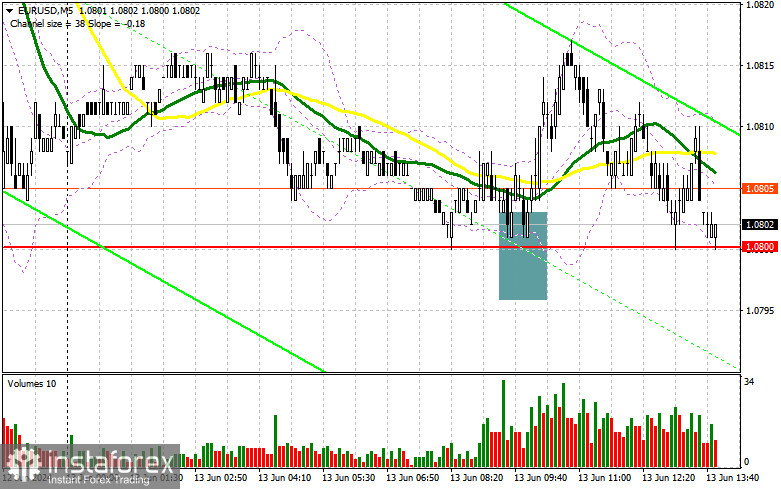

In my morning forecast, I highlighted the 1.0800 level and planned to make market entry decisions based on it. Let's look at the 5-minute chart and see what happened there. A decline and the formation of a false breakout at that level provided a signal to buy euros, resulting in a small rise of 15 points, after which the movement ended. The technical picture for the second half of the day still needs to be revised.

To Open Long Positions on EUR/USD:

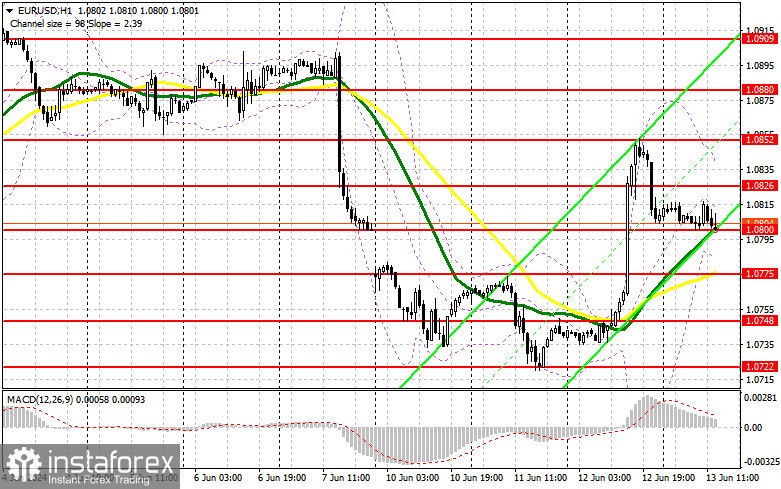

Today, a number of important statistics related to US inflation and the labor market will be released. It all starts with the Producer Price Index, excluding food and energy prices. A decline in these indicators will lead to euro growth, and positive news on the reduction of initial jobless claims in the US will further strengthen the bullish market. In case of a negative reaction, buyers will once again have to prove their presence around the 1.0800 level. A false breakout formation at that level will provide an entry point to buy euros, targeting a rise to the 1.0826 level, formed based on yesterday's results. Breaking and updating this range from top to bottom will strengthen the pair with a chance to rise to around 1.0852. The farthest target will be the maximum of 1.0880, where I will take profits. Testing this level will revive the bullish market. If the EUR/USD declines and there is no activity around 1.0800 in the second half of the day (as this level has already been tested for strength once today), this will significantly increase the pressure on the euro and lead to a new fall in the pair. In this case, I will only enter after a false breakout at the next support level of 1.0775. I plan to open long positions immediately on a rebound from 1.0748, targeting an intraday upward correction of 30-35 points.

To Open Short Positions on EUR/USD:

Sellers have shown themselves, but they need more enthusiasm. It is also important today not to let the pair go beyond the resistance level of 1.0826, which will happen if the inflation statistics are weak, similar to yesterday. A false breakout there will be a suitable entry point for short positions, targeting further decline towards the 1.0800 support. Considering this level has already been tested, breaking and consolidating below this range, as well as a retest from bottom to top, will provide another sell signal, targeting a new minimum of 1.0775, where I expect more active bulls. The farthest target will be the minimum of 1.0748, where I will take profits. If the EUR/USD moves up in the second half of the day and there are no bears at 1.0826, which is more likely, the bulls will have a chance for further growth. In this case, I will postpone selling until the next resistance at 1.0852 is tested. I will also sell there, but only after an unsuccessful consolidation. I plan to open short positions immediately on a rebound from 1.0880, targeting a downward correction of 30-35 points.

Indicator Signals:

Moving Averages

Trading is conducted below the 30 and 50-day moving averages, indicating further pair decline.

Note: The period and prices of the moving averages considered by the author are on the H1 hourly chart and differ from the classic daily moving averages on the D1 daily chart.

Bollinger Bands

In case of a decline, the lower boundary of the indicator, around 1.0740, will act as support.

Indicator Descriptions:

- Moving Average: Determines the current trend by smoothing volatility and noise. Period 50, marked in yellow on the chart.

- Moving Average: Determines the current trend by smoothing volatility and noise. Period 30, marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence): Fast EMA period 12, Slow EMA period 26, SMA period 9.

- Bollinger Bands: Period 20.

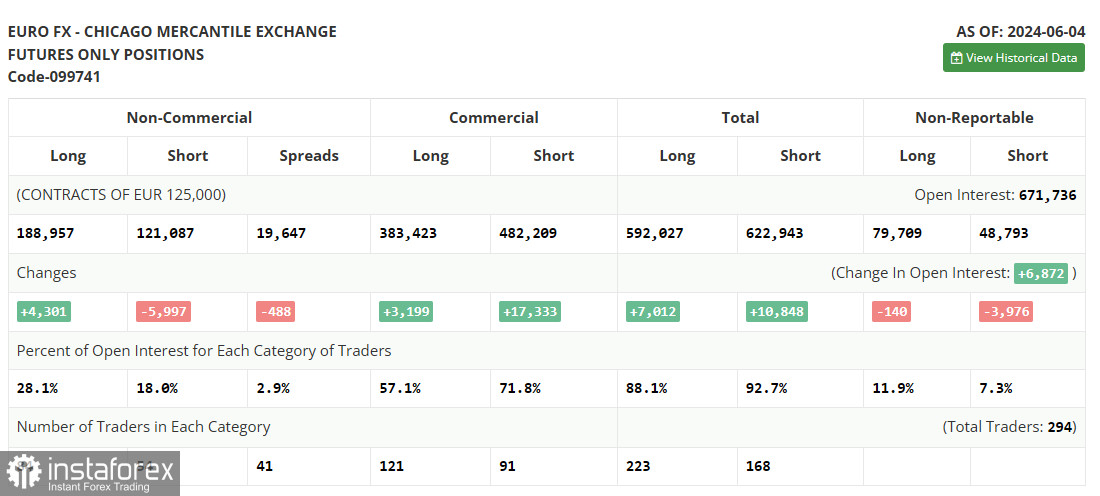

- Non-commercial traders: Speculators, such as individual traders, hedge funds, and large institutions, use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions: Represent the total long open position of non-commercial traders.

- Short non-commercial positions: Represent the total short open position of non-commercial traders.

- Total non-commercial net position: The difference between short and long positions of non-commercial traders.