The EUR/USD pair has been in a growth phase since April 16. The situation changed only at the end of last week when the ECB decided to start easing monetary policy. This decision had been anticipated for a long time, but there were still some doubts until it was officially announced. Or hopes. Hopes primarily held by the bulls, who had been driving the European currency upwards for almost two months. If the ECB had postponed the first rate cut to the next meeting, the European currency could have maintained its bullish trend. However, the euro had risen enough over the past few months. The ECB would have started cutting rates in any case.

Similarly, the Fed will start cutting rates eventually, but the timing is crucial. The market cannot simultaneously react to rate cuts by both the Fed and the ECB if these processes begin six months apart. It makes more sense to first react to easing in the Eurozone and then in the US. Thus, bears will dominate the market until autumn-winter, and then (when the FOMC starts discussing easing monetary policy openly) it will be the bulls' turn.

However, we are still far from that point. This week, the FOMC meeting will take place, but the inflation report is much more important. As before, the Fed's monetary policy depends specifically on inflation. If the consumer price index does not show the desired value, the central bank has no reason to change the rate.

US inflation has been quite contradictory over the past year. While core inflation has been steadily slowing down almost every month, the main indicator has been fluctuating between 3.0% and 3.7% for a year. Core inflation will likely stop slowing down in the coming months and will also remain above 3%. Both indicators staying above 3% will not allow the Fed to start easing monetary policy.

Traders' expectations for May inflation are around 3.4% for headline inflation and 3.5% for core inflation. No slowdown is expected for headline inflation in May, while core inflation may decrease by a maximum of 0.1%. Such changes will have no consequences for the dollar. However, actual values can significantly differ from market expectations.

Dollar growth on Wednesday can be expected if inflation remains at 3.4% and 3.5%, respectively, or if the actual values are higher. Dollar bulls may retreat from the market if inflation slows down or slows down more than expected. I want to remind you that traders' reactions to actual figures depend on the trend. Currently, the dollar is rising, so even neutral inflation values can help it continue to grow. To see a decline in the US dollar, we need "bad" figures.

Conclusion:

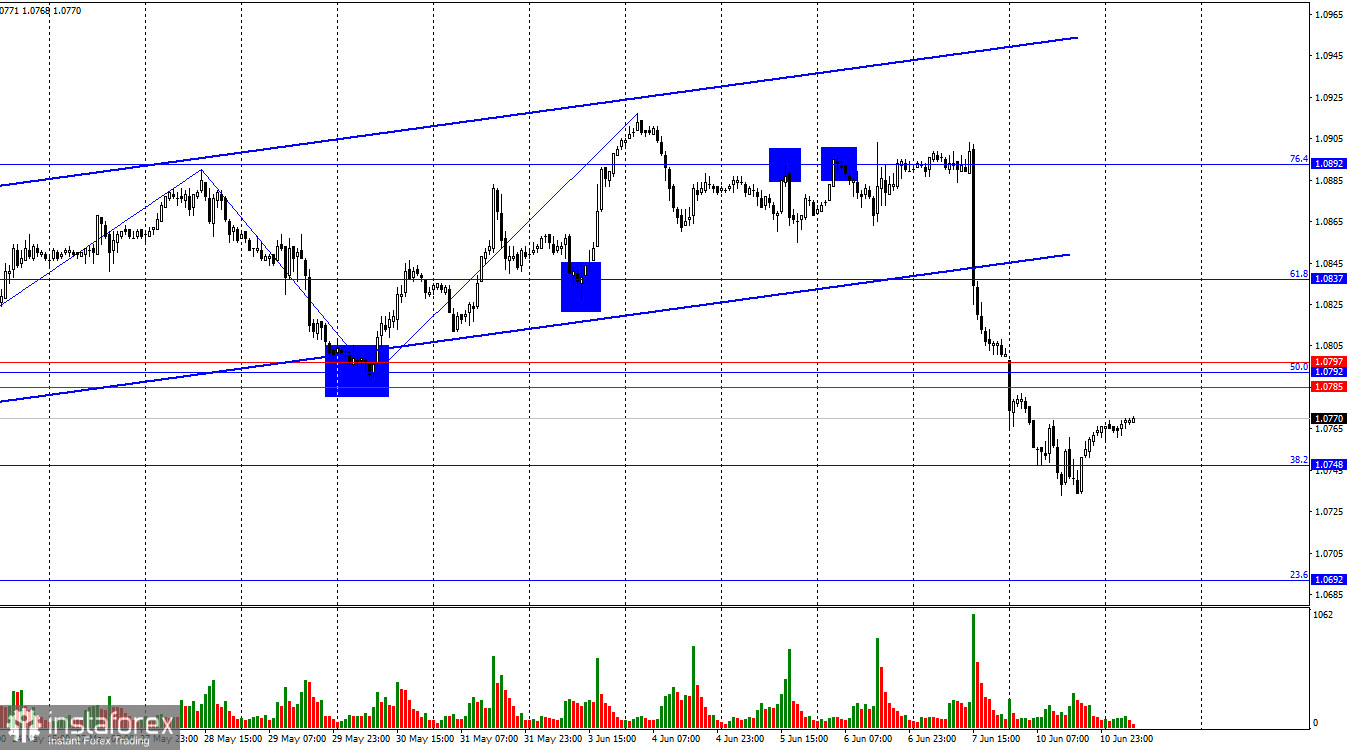

The trend for the EUR/USD pair has turned bearish, and this is very important. Over the past two months, we have often seen situations where the economic statistics were not so bad for the US dollar, yet it still fell. Now, the situation could reverse. Dollar buyers have become active and can use most statistics to their advantage. Therefore, on Wednesday, US inflation should show a decrease of 0.2% or more for us to see a decline in the US dollar. In other cases, the market reaction will be insignificant, or the dollar will continue to rise.