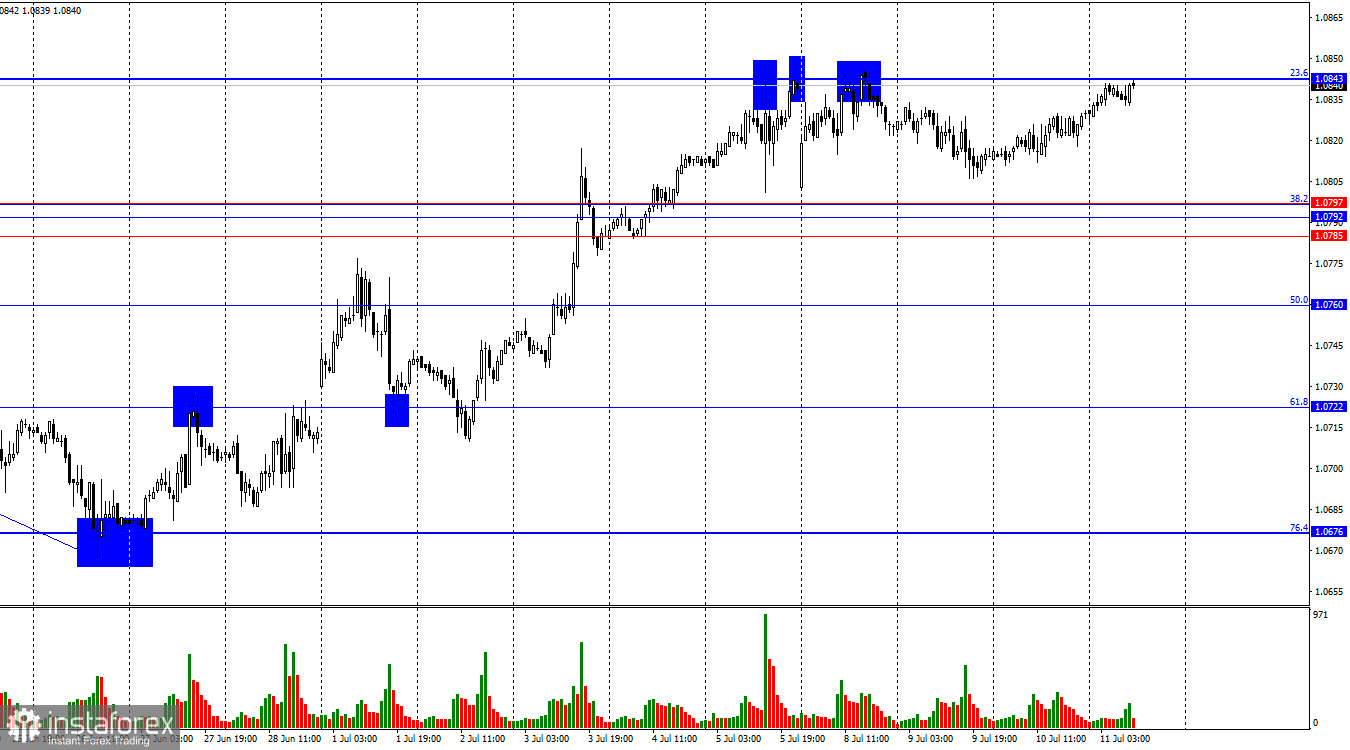

On Wednesday, the EUR/USD pair turned in favor of the euro and began a return process to the corrective level of 23.6%–1.0843. A rebound from this level for the fourth time will favor the dollar and some decline towards the support zone of 1.0785–1.0797. Securing the pair above the level of 1.0843 will favor continued growth towards the next Fibonacci level of 0.0%–1.0917.

The wave situation has become more complex. The new upward wave broke the peak of the previous wave and continued to form, while the last completed downward wave failed to break the low of the previous wave. Therefore, two signs of a trend change from "bearish" to "bullish" were received. Last week, the bulls received support from important information, which led to the pair's confident growth. The bulls have no informational support this week, but the euro continues to grow. From the level of 1.0843, a corrective "bearish" wave can be expected to form.

The informational background on Wednesday did not provide any hope for the bears. Jerome Powell's first appearance before the US Congress this week was on Tuesday, and the second on Wednesday was no different. Powell read the same speech twice. Therefore, if the bears found nothing to hold onto on Tuesday, there was no hope for dollar growth on Wednesday. Today, the US inflation report for June will be released, which is a lifeline for the dollar. However, the likelihood that inflation will slow to less than 3.1% is low, and any other value will mean a new offensive by the bulls. Germany's inflation report was also released in the morning, but its final estimate was the same 2.2% y/y as the preliminary estimate. Trader activity continues to fall, but the reasons for this are unknown. I expect stronger movement in the second half of the day today, but it may only be strong compared to yesterday's movement.

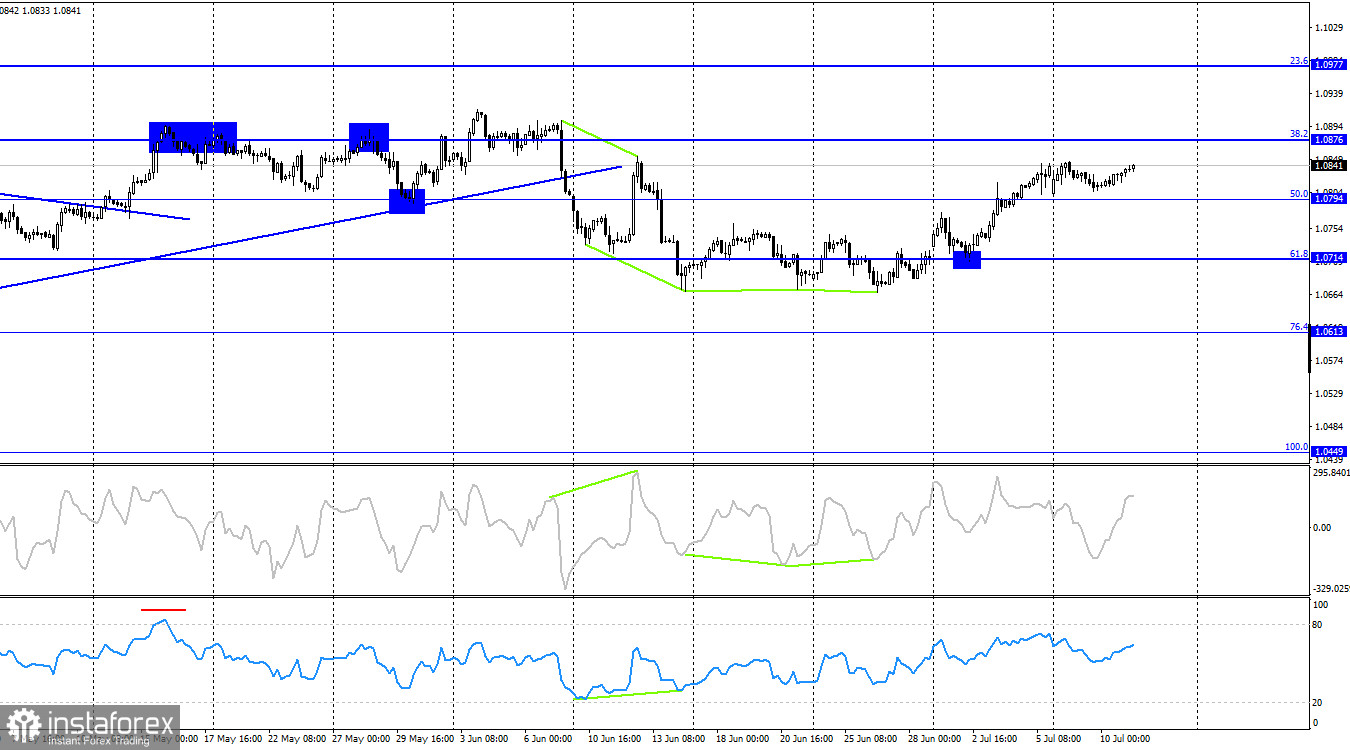

On the 4-hour chart, the pair turned in favor of the euro after forming a new "bullish" divergence with the CCI indicator and rebounding from the corrective level of 61.8%–1.0714. Later, the pair secured above the Fibonacci level of 50.0%–1.0794, which allows for continued growth towards the next corrective level of 38.2%–1.0876. No emerging divergences are observed in any indicator today.

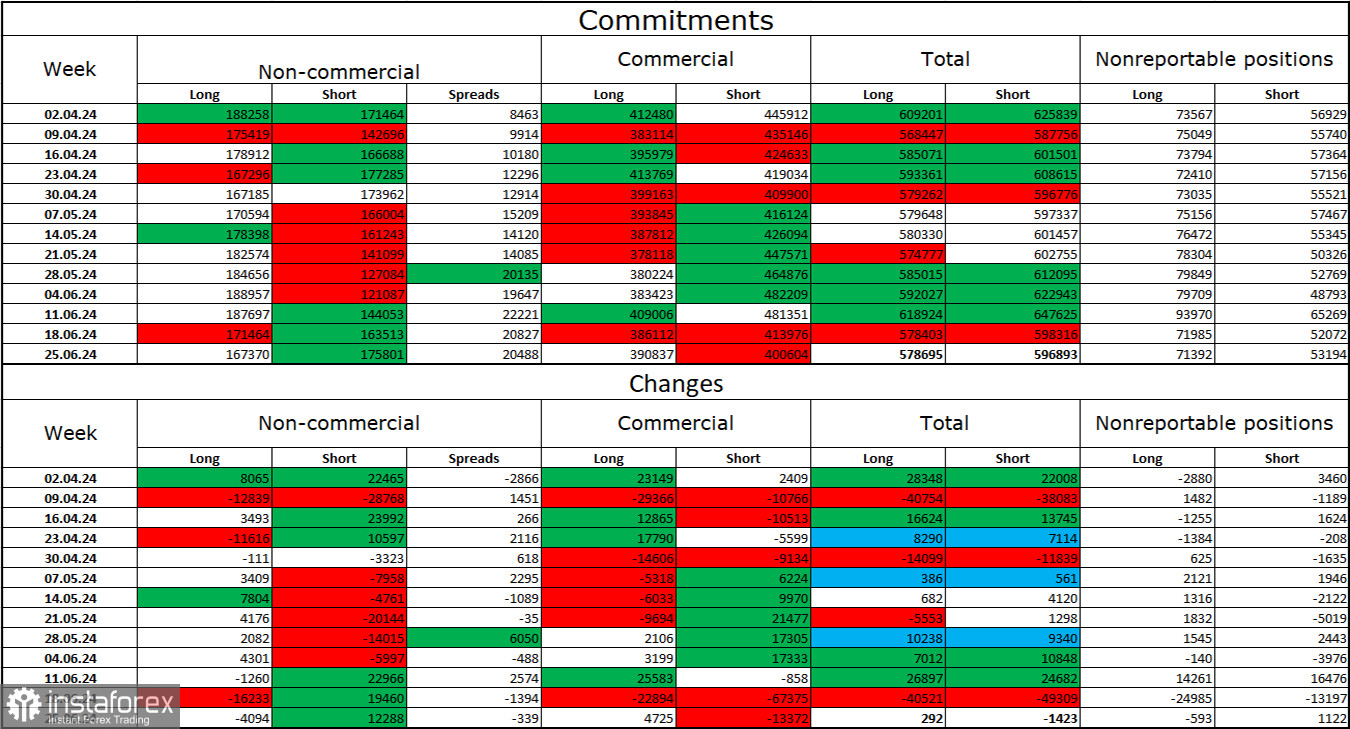

Commitments of Traders (COT) Report:

During the last reporting week, speculators closed 4,094 long positions and opened 12,288 short positions. The sentiment of the "Non-commercial" group changed to "bearish" a few weeks ago and is currently strengthening. The total number of long positions held by speculators is now 167,000, while the number of short positions is 175,000.

The situation will continue to change in favor of the bears. I see no long-term reasons to buy the euro, as the ECB has begun easing monetary policy, which will reduce the yield of bank deposits and government bonds. In America, they will remain at high levels for at least several months, making the dollar more attractive to investors. Even in the COT reports, the potential for the euro to fall looks significant. Currently, the number of short positions among professional players is growing.

News Calendar for the US and Eurozone:

- Eurozone – Consumer Price Index in Germany (06:00 UTC)

- US – Consumer Price Index (12:30 UTC)

- US – Change in the Number of Initial Jobless Claims

The economic events calendar contains several entries on July 11, the most notable being US inflation. The impact of the information background on market sentiment today may be strong, but mainly in the second half of the day.

Forecast for EUR/USD and Trading Tips:

Selling the pair is possible today upon a rebound on the hourly chart from the level of 1.0843 with a target of the zone 1.0785–1.0797. Buying is possible upon a rebound from the zone of 1.0785–1.0797 with a target of 1.0843 or upon securing above 1.0843 with a target of 1.0917.

Fibonacci levels are constructed from 1.0602 to 1.0917 on the hourly chart and from 1.0450 to 1.1139 on the 4-hour chart.