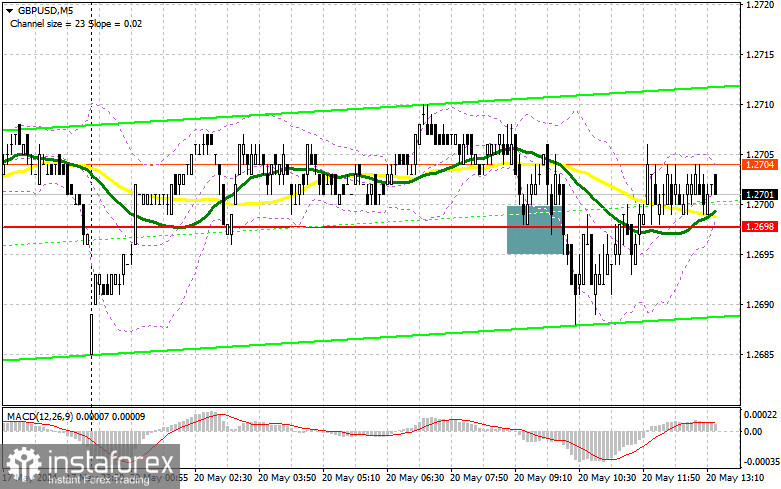

In my morning forecast, I paid attention to the 1.2698 level and planned to decide to enter the market based on it. Let's look at the 5-minute chart and figure out what happened there. The decline and the formation of a false breakdown there gave a buy signal, but it did not reach a major upward movement in the first half of the day. This led to revising the technical picture and strategy for the American session.

To open long positions on GBP/USD, you need:

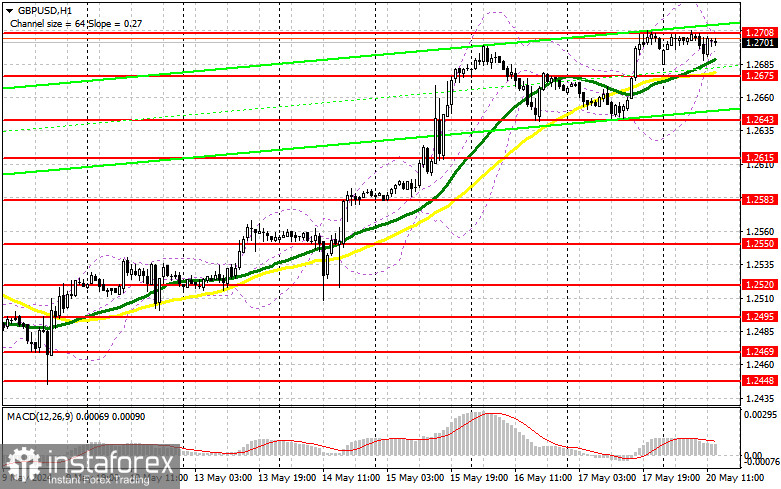

The lack of data on the UK kept the market on the side of pound buyers. However, I was counting on more active actions by the bulls. In the afternoon, FOMC member Christopher Waller will speak, so a move towards strengthening the US dollar may still occur. For this reason, it is best to focus on purchases in the new support area of 1.2675, just above the moving averages playing on the bulls' side. The decline and the formation of a false breakout there will give an entry point into long positions that can bring the pound back to the 1.2708–week high, above which it has not yet been possible to break through in the first half of the day. Only a rush and a top-down test of this range will determine the GBP/USD growth chance with the 1.2734 update. In the case of an exit above this range, we can talk about a breakthrough to 1.2765, where I will fix profits. In the scenario of GBP/USD falling and no buyers at 1.2675 in the afternoon, the pressure on the pound will increase, leading to a downward movement to the area of 1.2643, which will keep the pair within the side channel. Forming a false breakdown will be a suitable option for entering the market. Opening long positions on GBP/USD immediately on a rebound from 1.2615 to correct 30-35 points within a day is possible.

To open short positions on GBP/USD, you need:

In case of a bullish reaction to the speech of representatives of the Federal Reserve System, I'm going to act in the area of a new resistance of 1.2708, formed following the results of the first half of the day. The formation of a false breakdown there will lead to an excellent entry point into short positions to reduce GBP/USD to the new support area of 1.2675, where I expect the first buyers of the pound to show up. A breakout and a reverse test from the bottom up of this range will increase the pressure on the pair, giving the bears an advantage and another entry point to sell to update 1.2643. A further target will be a minimum of 1.2615, which will negate all buyers' efforts last week. I will fix the profit there. With the option of GBP/USD growth and the absence of bears at 1.2708 in the afternoon, which is more likely, buyers will have the opportunity to build a bull market further and update the level of 1.2734. I will also serve there only on a false breakdown. Without activity there, I advise you to open short positions on GBP/USD from 1.2765, counting on the pair's rebound down by 30-35 points within the day.

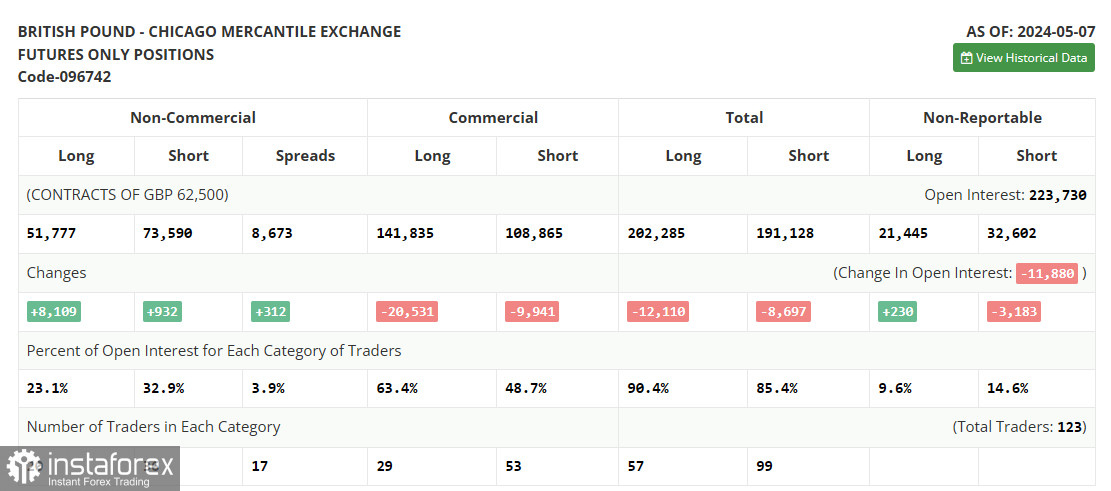

In the COT report (Commitment of Traders) for May 7, there was an increase in long and short positions. There were far more buyers of the pound than sellers, all thanks to the meeting of the Bank of England. The regulator has prepared the markets for future interest rate cuts this summer. And although this was supposed to weaken the pound, in the current situation of a troubled economy, traders reacted to everything with growth. The latest GDP and inflation data allow the Bank of England to begin easing policy, which will benefit consumers and businesses, and the pound will respond by strengthening in the medium term. The latest COT report says that long non-profit positions rose by 8,108 to 51,777, while short non-profit positions jumped by 932 to 73,590. As a result, the spread between long and short positions increased by 312.

Indicator signals:

Moving averages

Trading is above the 30 and 50-day moving averages, which indicates further pound growth.

Note: The author considers the period and prices of the moving averages on the hourly chart H1, which differs from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In case of a decline, the indicator's lower limit of 1.2685 will act as support.

Description of the indicators

• Moving average (moving average determines the current trend by smoothing volatility and noise). Period 50. It is marked in yellow on the chart.

• Moving average (moving average determines the current trend by smoothing volatility and noise). Period 30. It is marked in green on the chart.

• MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Fast EMA period 12. Slow EMA period 26. SMA period 9

• Bollinger Bands. Period 20

• Non-profit speculative traders, such as individual traders, hedge funds and large institutions that use the futures market for speculative purposes and meet certain requirements.

• Long non-commercial positions represent the total long open position of non-commercial traders.

• Short non-commercial positions represent the total short open position of non-commercial traders.

• The total non-commercial net position is the difference between non-commercial traders' short and long positions.