Analysis of Trades and Tips for Trading the Euro

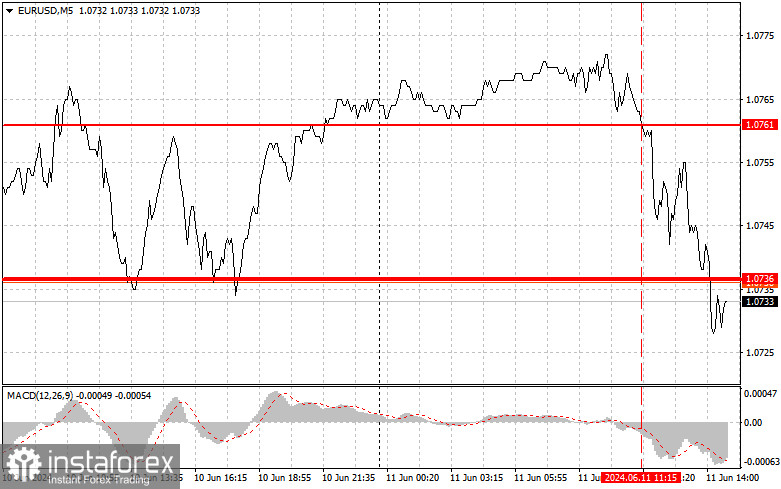

The test of the 1.0761 price level in the first half of the day coincided with the MACD indicator moving significantly below the zero mark, which limited the pair's further downward potential—especially in the absence of any statistics from the Eurozone. However, as you can see on the chart, the euro fell to the weekly low area and even updated it, proving that the downward potential is not yet exhausted. The lack of US statistics in the second half of the day may positively affect euro buyers, similar to yesterday, but how long this will last—especially before the key inflation statistics expected tomorrow—remains a difficult question. It is better to continue using corrections and trade within the channel. Regarding the intraday strategy, I plan to act based on Scenarios #1 and #2.

Buy Signal

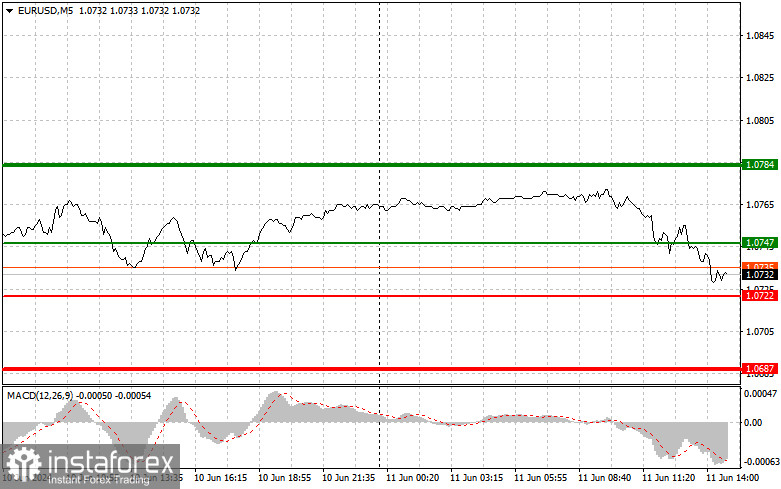

Scenario #1: Today, I plan to buy the euro upon reaching the price area of 1.0747 (green line on the chart) with a target of rising to the 1.0784 level. At the 1.0784 point, I will exit the market and also sell the euro in the opposite direction, expecting a movement of 30-35 points from the entry point. Upward movement of the euro today can only be expected within a small upward correction after an unsuccessful attempt to consolidate around the daily low. Important! Before buying, make sure the MACD indicator is above the zero mark and just starting to rise from it.

Scenario #2: I also plan to buy the euro today in case of two consecutive tests of the 1.0722 price when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a market reversal upward. We can expect a rise to the opposite levels of 1.0747 and 1.0784.

Sell Signal

Scenario #1: I will sell the euro after reaching the 1.0722 level (red line on the chart). The target will be the 1.0687 level, where I plan to exit the market and immediately buy the euro in the opposite direction (expecting a movement of 20-25 points from the level). Pressure on the pair will return in the case of a weak correction and attempts by buyers to regain the market. Important! Before selling, make sure the MACD indicator is below the zero mark and just starting to decline from it.

Scenario #2: I also plan to sell the euro today in case of two consecutive tests of the 1.0747 price when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. We can expect a decline to the opposite levels of 1.0722 and 1.0687.

Chart Legend:

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: Estimated price for setting Take Profit or manually fixing profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: Estimated price for setting Take Profit or manually fixing profits, as further decline below this level is unlikely.

- MACD Indicator: When entering the market, it is important to consider overbought and oversold zones.

Important: Beginner traders on the Forex market should be very cautious when making market entry decisions. It is best to stay out of the market before the release of significant fundamental reports to avoid sudden price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. You need to set stop orders to avoid losing your entire deposit, especially if you do not use money management and trade large volumes.

Remember that successful trading requires a clear trading plan, like the one I presented above. Spontaneous trading decisions based on the current market situation are initially a losing strategy for an intraday trader.