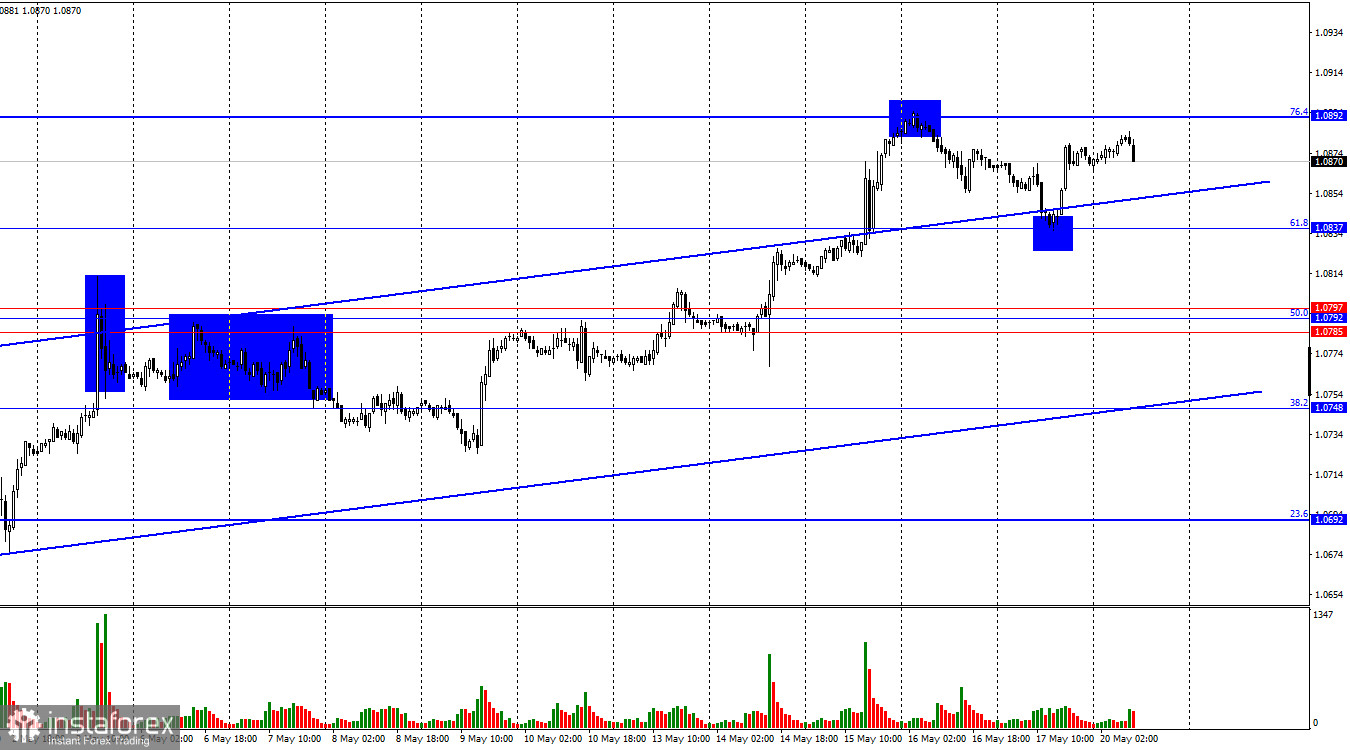

On Friday, the EUR/USD pair fell to the corrective level of 61.8% (1.0837), rebounded from it, and turned in favor of the euro, resuming growth towards the corrective level of 76.4% (1.0892). A rebound from this level will work in favor of the US dollar and a new decline towards 1.0837. Consolidation above 1.0892 will increase the likelihood of continued growth towards the next Fibonacci level of 100.0% at 1.0982.

The wave situation remains unchanged. The last downward wave ended on May 1 and did not approach the low of the previous wave, while the new upward wave has already broken the peak of the previous wave and has been forming for 13 days. Thus, a bullish trend has formed, with bull traders attacking almost every day. I consider this trend quite unstable and wonder if it will last long. However, the rise in quotes has continued for a month, and the bears cannot push the pair even to the lower line of the corridor. Therefore, there are no signs of the bullish trend ending now.

The informational background on Friday could have been stronger and more interesting. We learned during the day that inflation in the Eurozone slowed to 2.4% year-on-year, and core inflation slowed to 2.7% year-on-year. However, traders knew this information two weeks ago, when the preliminary estimates were released. Currently, the market is fully focused on the next ECB meeting, where interest rates may be lowered for the first time in a long time. It is hard to say why traders expect monetary policy to ease in the Eurozone, but the euro is still rising. This is not even a case of "buy the rumor, sell the fact," as the rumors now suggest selling the euro. However, there are no signs of the bullish trend ending, so we should continue looking for buy signals.

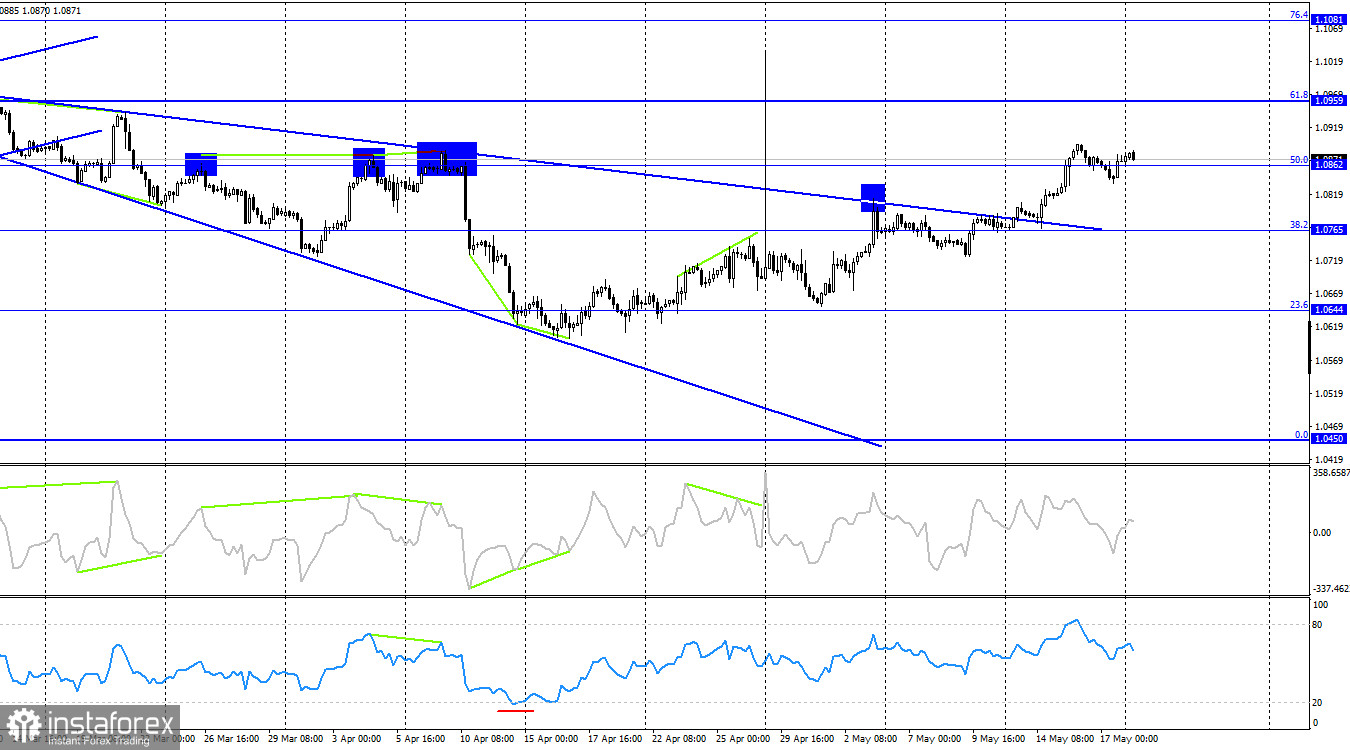

On the 4-hour chart, the pair consolidated above the "wedge" and rose to the 50.0% Fibonacci level at 1.0862. The recent segment of the euro's growth seems ambiguous, so I am not confident in its continuation. However, for a decline to be expected, there need to be sell signals, which are currently absent. No emerging divergences were observed today, either. The growth process may continue towards the next corrective level of 61.8% at 1.0959. The only factor working against the euro is the overbought RSI indicator (above +80).

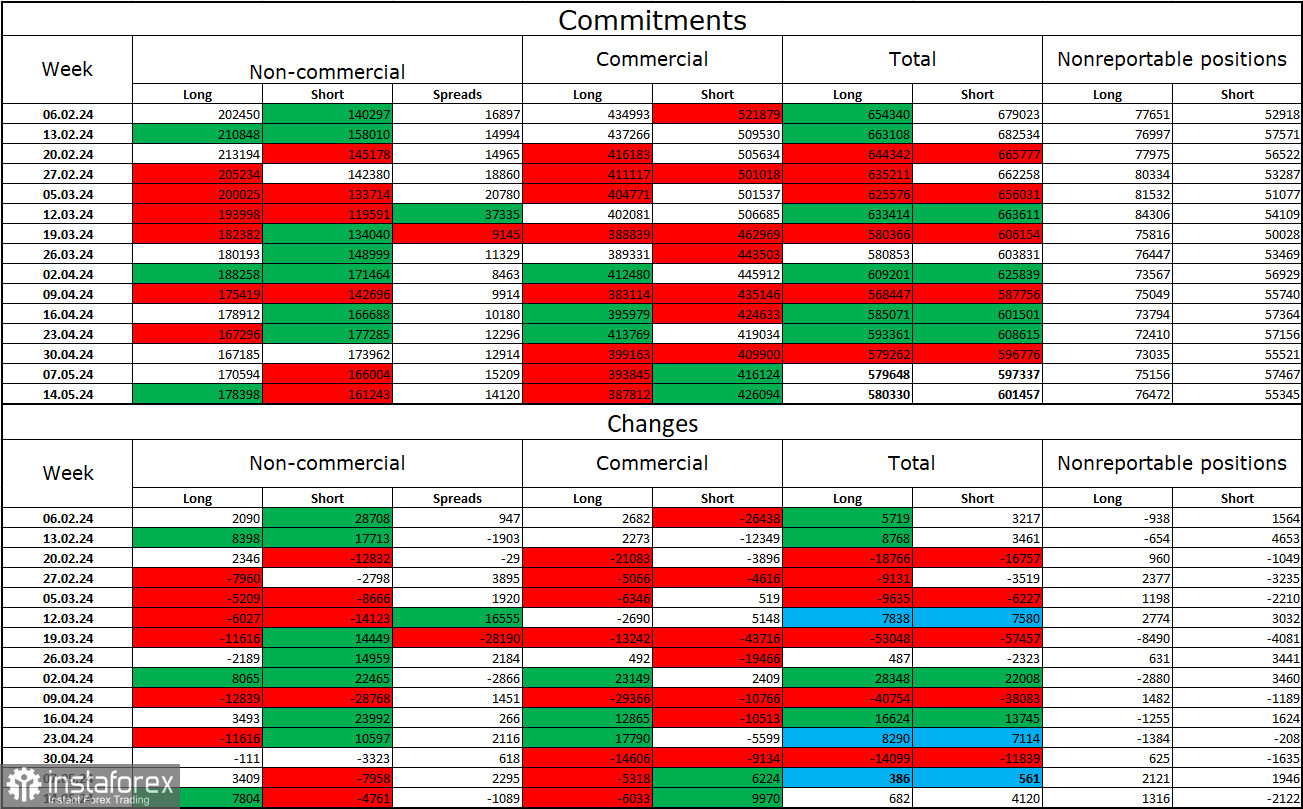

Commitments of Traders (COT) Report:

During the last reporting week, speculators opened 7804 long contracts and closed 4761 short contracts. The sentiment of the "non-commercial" group changed to "bearish" a few weeks ago, but now bulls are back in control. The total number of long contracts held by speculators is now 178 thousand, while the number of short contracts is 161 thousand. However, the situation will continue to shift in favor of the bears. The second column shows that the number of short positions has increased from 140 thousand to 161 thousand over the past three months. During the same period, the number of long positions has decreased from 202 thousand to 178 thousand. Bulls have dominated the market for too long and now need a strong informational background to resume the bullish trend. A series of poor reports from the US supported the euro, but more was needed in the long term.

News Calendar for the US and Eurozone:

The economic events calendar does not contain any entries on May 20. Therefore, the informational background's influence on traders' sentiment will be absent today.

Forecast for EUR/USD and Trading Tips:

Selling the pair was possible on a rebound from the 1.0892 level on the hourly chart, with targets of 1.0837 and the lower line of the ascending corridor. The first target was achieved. New sales are possible on a rebound from the 1.0892 level with the same targets. Buying the euro was likely on a rebound from the 1.0837 level on the hourly chart, with a target of 1.0892. This target was almost reached. New buys are possible on a new rebound from 1.0837 or closing above 1.0892 with a target of 1.0982.