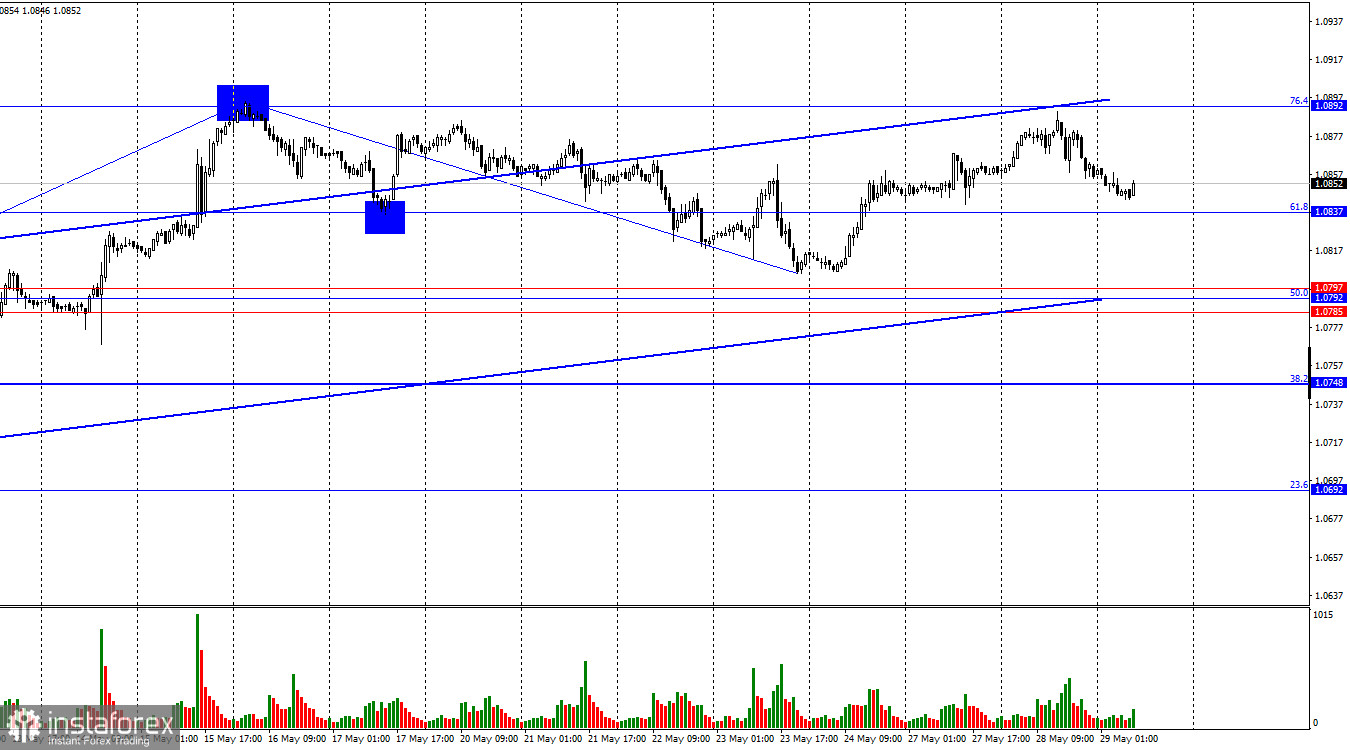

On Tuesday, the EUR/USD pair reversed in favor of the US dollar near the corrective level of 76.4% (1.0892), falling towards the corrective level of 61.8% (1.0837). The dollar has little to celebrate as its growth yesterday was very weak compared to the decline in recent weeks. A rebound from the 1.0837 level could easily restore the pair's upward movement towards 1.0892. Consolidation below 1.0837 will be the first signal of the bears taking the offensive. However, the ascending trend channel continues to characterize trader sentiment as "bullish."

The wave situation remains clear. The last upward wave broke the peak of the previous wave, while the most recent downward wave (May 16–23) did not come close to the low of the previous wave. Thus, the "bullish" trend persists. I consider this trend quite unstable and doubt it will last long. Nevertheless, the pair's growth has continued for over a month, and the bears have been unable to push it even to the channel's lower boundary. There are currently no signs of the "bullish" trend ending. The upward wave forming over the past few days has not yet broken the May 16 peak. If this remains the case, it will be the first sign of a trend change to "bearish."

There was no significant news on Tuesday. Bullish traders pushed the euro up for two days prior but retreated on Tuesday at the 1.0892 level due to the lack of informational support. Sustained momentum is hard to maintain on sheer enthusiasm. Today, Germany will release its May inflation report, serving as a "warm-up" for the Eurozone inflation report. If the consumer price index is rising again, bulls may regain the offensive, and the likelihood of an ECB rate cut in June might slightly decrease—but only slightly.

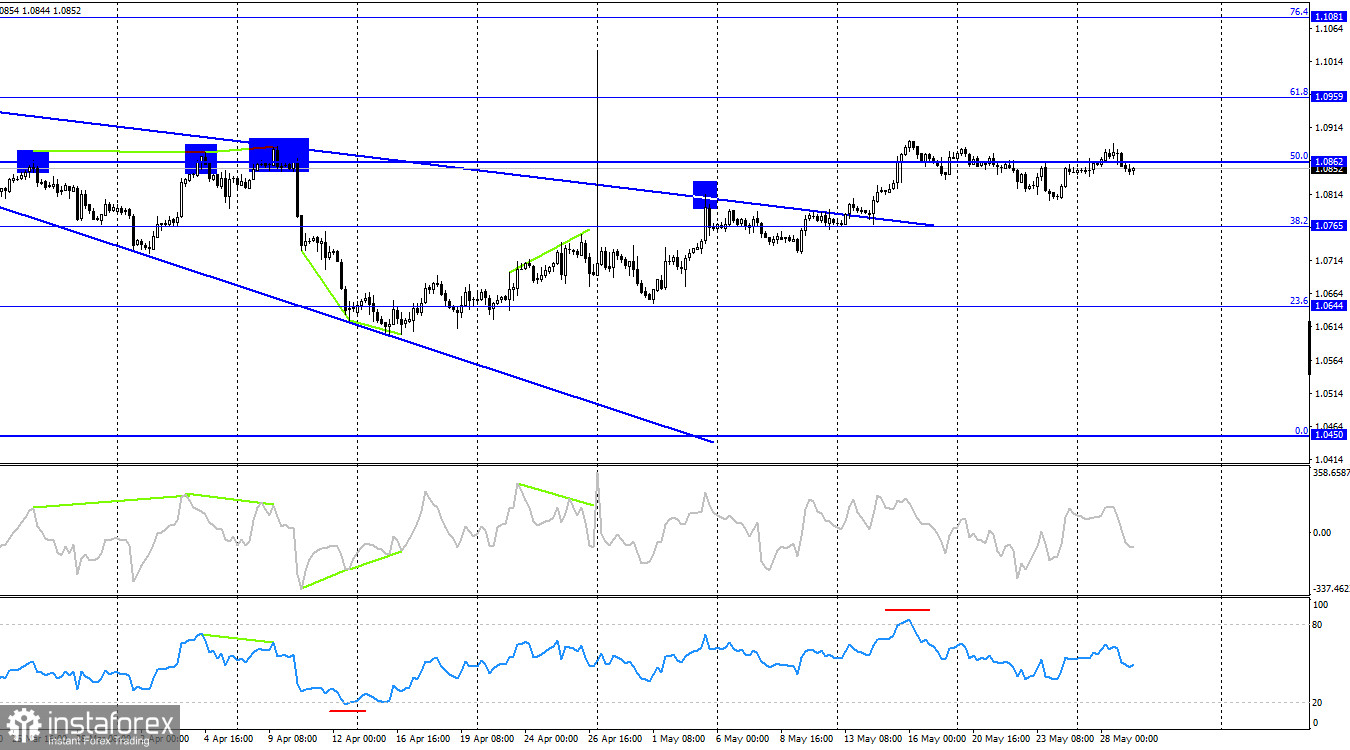

On the 4-hour chart, the pair consolidated above the "wedge" and rose to the 50.0% Fibonacci level at 1.0862. The latest euro growth segment seems ambiguous, but graphical analysis supports the pair's growth. No imminent divergences are observed today. If it closes above 1.0862, the growth process may continue towards the next corrective level of 61.8% at 1.0959. The hourly chart is currently more informative.

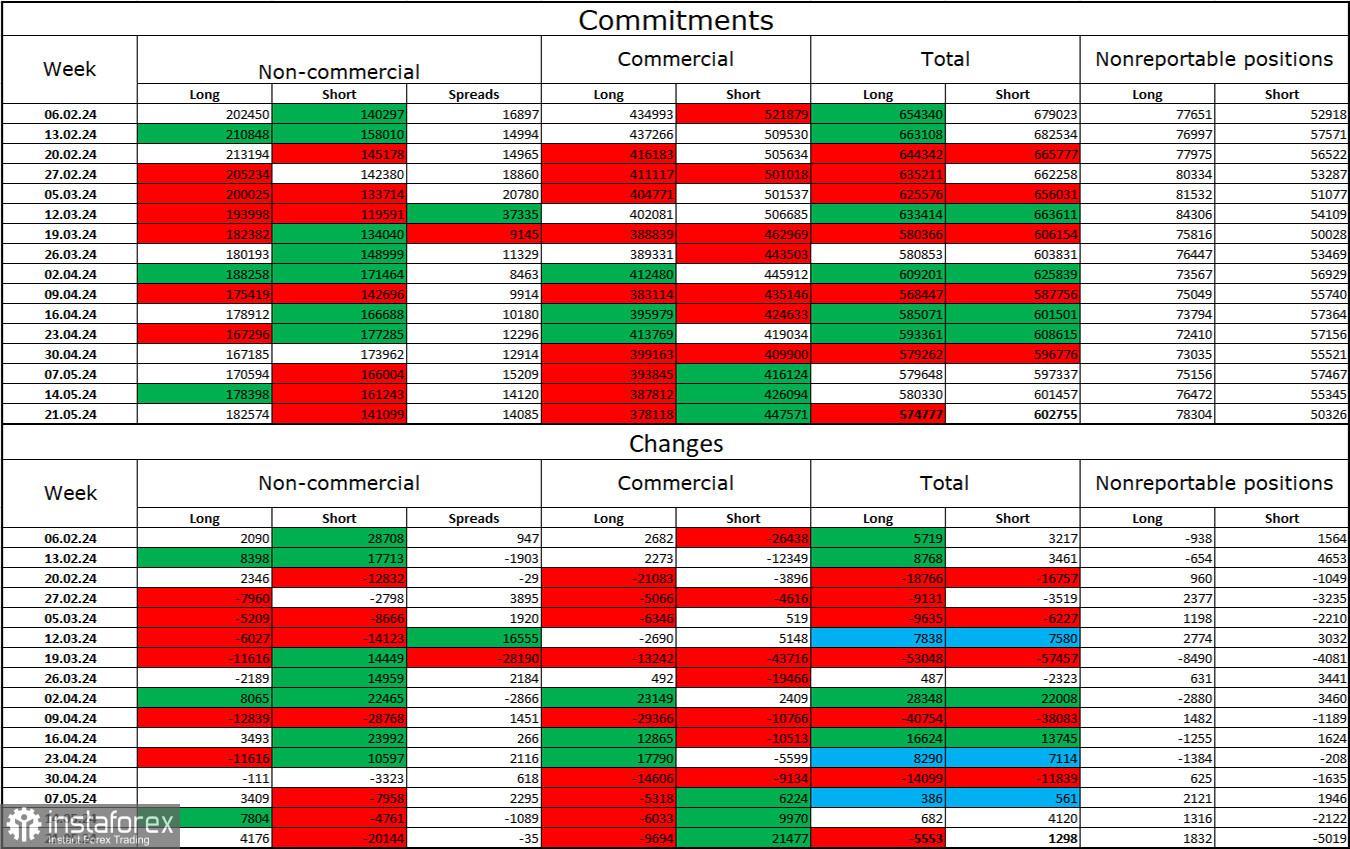

Commitments of Traders (COT) Report:

In the last reporting week, speculators opened 4,176 long contracts and closed 20,144 short contracts. The sentiment of the "Non-commercial" group turned "bearish" a few weeks ago, but now the bulls have the upper hand again. The total number of long contracts speculators hold is now 182,000, compared to 141,000 short contracts. The gap is widening in favor of the bulls.

However, the situation will continue to shift in favor of the bears. I do not see long-term reasons to buy euros, as the ECB is ready to start easing monetary policy, which will lower the yields on bank deposits and government bonds. They will remain at a high level in America, making the dollar more attractive to investors. However, at this time, it is important to respond to data from graphical analysis and COT reports, which indicate a continued "bullish" sentiment.

Economic Calendar for the US and Eurozone:

Eurozone – Germany Consumer Price Index (12-00 UTC).

The economic events calendar for May 29 contains only one entry. The informational background may have a relatively weak impact on trader sentiment today.

Forecast for EUR/USD and Trading Advice:

Selling the pair is possible today upon a rebound from the 1.0892 level with a target of 1.0837. Alternatively, selling is possible upon consolidation below 1.0837 with a target in the 1.0785–1.0797 support zone. Buying the euro was possible upon closing above the 1.0837 level on the hourly chart with a target of 1.0892. This target was almost reached yesterday. New purchases are possible upon a rebound from the 1.0837 level with the same target.