Analysis of transactions and tips on trading the British pound

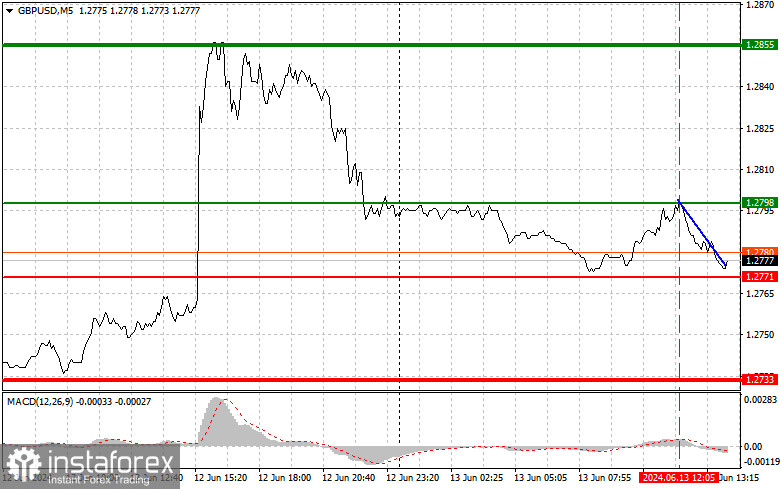

The price test of 1.2798 came at a time when the MACD was in the overbought area for quite a long period, and given that the buyers of the pound did not manage to get beyond the daily maximum, it was decided to sell GBP/USD. As a result, the pair went down about 20 points. The lack of statistics for the UK affected the upward potential of the pair. A lot of data on the American economy is expected in the afternoon. The producer price index, excluding food and energy prices, the number of initial applications for unemployment benefits, and the number of repeated applications for unemployment benefits will set the market direction. If the US data turns out to be better than economists' forecasts, the pressure on the British pound may quickly return. As for the intraday strategy, I plan to act based on the implementation of scenarios No. 1 and No. 2.

Buy signal

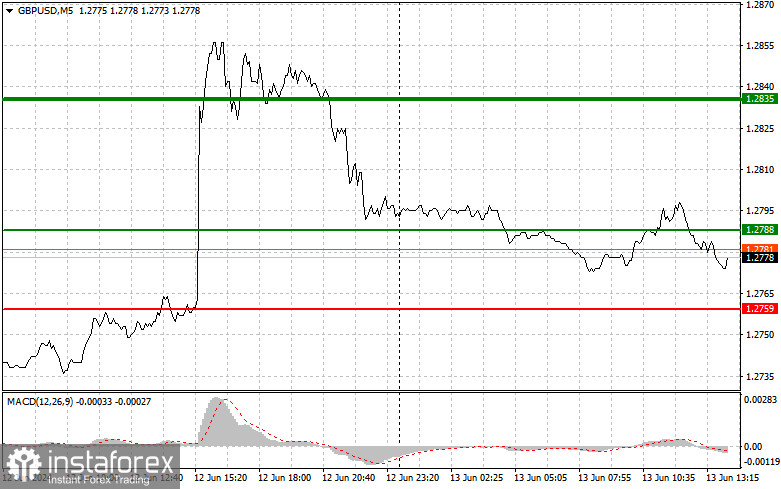

Scenario No. 1: I plan to buy the pound today when I reach the entry point in the area of 1.2788 (green line on the chart) in order to grow to the level of 1.2835 (thicker green line on the chart). In the area of 1.2835, I will exit purchases and open sales in the opposite direction (counting on a movement of 30-35 points in the opposite direction from the level). The growth of the pound today can be counted on only after weak data on American inflation. Important! Before buying, make sure that the MACD indicator is above the zero mark and is just starting to grow from it.

Scenario No. 2: I also plan to buy the pound today in the case of two consecutive price tests of 1.2759 at a time when the MACD indicator will be in the oversold area. This will limit the pair's downward potential and lead to an upward reversal of the market. We can expect an increase to the opposite levels of 1.2788 and 1.2835.

Sell signal

Scenario No. 1: I plan to sell the pound today after updating the level of 1.2759 (the red line on the chart), which will lead to a rapid decline in the pair. The key target of sellers will be the 1.2720 level, where I will exit sales, as well as immediately open purchases in the opposite direction (counting on a movement of 20-25 points in the opposite direction from the level). Sellers will prove themselves in case of unsuccessful attempts to return to the daily high and strong US data. Important! Before selling, make sure that the MACD indicator is below the zero mark and is just beginning its fall from it.

Scenario No. 2: I also plan to sell the pound today in the case of two consecutive price tests of 1.2788 at a time when the MACD indicator will be in the overbought area. This will limit the upward potential of the pair and lead to a downward reversal of the market. We can expect a decline to the opposite level of 1.2759 and 1.2720.

What's on the chart:

Thin green line is the entry price at which you can buy a trading instrument.

Thick green line is the estimated price where you can place Take profit or fix profits yourself, since further growth is unlikely above this level.

Thin red line is the entry price at which a trading instrument can be sold.

Thick red line is the estimated price where you can place Take profit or fix profits yourself, since further decline is unlikely below this level.

MACD indicator. When entering the market, it is important to be guided by overbought and oversold zones.

Important. Novice forex traders need to make decisions about entering the market very carefully. Before the release of important fundamental reports, it is best to stay out of the market to avoid falling into sharp fluctuations in the exchange rate. If you decide to trade during the news release, always place stop orders to minimize losses. You need to place stop orders to avoid losing the entire deposit very quickly, especially if you do not use money management but trade in large volumes.

And remember that for successful trading it is necessary to have a clear trading plan, following the example of the one I presented above. Making spontaneous trading decisions based on the current market situation is an inherently losing strategy for an intraday trader.