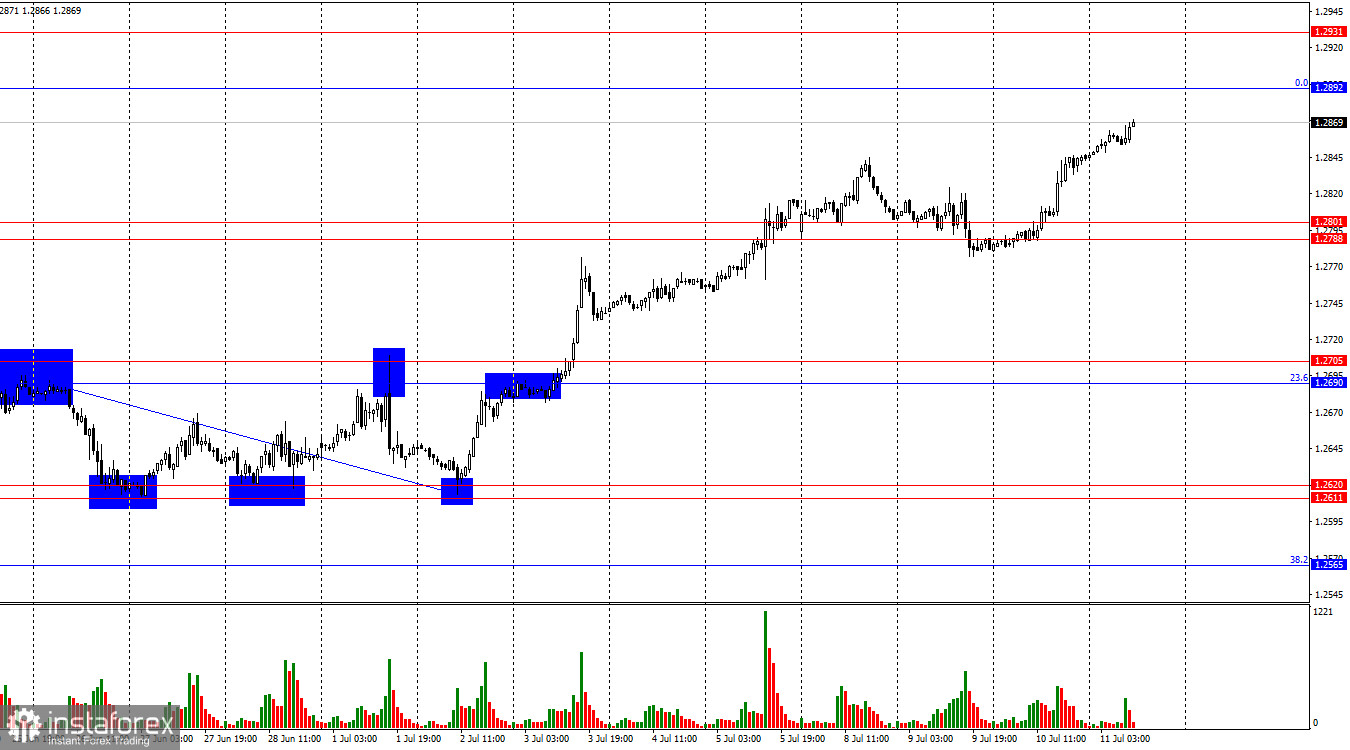

On the hourly chart, on Wednesday, the GBP/USD pair secured above the zone of 1.2788–1.2801, turned in favor of the British pound, and resumed the growth process towards the corrective level of 0.0%–1.2892. A rebound from this level will temporarily halt the pound's growth, but I advise paying attention to the nature of the pair's movement. It is almost seamless and without sharp swings up or down. This indicates that the market steadily buys the pound, regardless of the information background.

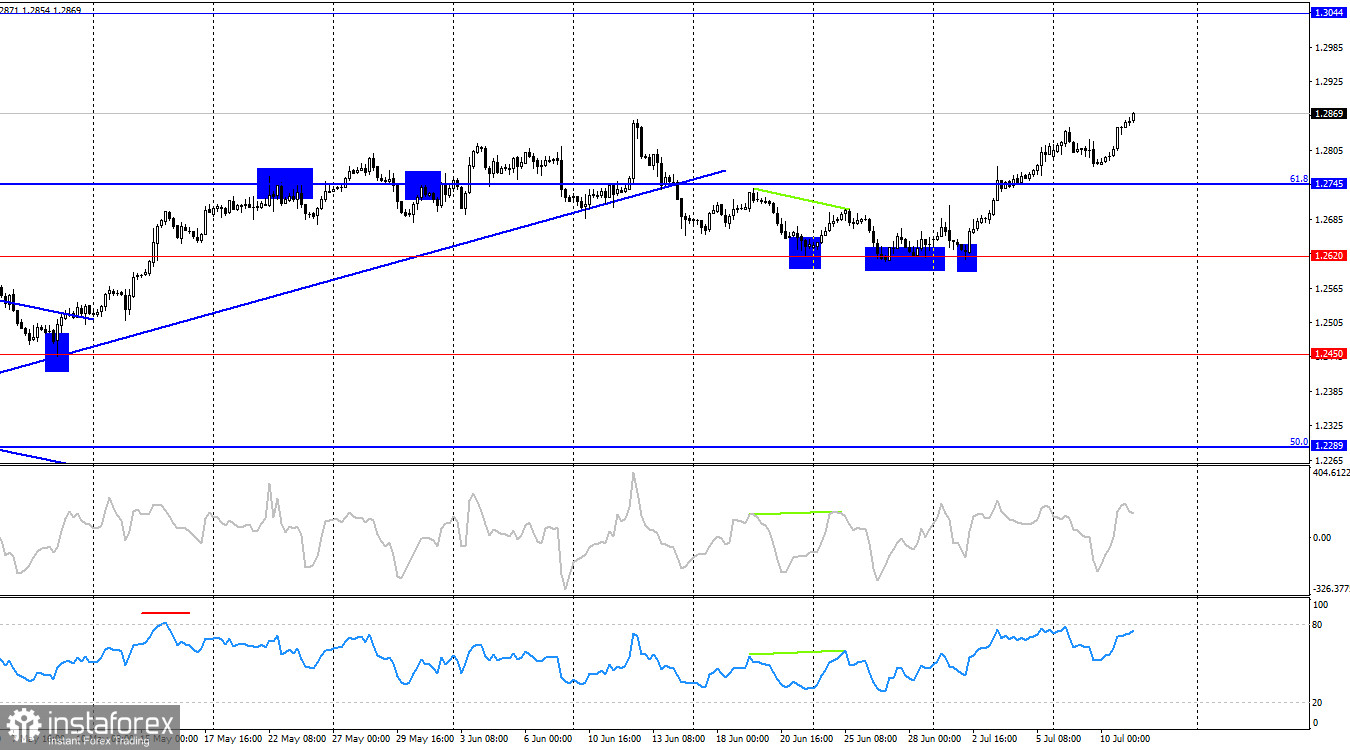

The wave situation has changed today. The last downward wave (which formed starting from June 12) managed to break the low of the previous wave, and the new upward wave (which is currently forming) managed to break the peak of the previous wave. Thus, we received the first sign of a trend reversal to "bullish" after the "bearish" trend failed to materialize. The pound's growth may continue, but I doubt this movement.

The information background on Wednesday did not predict new growth for the pound, but the bulls continued to attack throughout the day. This morning, the UK GDP report for May was released, showing +0.4% m/m, which is twice the traders' expectations. However, look closely at the chart. Do you see any reaction from traders to the positive report? I don't. This tells us that the bulls continue to buy, and the information background does not matter to them now. The industrial production report in the UK was also positive but did not exceed the forecast. The US inflation report will be released in the second half of the day, but as we have already found out, the bulls are not very interested in the news right now. Thus, the pair's growth may continue unless we see inflation significantly higher than the forecast (3.1% y/y).

On the 4-hour chart, the pair turned in favor of the British currency after four rebounds from the level of 1.2620 and then secured above the corrective level of 61.8%–1.2745. If you look closely at the 4-hour chart, there are no obstacles to the pound's further growth up to 1.3044. The bears were unable to break even the simplest level. Currently, the pound has good graphical prospects for growth.

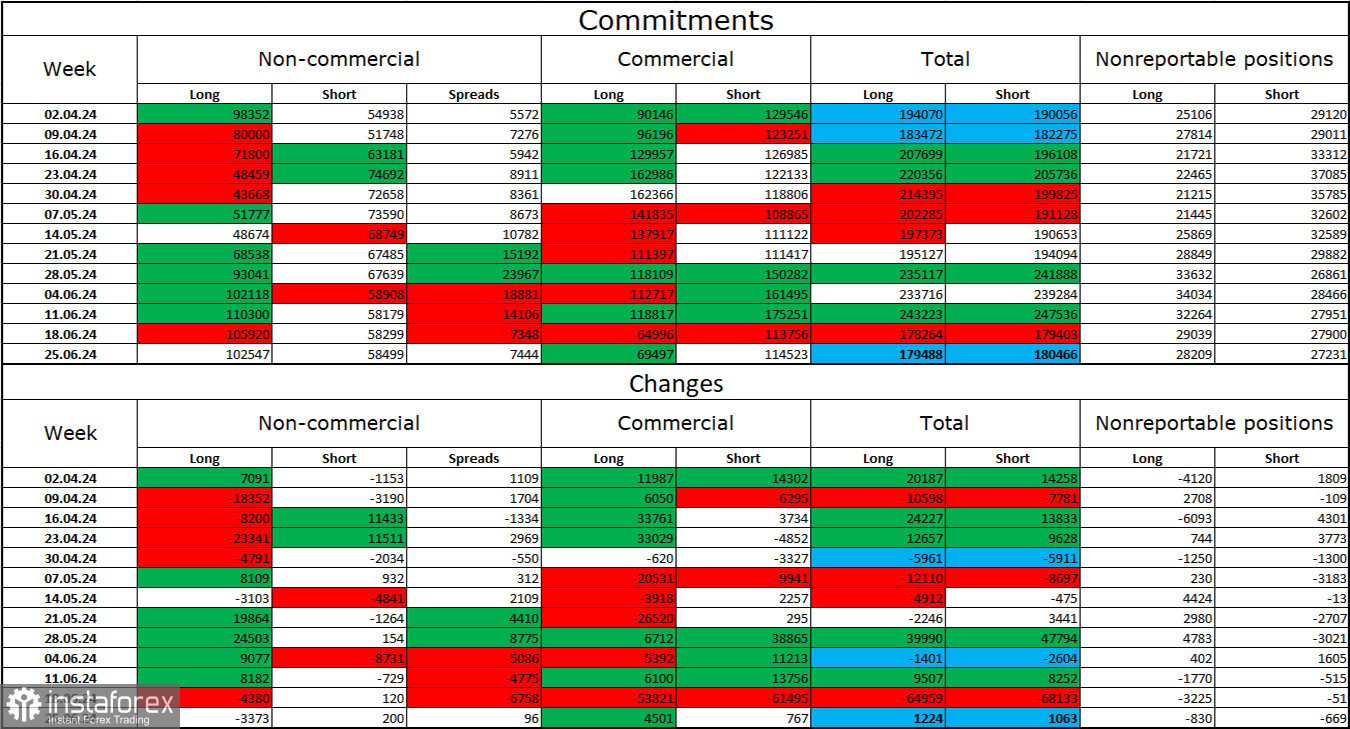

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" category of traders became slightly less "bullish" over the last reporting week. The number of long positions held by speculators decreased by 3,373 units, and the number of short positions increased by 200. The bulls still have a solid advantage. The gap between the long and short positions is 44 thousand: 102 thousand versus 58 thousand.

The prospects for the pound's decline remain. The graphical analysis has given several signals of the "bullish" trend breaking, and the bulls cannot attack forever. Over the past 3 months, the number of long positions has increased from 98 thousand to 102 thousand, and the number of short positions has increased from 54 thousand to 58 thousand. Over time, major players will continue to get rid of long positions or increase short positions since all possible factors for buying the British pound have already been worked out. However, it should be remembered that this is just a hypothesis. The graphical analysis still indicates the weakness of the bears, who cannot "take" even the level of 1.2620.

News Calendar for the US and UK:

- UK – GDP for May (06:00 UTC)

- UK – Change in Industrial Production Volume (06:00 UTC)

- US – Consumer Price Index (12:30 UTC)

- US – Change in the Number of Initial Jobless Claims

The economic events calendar contains several entries on Thursday, with the most important being US inflation. The influence of the information background on market sentiment today may be present, but I wonder if the bull traders will pay attention to it.

Forecast for GBP/USD and trading tips:

Selling the pound is possible upon a rebound from 1.2892 on the hourly chart with a target of 1.2788–1.2801. Buying could have been considered yesterday upon securing above the zone of 1.2788–1.2801 with a target of 1.2892. These trades can now be kept open.

Fibonacci levels are constructed from 1.2036 to 1.2892 on the hourly chart and from 1.4248 to 1.0404 on the 4-hour chart.