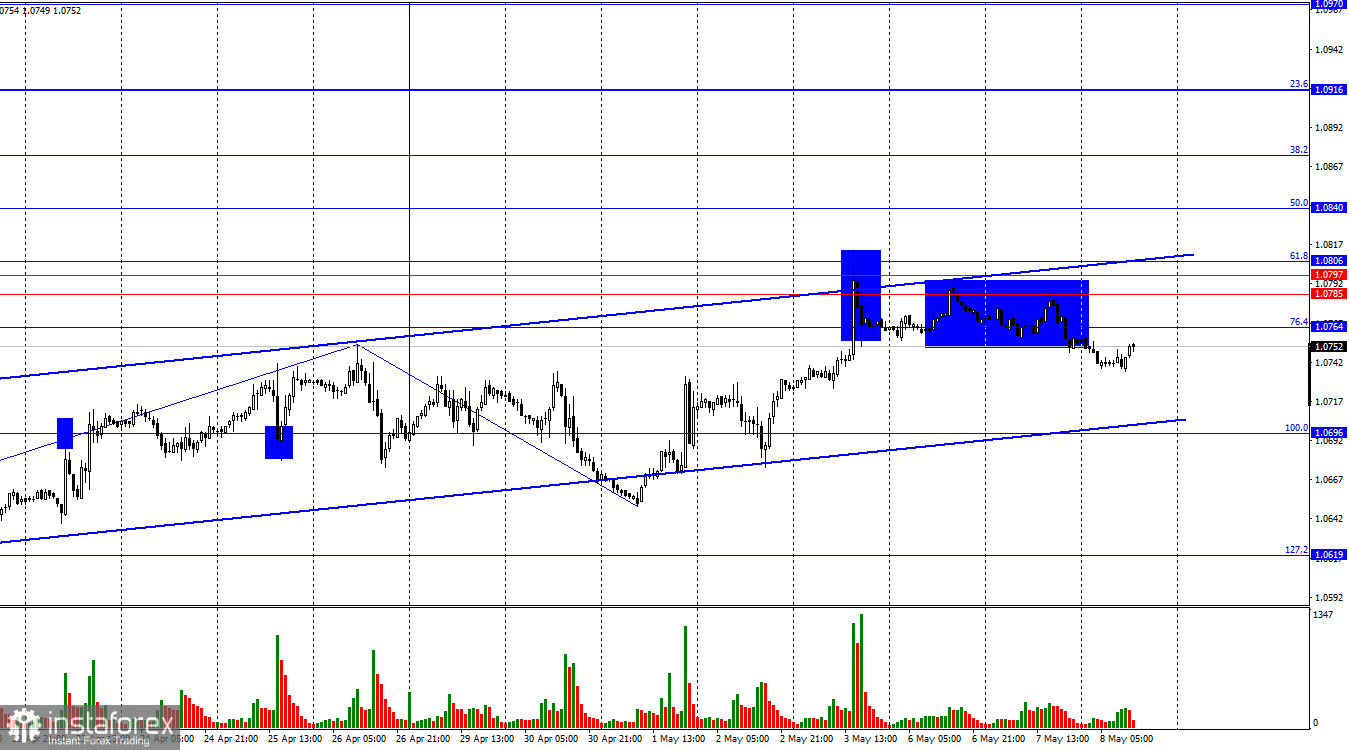

The EUR/USD pair on Tuesday did indeed bounce off the resistance zone of 1.0764–1.0806, which allows for a reversal in favor of the US dollar and some decline towards the lower line of the ascending trend channel and the corrective level of 100.0%–1.0966. However, the "bullish" trend is not yet complete or canceled. Until the pair closes below the trend channel, bulls may initiate a new rally at any moment.

The wave situation remains unchanged. The last downward wave failed to reach the low of the previous wave, while the new upward wave has already surpassed the peak of the previous wave. Thus, a "bullish" trend has formed, but its prospects personally raise doubts for me. Over the past 2-3 weeks, the information background has favored bull traders, but will it continue to support them further? This is a big question, as the European Union's economy is not in its best times, and the ECB is ready to start easing monetary policy earlier than the Fed, already having a much lower interest rate.

The information background on Monday was weak, on Tuesday even weaker, and today - simply absent. Low market activity is a consequence of this factor. Since there is no market activity, it isn't easy to give a reasonable forecast for the near future. The pair may decline for several days until it reaches 1.0696. It is much better now to consider longer-term prospects for the euro and the dollar. They also remain unchanged. The most significant reason for a new decline in the euro is the ECB rate cut, which will take place in June. The second significant reason is the Fed rate cut, which will not happen sometime soon. Thus, bears have an advantage in the market, but they prefer to wait for the right moment. It may come later than this week, as the information background could be stronger. However, the pound may always help the euro, as there will be plenty of news for it in the remaining part of the week.

On the 4-hour chart, the pair bounced off the upper line of the "wedge" and reversed in favor of the US dollar. The process of decline toward the corrective level of 23.6% (1.0644) has begun. Consolidation of quotes above the "wedge" will increase the probability of further growth towards the next Fibonacci level of 50.0%–1.0862 and change the "bearish" trend to "bullish." There are no imminent divergences today.

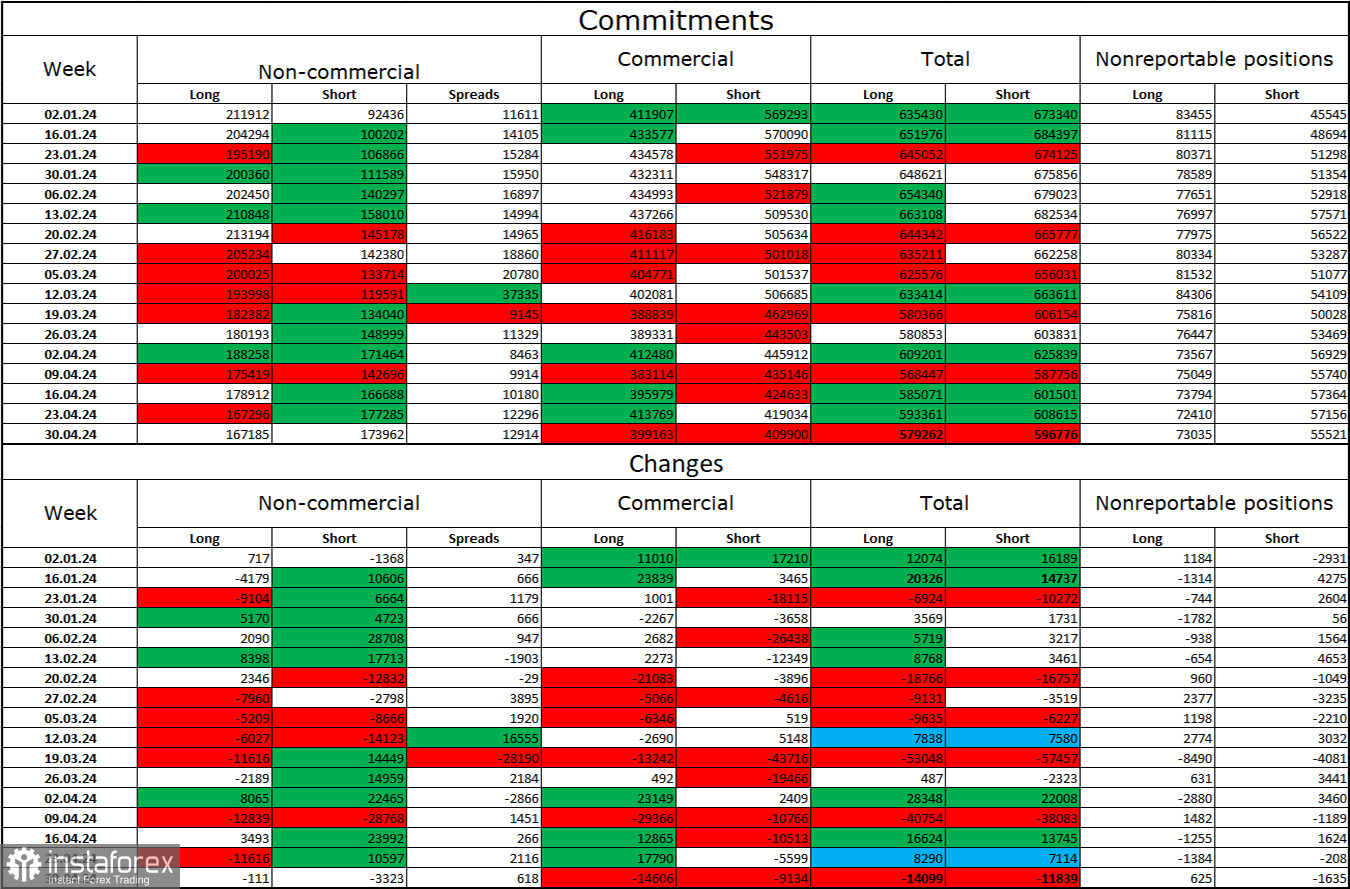

Commitments of Traders (COT) report:

During the last reporting week, speculators closed 111 long contracts and 3323 short contracts. The sentiment of the "non-commercial" group has shifted to "bearish" and is overall rapidly strengthening. The total number of long contracts held by speculators now stands at 167 thousand, while short contracts amount to 173 thousand. The situation will continue to change in favor of bears. In the second column, we see that the number of short positions has increased from 92 thousand to 173 thousand over the last 3 months. During the same period, the number of long positions decreased from 211 thousand to 167 thousand. Bulls have dominated the market for too long, and now they need strong informational support to resume the "bullish" trend. Several poor reports from the US have supported the euro, but in the long run, more is needed.

News Calendar for the US and the European Union:

On May 8, the economic events calendar does not contain any entries. The impact of the information background on traders' sentiment for the remaining part of the day will be absent.

EUR/USD Forecast and Trader Advice:

Sales of the pair were possible upon consolidation of quotes below the level of 1.0764 on the hourly chart with a target of 1.0696. These trades can be held now, but I don't expect the target to be hit quickly. I would only consider buying the euro once the pair consolidates above the level of 1.0806 on the hourly chart, with targets of 1.0840 and 1.0874. Or upon a rebound from the lower line of the ascending corridor.