Yesterday, EUR/USD reversed near the Murray "0/8" at 1.0742, and the pair slightly fell. As a reminder, the movement that started on June 14 is considered a bullish correction, and at the moment, we cannot confirm if it has ended. Movements within the correction (which often takes on a "flat-like" appearance) can be quite erratic, with frequent pullbacks. Therefore, we weren't surprised that the euro initially fell on Tuesday. Ideally, traders should aim to trade with the trend, not against it. Currently, we have a downward trend at our disposal, both on the 24-hour and 4-hour timeframes. Therefore, the goal is to open short positions rather than long ones.

I wish to remind you that we expect the euro to fall. We say this quite often because it is extremely important to understand that there is no logical way for the euro to show growth at the moment. This doesn't mean that it is impossible for the pair to show growth. In fact, it can practically exhibit any movement. However, it is worth noting that it would be logical for the pair to show a downward movement.

The European Central Bank has started lowering interest rates, which triggered the market that had been diligently pushing the pair up for a long time (two months) to sell at a higher price. At the same time, the Federal Reserve does not intend to deliver its interest rate cut anytime soon. Some experts and analysts believe that the first Fed rate cut will happen in September, but we don't share that opinion. It must be pointed out that the market expected a Fed rate cut in March, then in June, and now in September. US inflation was 3.1% in January, 3.5% in March, and 3.3% in May. Thus, we can conclude that the US Consumer Price Index is not slowing down. If it is not slowing down, and the Fed did not start an easing cycle in either March or June, why should it start in September?

It is important to note that this is not just our opinion. For example, Bank of America also refers to US inflation's stubborn persistence and does not believe it will significantly slow down this year. The bank believes that inflation will remain above the target level until 2026 due to high demand for workers and increasing consumer spending. The bank's experts expect the Fed to hold the rate at its peak level for a longer period, and the US dollar will benefit greatly from this. We also believe that the increasing "rate divergence" between the ECB and the Fed will work in favor of the US dollar. However, we have been voicing these thoughts since the beginning of the year. Therefore, as before, we expect the pair to gradually decline to the levels of 1.0608, 1.0450, and 1.0200. The current downward trend will depend on when the Fed begins to at least hint at a readiness to ease monetary policy.

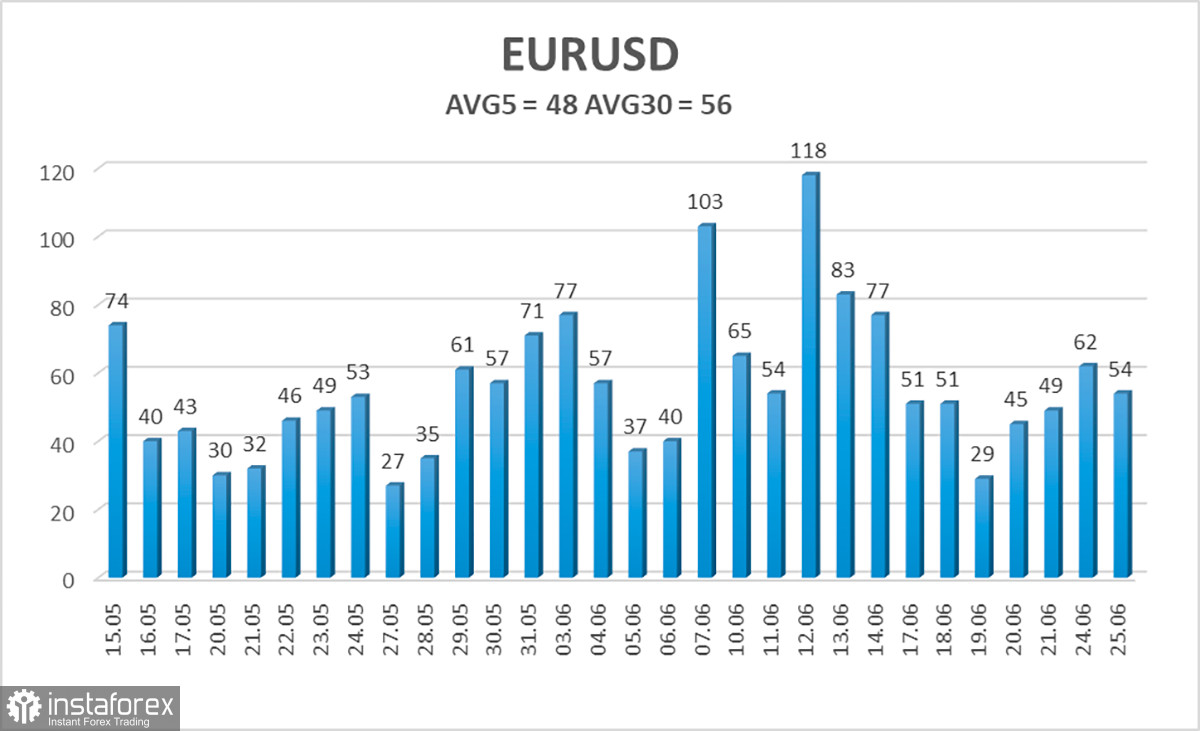

The average volatility of the EUR/USD pair over the last five trading days as of June 26 is 48 pips, which is considered a low value. We expect the pair to move between 1.0664 and 1.0760 on Wednesday. The higher linear regression channel has turned upwards, but the global downtrend remains intact. The CCI indicator entered the oversold area, but at this time we do not expect a strong rise.

Nearest support levels:

S1 - 1.0681

S2 - 1.0620

S3 - 1.0559

Nearest resistance levels:

R1 - 1.0742

R2 - 1.0803

R3 - 1.0864

Trading Recommendations:

The EUR/USD pair maintains a global downtrend, and it is located near the moving average on the 4-hour timeframe. In previous reviews, we said that we don't consider long positions and that we should wait for a continuation of the downtrend. At this time, short positions with targets like 1.0681 and 1.0620 are still valid. A rebound from 1.0681 triggered another round of the upward correction. We don't recommend buying the euro, as we believe that the global downtrend has resumed, and the single currency has no grounds for growth. But the price may rise within the correction for quite some time.

Explanation of the chart:

- Linear Regression Channels – Helps determine the current trend. If both are directed in the same direction, it means the trend is currently strong.

- Moving Average Line (settings 20.0, smoothed) – Determines the short-term trend and the direction in which trading should currently be conducted.

- Murray Levels – Target levels for movements and corrections.

- Volatility Levels (red lines) – The probable price channel in which the pair will spend the next day, based on current volatility indicators.

- CCI Indicator – Its entry into the oversold area (below -250) or the overbought area (above +250) means that a trend reversal in the opposite direction is imminent.