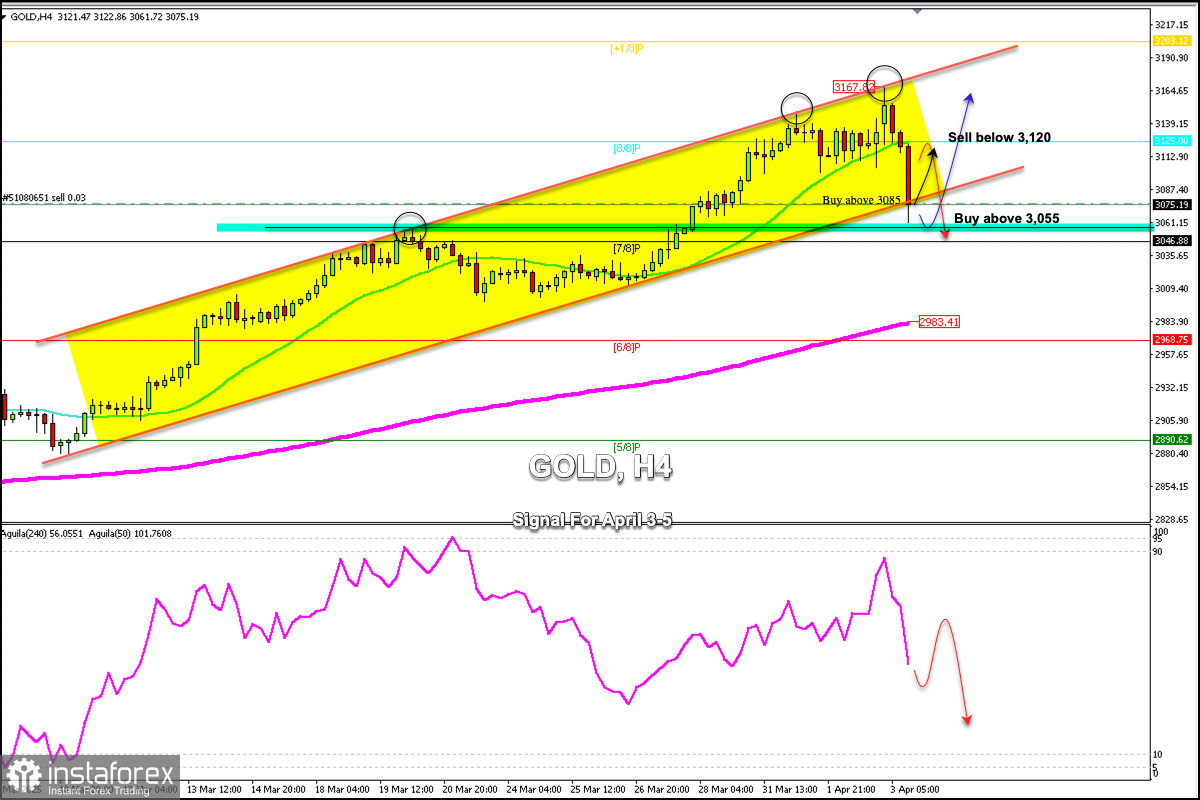

Early in the American session, gold is trading around 3,065, below the 21 SMA, breaking the uptrend channel formed since March 10.

Having reached a new high at 3,167, gold made a sharp technical correction as part of profit-taking, breaking the 21 SMA and momentarily breaking the uptrend channel.

The price made a sharp technical correction after the US president issued the toughest tariffs. Investors believe gold may have reached the end of its safe-haven status and expect that it could resume its bearish cycle after a technical correction. The instrument is expected to reach $2,900 in the coming days and weeks.

Having formed a double top pattern, gold made a technical correction and is now reaching important support around 3,055.

This area represents key support as it coincides with the weekly pivot point. Above this area, gold could rebound over the next few days until it reaches the 21-SMA again at 3,125.

If the gold price returns above the uptrend channel and consolidates above 3,075, the outlook could be bullish, and we could look for buying opportunities with a target at 3,125 (8/8 Murray).