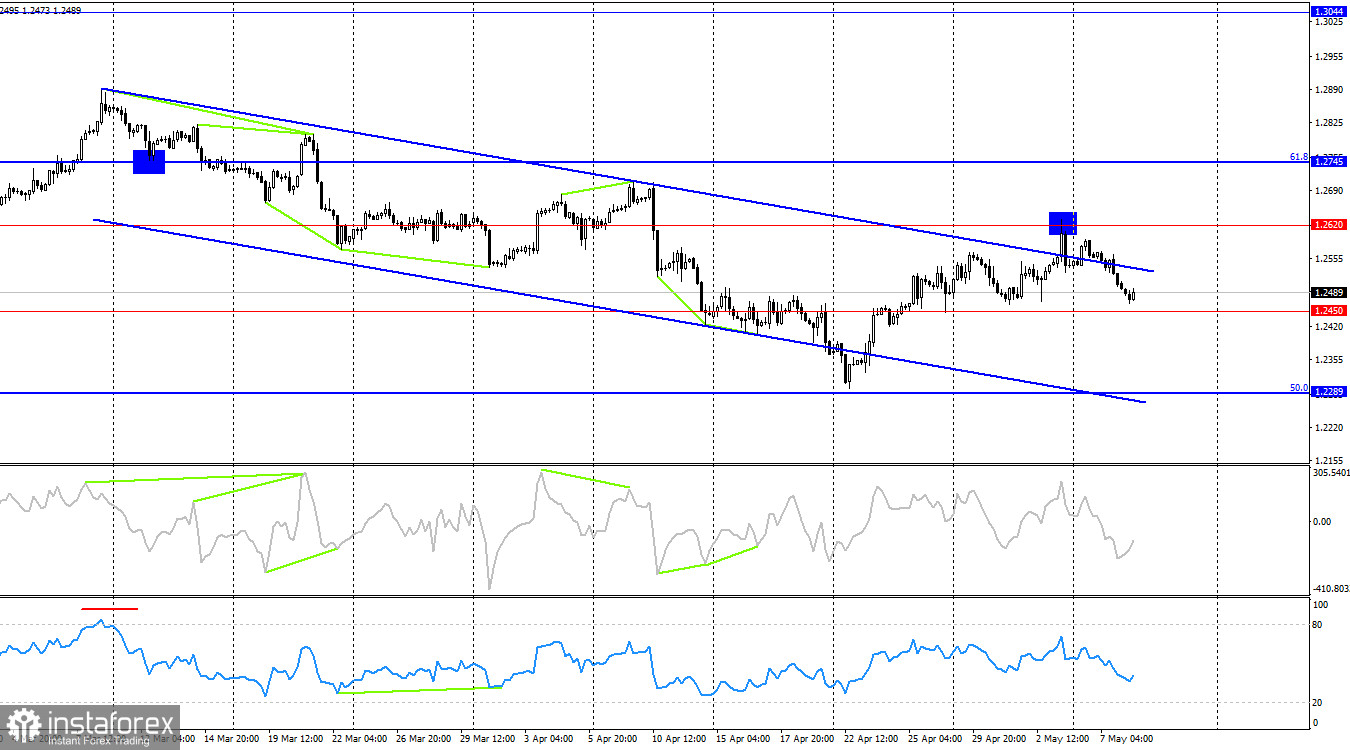

On the 4-hour chart, the pair rose to the level of 1.2620 and bounced off it. The upper line of the descending trend channel has been broken, but it is still not time to bury the "bearish" trend. This week, a decline towards the levels of 1.2450 and 1.2289 has begun. Consolidation of the pair's rate below the level of 1.2450 will increase the probability of further decline towards the next correction level of 50.0% (1.2289). There are no imminent divergences today.

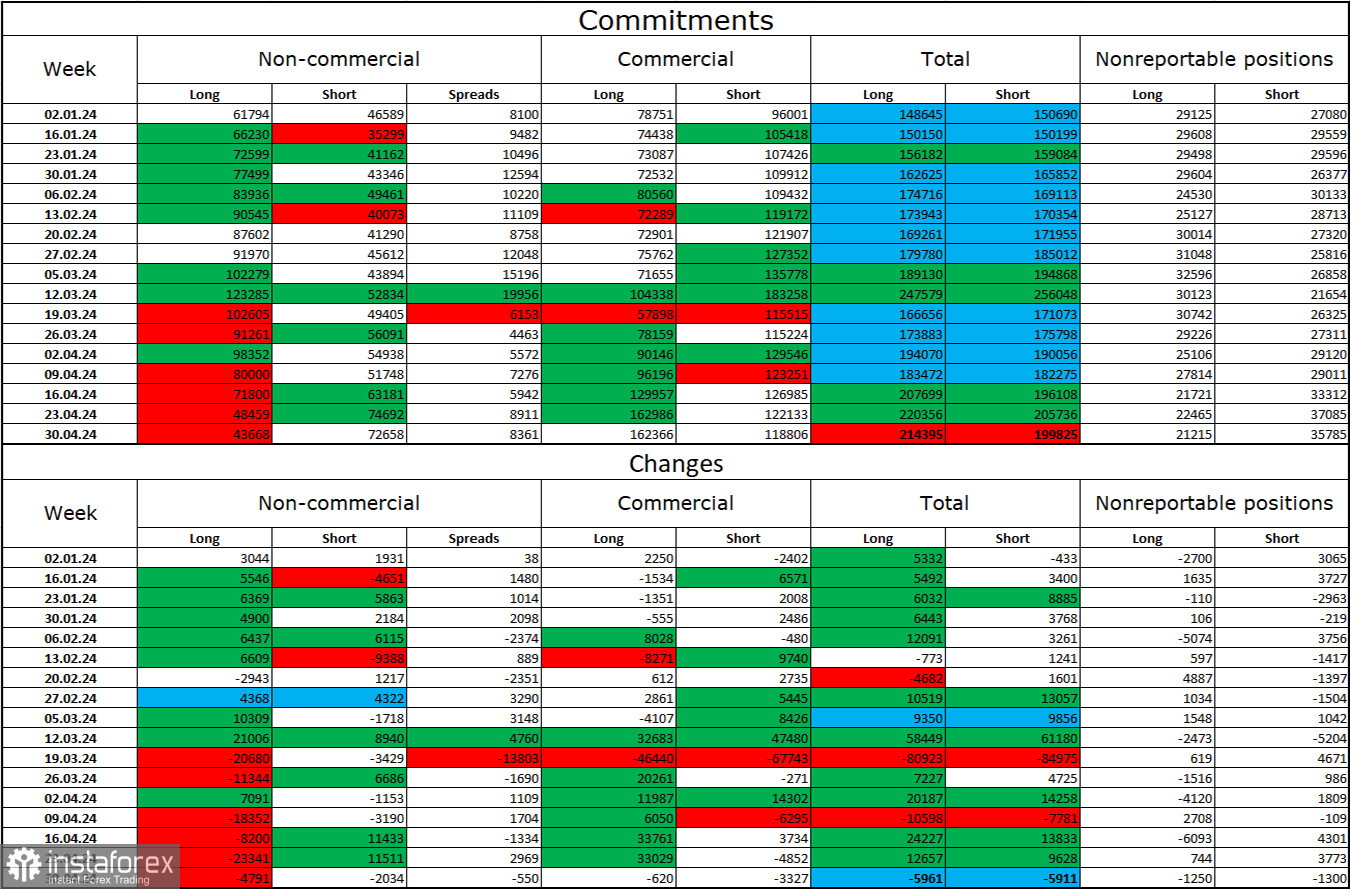

Commitments of Traders (COT) report:

The sentiment of the "non-commercial" trader category became more "bearish" over the past reporting week. The number of long contracts held by speculators decreased by 4791 units, and the number of short contracts decreased by 2034 units. The overall sentiment of large players has changed, and now bears dictate their terms in the market. The gap between the number of long and short contracts is 30 thousand: 43 thousand versus 73 thousand.

There are still prospects for a decline in the pound. Over the past 3 months, the number of long positions has decreased from 62 thousand to 43 thousand, while the number of short positions has increased from 47 thousand to 73 thousand. Over time, bulls will start to get rid of buy positions or increase sell positions, as all possible factors for buying the British pound have already been exhausted. The bears have shown their weakness and complete reluctance to advance over the past few months. However, I still expect the pound to experience a stronger decline.

News Calendar for the US and UK:

Wednesday's economic events calendar contains a few interesting entries. The impact of the information background on market sentiment will be absent today.

GBP/USD Forecast and Trader Advice:

Sales of the pound were possible upon consolidation on the hourly chart below the level of 1.2565, with a target of 1.2517. Today, these trades can be kept open. The second target of 1.2464 has also been reached. New sales - upon closing below the level of 1.2464 with a target of 1.2370. Purchases can be considered upon rebound from the level of 1.2464 on the hourly chart, with targets of 1.2517 and 1.2565. Tomorrow, after the Bank of England meeting, any movement is possible.