Analysis of transactions and tips on trading the European currency

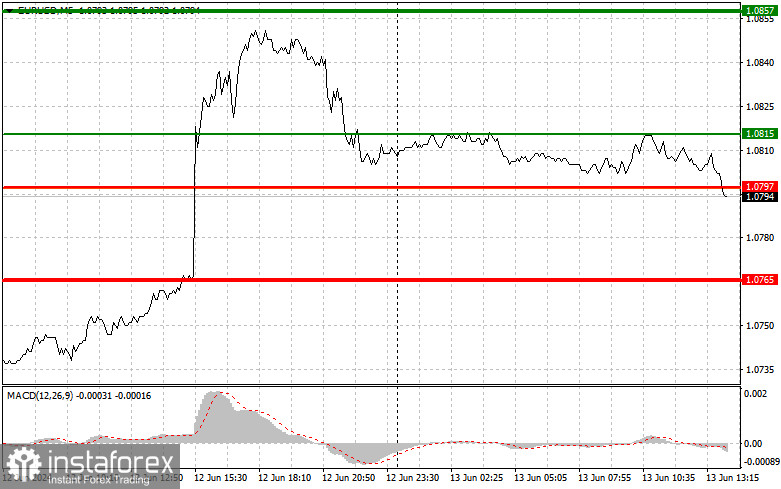

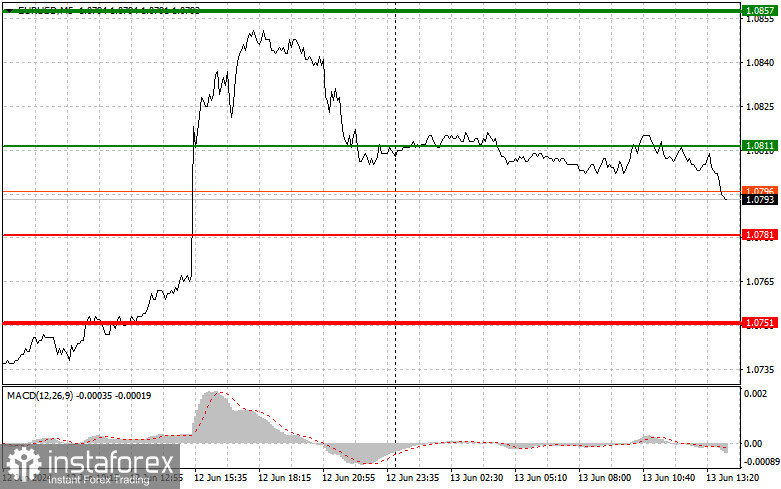

The price test of 1.0815 in the first half of the day came at a time when the MACD indicator went up a lot from zero, which limited the further upward potential of the pair. For this reason, I did not sell euros. In the afternoon, quite a lot of data on the American economy is expected again. The producer price index, the producer price index excluding food and energy prices, the number of initial applications for unemployment benefits, and the number of repeated applications for unemployment benefits will set the market direction. It will all end with a speech by Finance Minister Janet Yellen, who will certainly talk about trade relations with China, which may further strengthen the dollar's position, provided that the US data turns out to be better than economists' forecasts. As for the intraday strategy, I plan to act based on the implementation of scenarios No. 1 and No. 2.

Buy signal

Scenario No. 1: today, I plan to buy euros when the price reaches 1.0811 (the green line on the chart) in order to grow to the level of 1.0857. At 1.0857, I will exit the market, as well as sell euros in the opposite direction, counting on a movement of 30-35 points from the entry point. The upward movement of the euro today can be counted on only after a decrease in inflation in the United States. Important! Before buying, make sure that the MACD indicator is above the zero mark and is just starting to grow from it.

Scenario No. 2: I also plan to buy euros today in the case of two consecutive price tests of 1.0781 at a time when the MACD indicator will be in the oversold area. This will limit the pair's downward potential and lead to an upward reversal of the market. We can expect an increase to the opposite levels of 1.0811 and 1.0857.

Sell signal

Scenario No. 1: I will sell euros after reaching the level of 1.0781 (the red line on the chart). The target will be the 1.0751 level. I plan to exit the market and buy euros immediately in the opposite direction (counting on a movement of 20-25 points in the opposite direction from the level). The pressure on the pair will return in case of strong US data. Important! Before selling, make sure that the MACD indicator is below the zero mark and is just beginning its decline from it.

Scenario No. 2: I also plan to sell euros today in the case of two consecutive price tests of 1.0811 at a time when the MACD indicator will be in the overbought area. This will limit the upward potential of the pair and lead to a downward reversal of the market. We can expect a decline to the opposite level of 1.0781 and 1.0751.

What's on the chart:

Thin green line is the entry price at which you can buy a trading instrument.

Thick green line is the estimated price where you can place Take profit or fix profits yourself, since further growth is unlikely above this level.

Thin red line is the entry price at which a trading instrument can be sold.

Thick red line is the estimated price where you can place Take profit or fix profits yourself, since further decline is unlikely below this level.

MACD indicator. When entering the market, it is important to be guided by overbought and oversold zones.

Important. Novice forex traders need to make decisions about entering the market very carefully. Before the release of important fundamental reports, it is best to stay out of the market to avoid falling into sharp fluctuations in the exchange rate. If you decide to trade during the news release, always place stop orders to minimize losses. You need to place stop orders to avoid losing the entire deposit very quickly, especially if you do not use money management but trade in large volumes.

And remember that for successful trading it is necessary to have a clear trading plan, following the example of the one I presented above. Making spontaneous trading decisions based on the current market situation is an inherently losing strategy for an intraday trader.