Gold is finding support near the $3,116 level, pausing its intraday pullback after reaching a new all-time high. Investor concerns over the potential consequences of President Donald Trump's reciprocal tariffs on global free trade and the broader global economy are driving increased demand for safe-haven assets, including gold.

Expectations that the U.S. economic slowdown will lead to Federal Reserve rate cuts sooner than previously anticipated are also weighing on the dollar, thereby supporting gold prices.

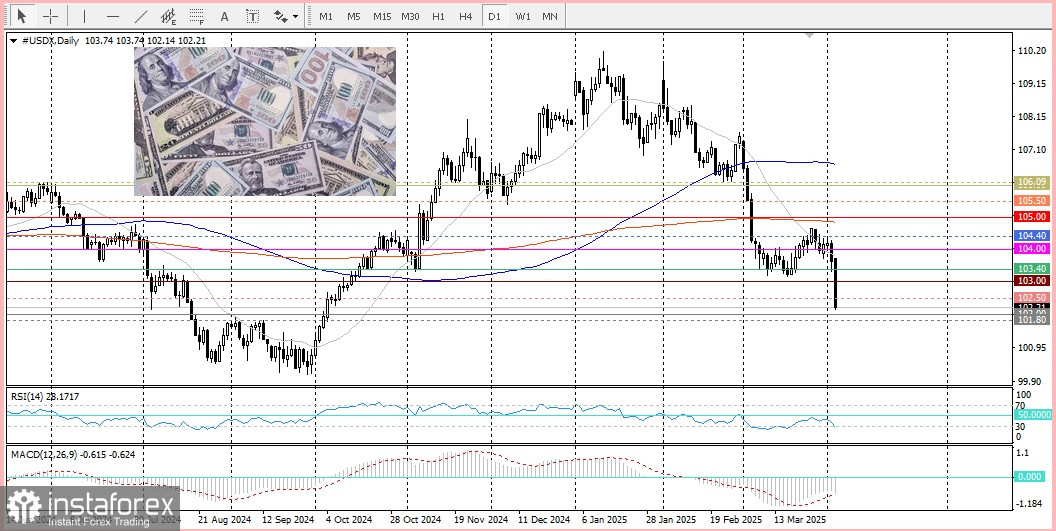

From a technical perspective, the RSI indicator on the daily chart signals overbought conditions, which is keeping bulls from initiating new long positions. A period of consolidation or a short-term pullback before the uptrend resumes appears reasonable. However, the overall trend remains bullish, and any decline toward the $3,100 level could offer a buying opportunity. This is a key support level—weakness below it may trigger further declines toward the $3,076 area and potentially down to the psychological $3,000 level.