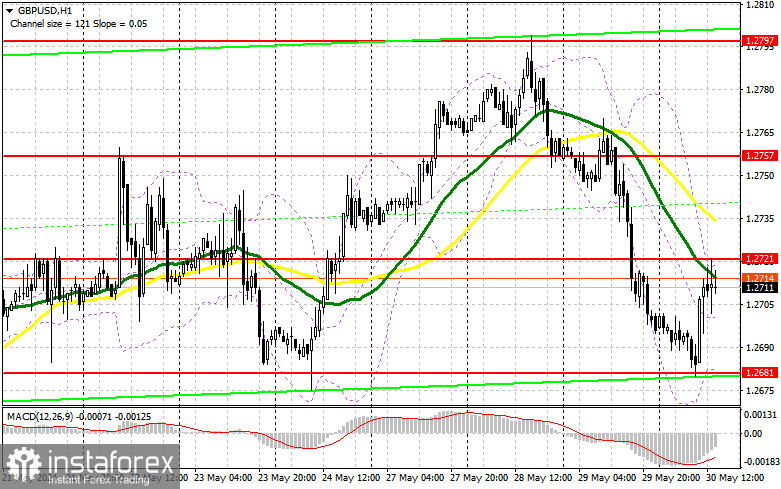

In my morning forecast, I highlighted the level of 1.2714 and planned to make market entry decisions based on it. Let's look at the 5-minute chart and analyze what happened. The rise and formation of a false breakout around 1.2714 led to a sell signal for the pound, resulting in only a 10-point drop at the time of writing. The technical picture for the second half of the day has been slightly revised.

To open long positions in GBP/USD:

All attention will now be on the US data. Only weak figures on GDP changes and a decline in the core personal consumption expenditures index in the US will lead to a new wave of pound growth. If the figures turn out better than economists' forecasts and the labor market data are positive, pressure on the pair will likely return. In that case, I will postpone long positions until the new support at 1.2681, formed in the first half of the day. Only a false breakout formation there will confirm the presence of major players in the market, providing a good entry point for long positions, potentially breaking through 1.2721, which bulls have struggled with today. A breakout and test from top to bottom of this range will give a chance for GBP/USD to rise with an update to 1.2757. If it goes above this range, we can talk about a surge to 1.2797, where I plan to take profits. If GBP/USD falls and there are no buyers at 1.2681 in the second half of the day, pressure on the pound will return, leading to a decline to the support area of 1.2646. A false breakout formation there will be a suitable entry point. Opening long positions on a rebound can be done from 1.2615 with the aim of a 30-35 point upward correction within the day.

To open short positions in GBP/USD:

In the event of another rise in the pair, which is more likely, I plan to act after another false breakout formation around the resistance at 1.2721, similar to the scenario discussed earlier. This will lead to an entry point for short positions, aiming for a decline in GBP/USD to the support area of 1.2681, formed during European trading. A breakout and retest from the bottom to the top of this range will increase pressure on the pair, giving bears an advantage and another entry point for selling, aiming to update 1.2646, where I expect more active buying. The furthest target will be the minimum at 1.2615, indicating the formation of a new bearish trend. There, I will take profits. In the scenario of GBP/USD rising and no bears at 1.2721 in the second half of the day, buyers will regain the initiative with a chance to update 1.2757. I will sell there only on a false breakout. If there is no activity there, I recommend opening short positions on GBP/USD from 1.2797, aiming for a 30-35 point downward correction.

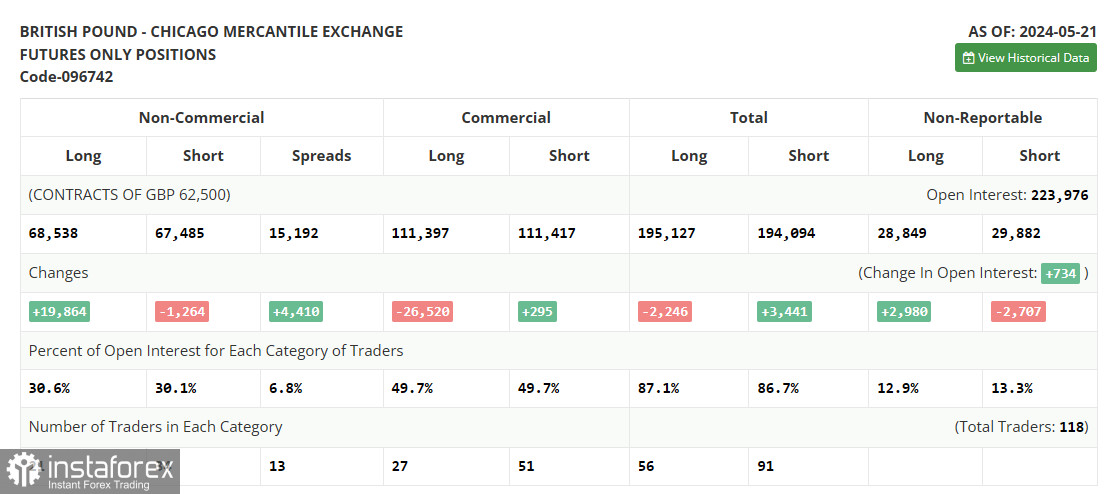

The COT report showed a sharp increase in long positions and a decrease in short ones. Traders continue to believe that the Bank of England will cut interest rates by the end of summer or early fall this year, providing good support for the UK economy. Recent inflation data indicated this possibility, but for a complete picture, the regulator wants to ensure prices are declining across the board. The services sector remains problematic, with rising prices due to increased household wage growth. Once this component is addressed, rate cuts will occur, supporting the pound and the UK economy in the medium term. The latest COT report indicated that non-commercial long positions increased by 19,864, reaching 68,538, while short non-commercial positions fell by 1,264, reaching 67,485. As a result, the spread between long and short positions increased by 2,109.

Indicator Signals:

Moving Averages:

Trading is below the 30 and 50-day moving averages, indicating further pair decline.

Note: The author considers the period and prices of moving averages on the hourly H1 chart, differing from the general definition of classical daily moving averages on the D1 chart.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator, around 1.2681, will serve as support.

Indicator Descriptions:

- Moving average (determines the current trend by smoothing volatility and noise). Period – 50. Marked in yellow on the chart.

- Moving average (determines the current trend by smoothing volatility and noise). Period – 30. Marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence – convergence/divergence of moving averages) Fast EMA – period 12. Slow EMA – period 26. SMA – period 9.

- Bollinger Bands. Period – 20.

- Non-commercial traders – speculators such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open positions of non-commercial traders.

- The total non-commercial net position is the difference between the short and long positions of non-commercial traders.