EUR/USD continued its illogical movement on Tuesday. This time, the pair started to fall in the morning. Take note that the day before, the euro continued to rise from the moment the US ISM PMI data was published. We would like to highlight the fact that the market had an extremely strong reaction to this particular report. Typically, a reaction lasts for 1-2 hours, but this time the market was selling the dollar for 4-5 hours, which exhibits the market's predisposition to buying the euro and selling the dollar. And if so, the single currency will continue to rise in any case.

Recall that the recent uptrend, which still constitutes a correction (as clearly seen on the 24-hour timeframe), raises numerous questions. Tomorrow, the European Central Bank may announce the first rate cut, but the market is not interested in this at all. If the ECB does not lower rates as everyone expects, there is no doubt that another EUR/USD upswing awaits us.

But let's go back to Tuesday. The euro fell for most of the day, which doesn't mean anything. Just a simple retracement, nothing more. If you look closely at the entire period between April 16th and today, it's clear that the pair constantly retreated, but these retracements were so weak that it created the impression that the price constantly increased. Over a month and a half, the single currency managed to add about 300 pips in this manner. That's roughly 10 pips of growth per day. Moreover, as we have already determined, the price has almost always moved in one direction.

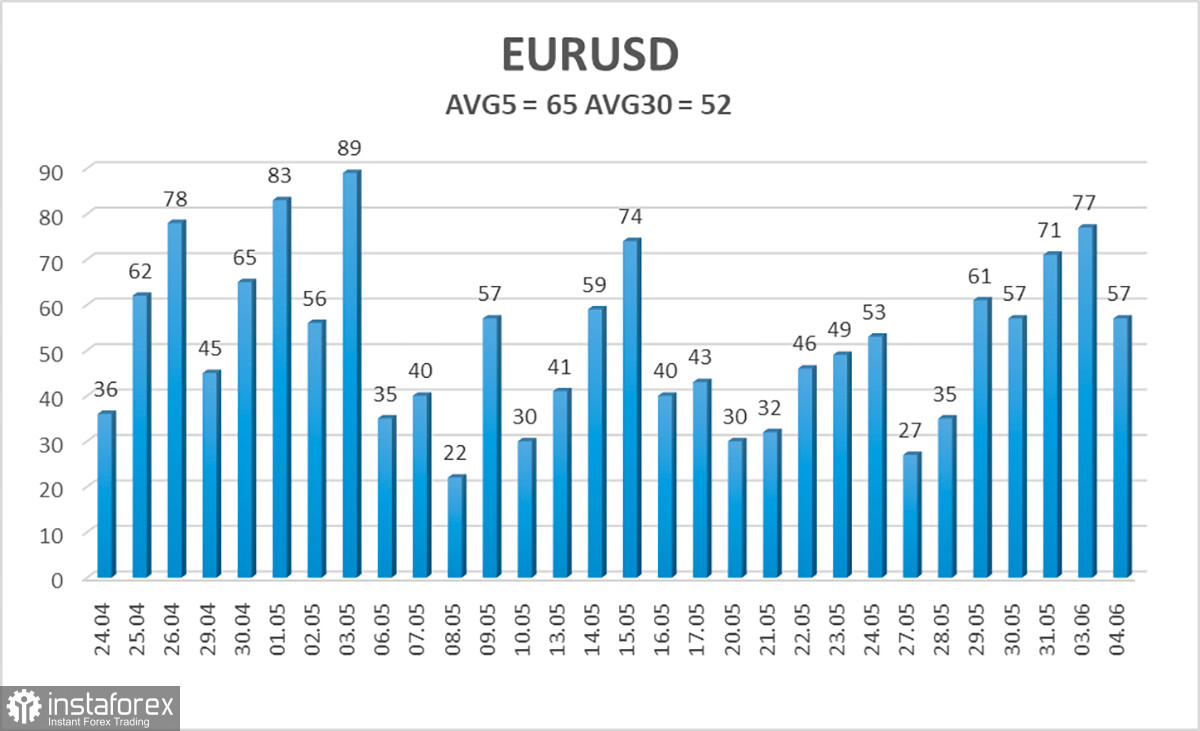

Volatility remains quite low, movements are erratic but with a bullish bias. In our opinion, not only does the pair show illogical movements (as it ignores the obvious fundamental background), but it is also quite inconvenient to trade. If the movements were strong and volatile, one could make profit every single day even on intraday trades. If the pair moved with volatility and corrected with volatility, again one could trade with both the main movement and the correction. Instead, we're dealing with small movements that are constantly alternating. The pair advances by 40 pips, then retreats by 30 pips. Traders have to catch tiny movements or stay in one trade for several weeks just to make a profit of 80-100 pips.

And we want to mention that right now it has been extremely difficult to hold on to long positions in the euro, as the fundamental background suggests that the pair may fall, as well as to the corrective nature of the current rise.

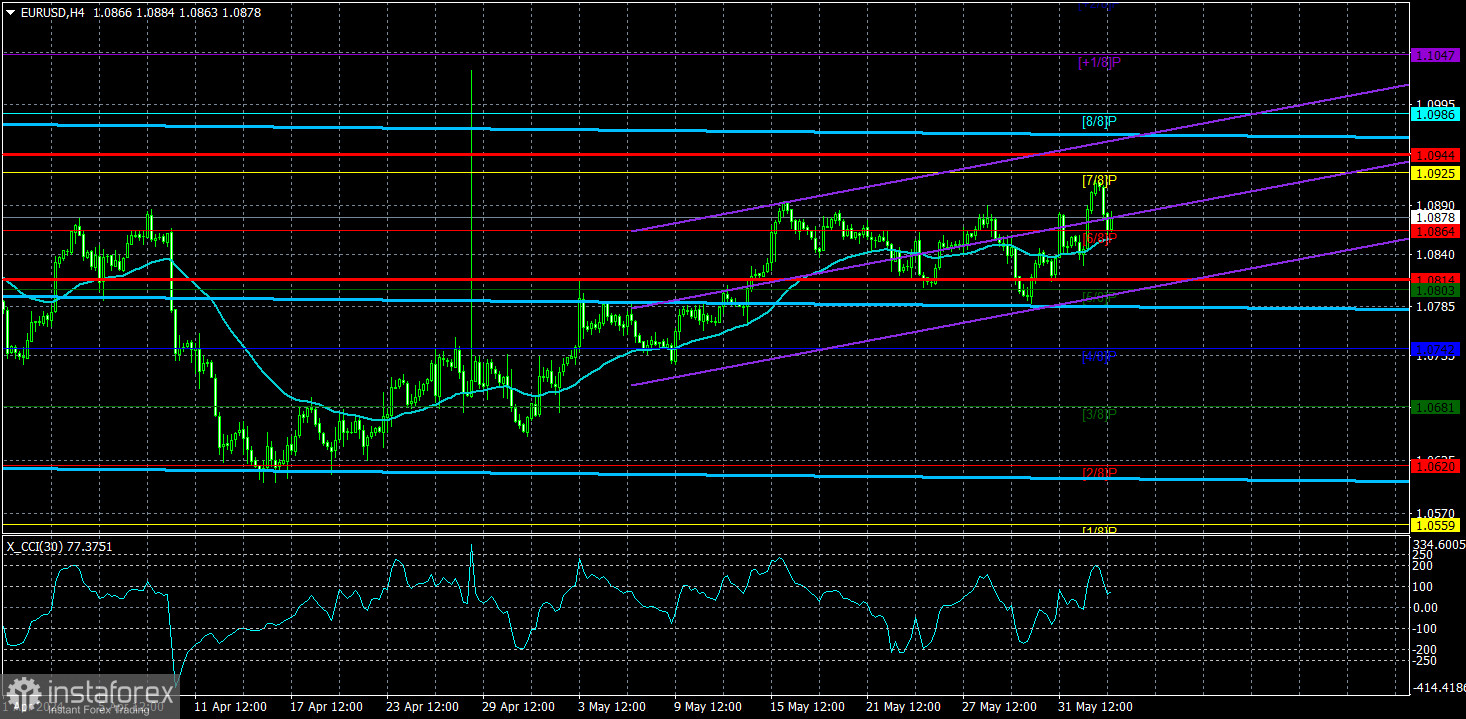

The average volatility of the EUR/USD pair over the last five trading days as of June 5 is 65 pips, which is considered an average value. We expect the pair to move between the levels of 1.0814 and 1.0944 on Wednesday. The higher linear regression channel is directed downward, so the global downward trend remains intact. The CCI indicator entered the oversold area in May, which triggered the upward movement. However, the bullish correction has lasted for a long time so it's difficult to expect it to end anytime soon.

Nearest support levels:

S1 - 1.0864

S2 - 1.0803

S3 - 1.0742

Nearest resistance levels:

R1 - 1.0925

R2 - 1.0986

R3 - 1.1047

Trading Recommendations:

The EUR/USD pair maintains a downtrend, but the bullish correction remains intact. The price continues to stay above the moving average, but a downtrend doesn't start even if the euro drops below this mark. The euro should resume its downward movement in the medium term, but the market continues to interpret almost every event against the dollar. We believe that this will not last forever. You may consider selling the euro if the price consolidates below the moving average. If the price continues to fall, the euro could become much cheaper in the next few months, as the fundamental and macroeconomic background continues to support the dollar. A global downtrend also persists on the 24-hour TF. But at the moment, the bullish bias persists, and pure technical analysis only points to buying the pair with targets at 1.0925 and 1.0944.

Explanation of Illustrations:

- Linear Regression Channels – Helps determine the current trend. If both are directed in the same direction, it means the trend is currently strong.

- Moving Average Line (settings 20.0, smoothed) – Determines the short-term trend and the direction in which trading should currently be conducted.

- Murray Levels – Target levels for movements and corrections.

- Volatility Levels (red lines) – The probable price channel in which the pair will spend the next day, based on current volatility indicators.

- CCI Indicator – Its entry into the oversold area (below -250) or the overbought area (above +250) means that a trend reversal in the opposite direction is imminent.