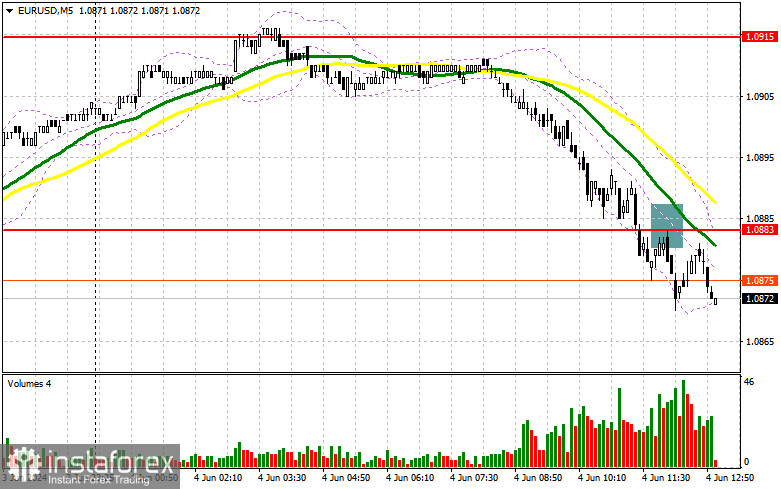

In my morning forecast, I paid attention to the 1.0883 level and planned to decide to enter the market from it. Let's look at the 5-minute chart and figure out what happened there. A breakout and a reverse test of this range gave a sell signal, which resulted in a drop of 10 points at the time of writing. In the afternoon, the technical picture still needed to be revised.

To open long positions on EURUSD, you need:

The number of unemployed in Germany in April of this year turned out to be three times higher than economists' expectations, partly leading to increased pressure on the euro. The complete absence of any attempts by buyers to protect 1.0883 surprised me, and now, obviously, only the 1.0855 area will act as the closest support, which is where the pair is heading now. The pressure on EUR/USD may increase again after strong data on vacancies and labor turnover in the United States from the Bureau of Labor Statistics, changes in the volume of production orders and the index of economic optimism. Therefore, I will open long positions in the 1.0855 area only after forming a false breakdown, which will be a suitable option to enter the market based on an upward correction at the end of the day. The target will now be the 1.0855 resistance, which acts as a support in the morning. A breakout and a top-down update of this range will strengthen the pair with a chance of returning to 1.0915–month high. The farthest target will be the 1.0942 area, where I will record profits. With the option of a decrease in EUR/USD and a lack of activity around 1.0855 in the afternoon, the pressure on the market will return, leading to a larger drop in the pair to the area of 1.0829. I will also enter there only after the formation of a false breakdown. I plan to open long positions immediately for a rebound from 1.0813 with the aim of an upward correction of 30-35 points within the day.

To open short positions on EUR/USD:

Sellers have a chance to regain control of the market, but good US statistics are needed for this. It's best to wait for growth and a false breakout around the new resistance of 1.0883 before selling. This will provide an entry point for new short positions with the prospect of a euro decline and a renewal of support at 1.0855, which will completely negate all of the pair's upward potential from yesterday. A breakout and consolidation below this range, followed by a retest from below, will give another selling point, moving the pair to the 1.0829 minimum, where I expect more active buyer participation. The furthest target will be the minimum at 1.0813, where I will take profit. In case of an upward move in EUR/USD in the second half of the day and the absence of bears around 1.0883, buyers will have a chance to continue the pair's growth. In this case, I will postpone selling until the next resistance test at 1.0915. I will also sell there, but only after a failed consolidation. I plan to open short positions on the bounce from 1.0942 with the goal of a downward correction of 30-35 points.

Indicator Signals:

Moving Averages

Trading occurs around the 30 and 50-day moving averages, indicating market uncertainty.

Note: The author considers the period and prices of moving averages on the hourly chart H1, which differs from the general definition of classic daily moving averages on the daily chart D1.

Bollinger Bands

In case of a decline, the lower boundary of the indicator, around 1.0866, will act as support.

Indicator Descriptions:

- Moving Average (MA): Determines the current trend by smoothing volatility and noise. Period 50. Marked in yellow on the chart.

- Moving Average (MA): Determines the current trend by smoothing volatility and noise. Period 30. Marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence): Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands: Period 20.

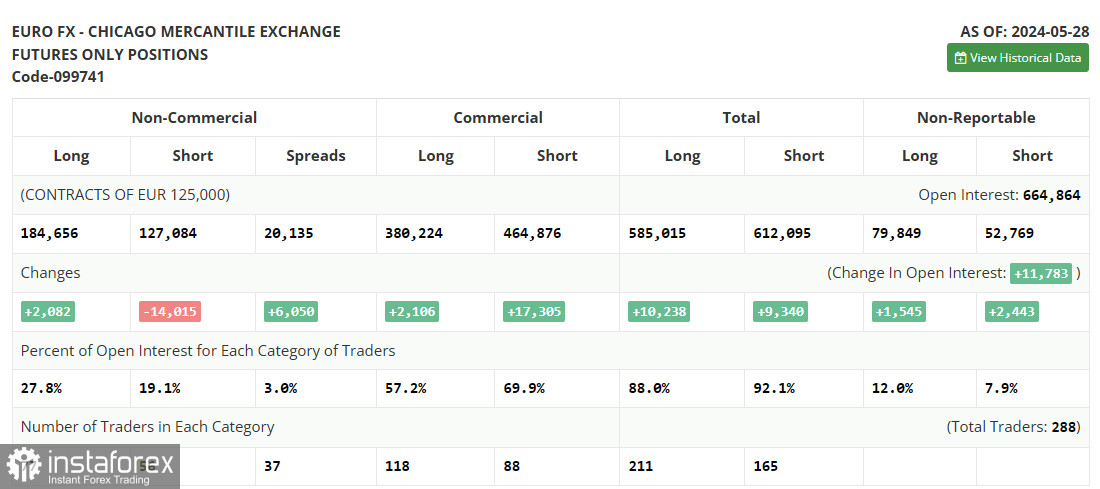

- Non-Commercial Traders: Speculators such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and meet specific requirements.

- Long Non-Commercial Positions: Represent the total long open positions of non-commercial traders.

- Short Non-Commercial Positions: Represent the total short open positions of non-commercial traders.

- Total Non-Commercial Net Position: The difference between short and long positions of non-commercial traders.