Analysis of transactions and tips on trading the European currency

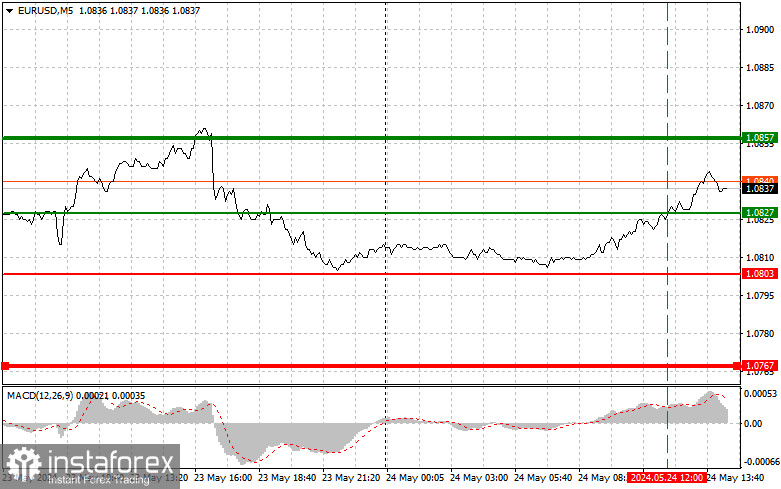

The price test of 1.0827 came at a time when the MACD indicator went up a lot from zero, which limited the further upward potential of the pair – especially after yesterday's sharp drawdown of the euro. For this reason, I did not buy. I did not wait for any other signals to enter the market. Traders reacted by buying German GDP data, but we have American statistics ahead that can turn the market around. Figures are expected on changes in the volume of orders for durable goods, the consumer sentiment index from the University of Michigan, and inflation expectations from the University of Michigan. There will also be a speech by FOMC member Christopher Waller. However, it is worth understanding that the Fed's position is now clear, and everything is clear, so his statements are unlikely to have much effect on the market. For this reason, it is better to focus on the data. Strong reports will lead to a fall in the euro by the end of the week. As for the intraday strategy, I plan to act based on implementing scenarios No. 1 and No. 2.

Buy signal

Scenario No. 1: I plan to buy euros when the price reaches 1.0856 (the green line on the chart) to grow to the level of 1.0891. At 1.0891, I will exit the market and sell euros in the opposite direction, counting on a movement of 30-35 points from the entry point. The euro's upward movement today is possible only after very weak data on the United States. Important! Before buying, ensure the MACD indicator is above the zero mark and is just starting to grow from it.

Scenario No. 2: I also plan to buy euros today for two consecutive price tests of 1.0828 when the MACD indicator will be in the oversold area. This will limit the pair's downward potential and lead to an upward market reversal. We can expect an increase to the opposite levels of 1.0856 and 1.0891.

A sell signal

Scenario No. 1: I will sell euros after reaching the level of 1.0828 (the red line on the chart). The target will be the 1.0805 level. I plan to exit the market and buy euros immediately in the opposite direction (counting on a movement of 20-25 points in the opposite direction from the level). The pressure on the pair will return after the release of good reports on the state of the American economy. Important! Before selling, ensure that the MACD indicator is below the zero mark and is just beginning its decline.

Scenario No. 2: I also plan to sell euros today in the case of two consecutive price tests of 1.0856 at a time when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a reverse downward reversal of the market. We can expect a decline to the opposite levels of 1.0828 and 1.0805.

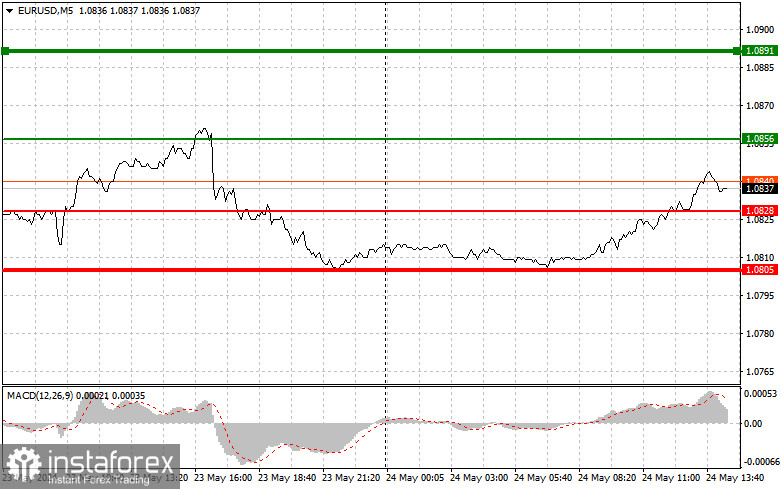

Buy signal

Scenario No. 1: I plan to buy euros when the price reaches 1.0856 (the green line on the chart) to grow to the level of 1.0891. At 1.0891, I will exit the market and sell euros in the opposite direction, counting on a movement of 30-35 points from the entry point. The euro's upward movement today is possible only after very weak data on the United States. Important! Before buying, ensure the MACD indicator is above the zero mark and is just starting to grow from it.

Scenario No. 2: I also plan to buy euros today for two consecutive price tests of 1.0828 when the MACD indicator will be in the oversold area. This will limit the pair's downward potential and lead to an upward market reversal. We can expect an increase to the opposite levels of 1.0856 and 1.0891.

A sell signal

Scenario No. 1: I will sell euros after reaching the level of 1.0828 (the red line on the chart). The target will be the 1.0805 level. I plan to exit the market and buy euros immediately in the opposite direction (counting on a movement of 20-25 points in the opposite direction from the level). The pressure on the pair will return after the release of good reports on the state of the American economy. Important! Before selling, ensure that the MACD indicator is below the zero mark and is just beginning its decline.

Scenario No. 2: I also plan to sell euros today in the case of two consecutive price tests of 1.0856 at a time when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a reverse downward reversal of the market. We can expect a decline to the opposite levels of 1.0828 and 1.0805.