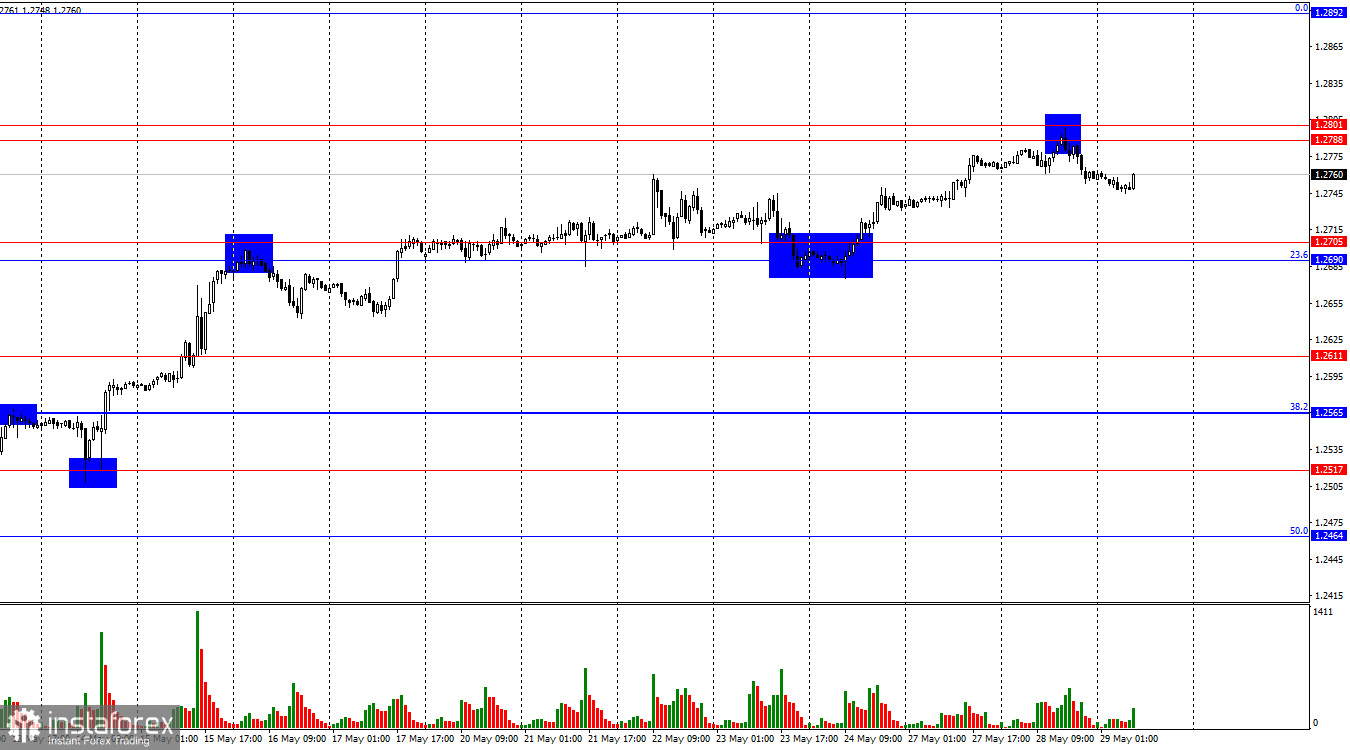

On the hourly chart, the GBP/USD pair rose towards the resistance zone of 1.2788–1.2801 on Tuesday, rebounded, and experienced a slight decline. Wednesday began with a new pound rise towards the 1.2788–1.2801 zone. Therefore, there is a high probability of the pair consolidating above this zone, allowing us to expect continued growth towards the next corrective level of 0.0% at 1.2892. Another rebound from the 1.2788–1.2801 zone will favor the US dollar and a slight decline towards the support zone of 1.2690–1.2705.

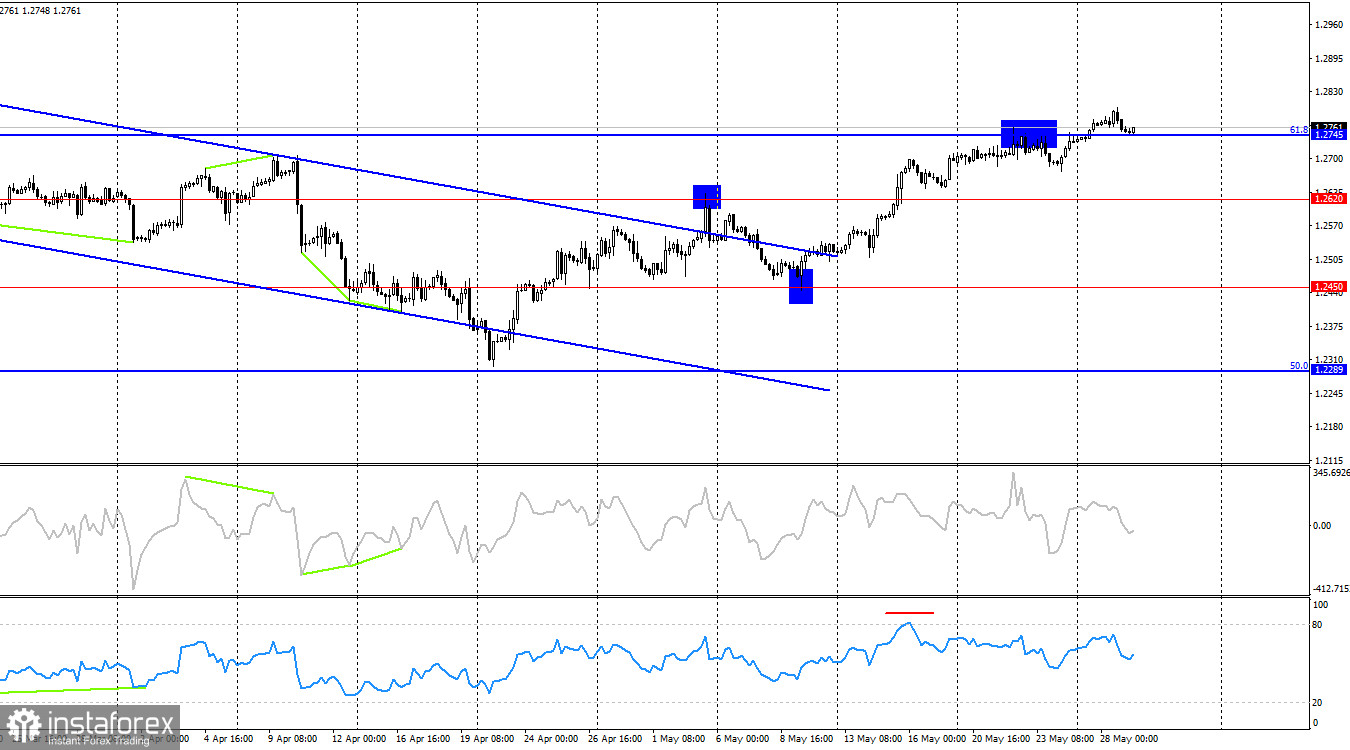

The wave situation remains unchanged. The last downward wave ended on May 9 and did not break the low of the previous wave, while the new upward wave broke the peak of May 3 and has been forming for 14 days. Thus, the trend for the GBP/USD pair has turned "bullish" and remains so. The "bullish" trend may be short-lived as the current information background is not strong enough to push the pound higher. However, the first sign of the "bullish" trend ending will appear only when a new downward wave breaks the low of the previous wave from May 9. For this to happen, the pound would need to drop by 340-350 pips from the current price, which seems unrealistic for this week.

The pound continues to rise almost without interruption. Occasionally, it encounters serious obstacles, but during such moments, the bears do not show initiative and do not attempt a counterattack. As a result, rebounds from levels or zones only lead to minor declines. There was no significant news on Monday and Tuesday, and trader activity was relatively low. However, even this low bullish activity is enough for the pound to continue its steady rise. No news is expected from the UK or the US today, but the pound might return to the 1.2788–1.2801 zone and attempt to close above it. The Fed still sees no reason to shift towards easing monetary policy, but the bears are not using this information to their advantage.

On the 4-hour chart, the pair consolidated above the correction level of 1.2745. Therefore, the upward movement may continue towards the 1.3044 level. No imminent divergences are observed in any indicators today. On the hourly chart, the zone of 1.2690–1.2705 holds back the pair's decline, while the zone of 1.2788–1.2801 limits further growth. The trend is "bullish," and I do not anticipate a trend change until the bears close the pair below at least the 1.2690–1.2705 zone.

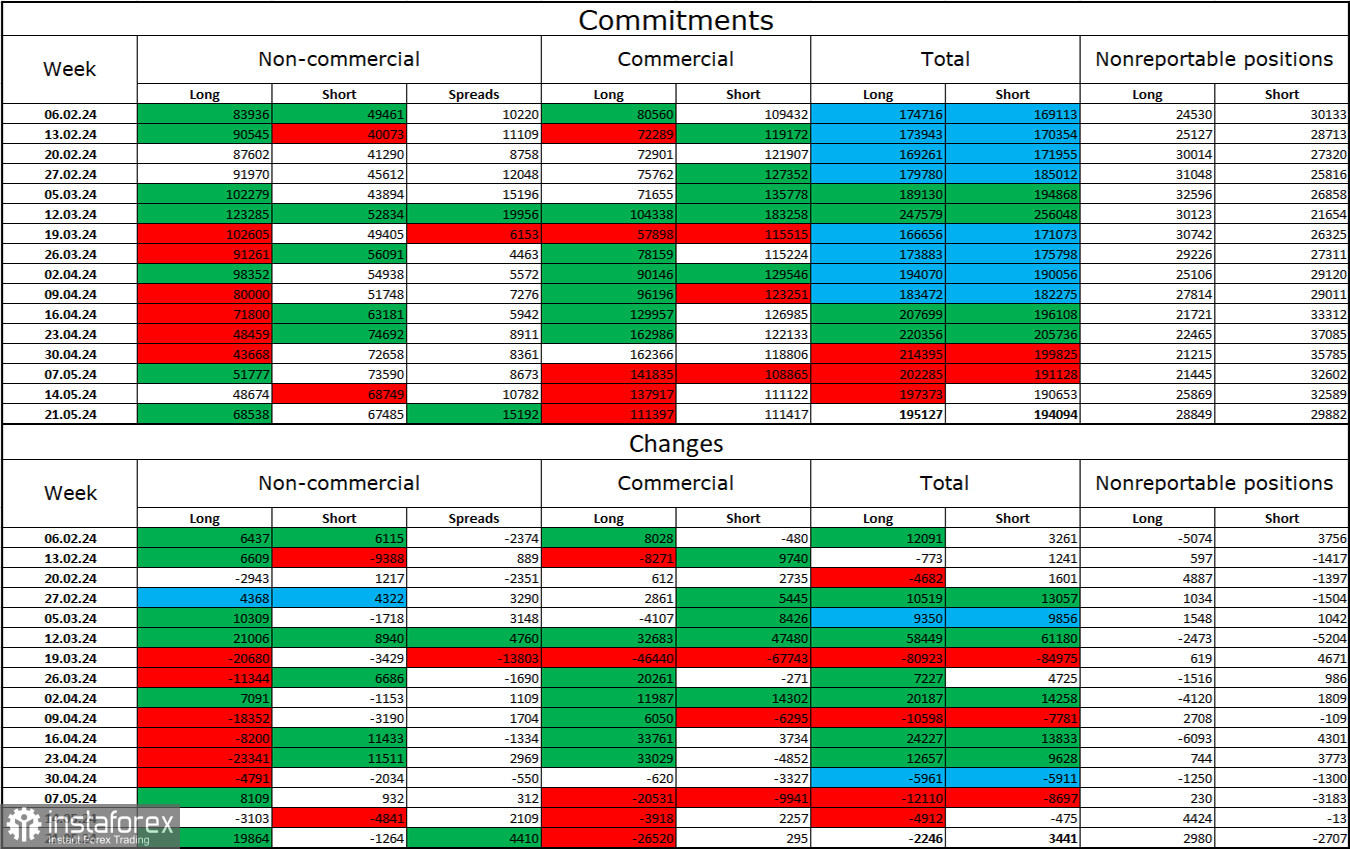

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" category of traders became less "bearish" in the last reporting week. The number of long contracts held by speculators increased by 19,864, while the number of short contracts decreased by 1,264. The overall sentiment of large players has changed again, and now neither bulls nor bears have the upper hand. The gap between long and short contracts is only one thousand: 68,000 vs. 67,000.

The pound still faces prospects of decline. Over the past three months, the number of long positions has decreased from 83,000 to 68,000, while the number of short positions has increased from 49,000 to 67,000. Over time, bulls will continue to reduce their buy positions or increase their sell positions, as all potential factors for buying the British pound have already played out. Bears have shown weakness and a complete unwillingness to go on the offensive in recent months, making it difficult for the pair to move downwards.

Economic Calendar for the US and UK:

Wednesday's economic calendar contains a few interesting entries. The impact of the information background on market sentiment will be absent for the rest of the day.

Forecast for GBP/USD and Trading Advice:

Selling the pound was possible in case of a rebound from the resistance zone on the hourly chart at 1.2788–1.2801 with a target of 1.2690–1.2705. These trades must be handled carefully since the trend remains "bullish." Purchases could have been opened on Friday with a rebound from the 1.2690–1.2705 zone with a target of 1.2788–1.2801. This target has been met. New purchases can be made upon closing above the 1.2788–1.2801 zone with a target of 1.2891 or with a new rebound from the 1.2690–1.2705 zone with a target of 1.2788–1.2801.