Analysis of GBP/USD 5M

GBP/USD was also trading lower on Thursday. By the end of the day, the price had settled below the ascending channel, within which the pair had traded in for more than three weeks. The pound's growth was not always justified and reasonable, but we have observed the same pattern for at least 6-9 months. Therefore, another surge from the pound is no longer surprising. At the moment, the price has dropped only 100 pips, so it's still too early to celebrate the end of the upward trend. However, a consolidation below the ascending channel is significant. At the very least, there are now grounds to expect a decline in the British currency, which (as before) remains overbought. The nearest target for the decline is the Senkou Span B line.

Among the macroeconomic events on Thursday, we can highlight UK reports on wages and unemployment. The unemployment rate remained unchanged, wage growth matched predictions, and only the number of unemployed came in slightly above market expectations. It is unlikely that the pound fell due to these reports. Similarly, it was not triggered by the results of the European Central Bank meeting, as there was nothing dovish about it. The pound had been rising for a long time, so it was logical to fall. However, the decline was not triggered by macroeconomic factors. Nevertheless, we still expect the pair to fall.

The pair's trading signals were quite complicated on Thursday. Initially, it bounced off the 1.2981-1.2987 area but failed to rise further. Traders should have been cautious with this signal since the Stop Loss would have to be set below the critical line. By the end of the day, the pair had overcome the 1.2981-1.2987 area and the Kijun-sen line, so traders could open short positions, which can be kept today. The pair continues to go through very weak volatility, and the nearest target is the 1.2863 level. It may take a few days to reach this target.

COT report:

COT reports on the British pound show that the sentiment of commercial traders has frequently changed in recent years. The red and blue lines, which represent the net positions of commercial and non-commercial traders, constantly intersect and mostly remain close to the zero mark. According to the latest report on the British pound, the non-commercial group opened 28,600 buy contracts and 5,900 short ones. As a result, the net position of non-commercial traders increased by 22,700 contracts over the week. Thus, sellers failed to seize the initiative once again.

The fundamental background still does not provide a basis for long-term purchases of the pound sterling, and the currency has a good chance to resume the global downward trend. However, the price has already breached the trend line on the 24-hour timeframe at least twice. The pound sterling is rising despite almost everything, and such a movement is extremely difficult to predict.

The non-commercial group currently has a total of 135,300 buy contracts and 50,600 sell contracts. The bulls are taking the lead in the market, but aside from the COT reports, nothing else suggests a potential rise in the GBP/USD pair. And such a strong advantage suggests a potential change in trend.

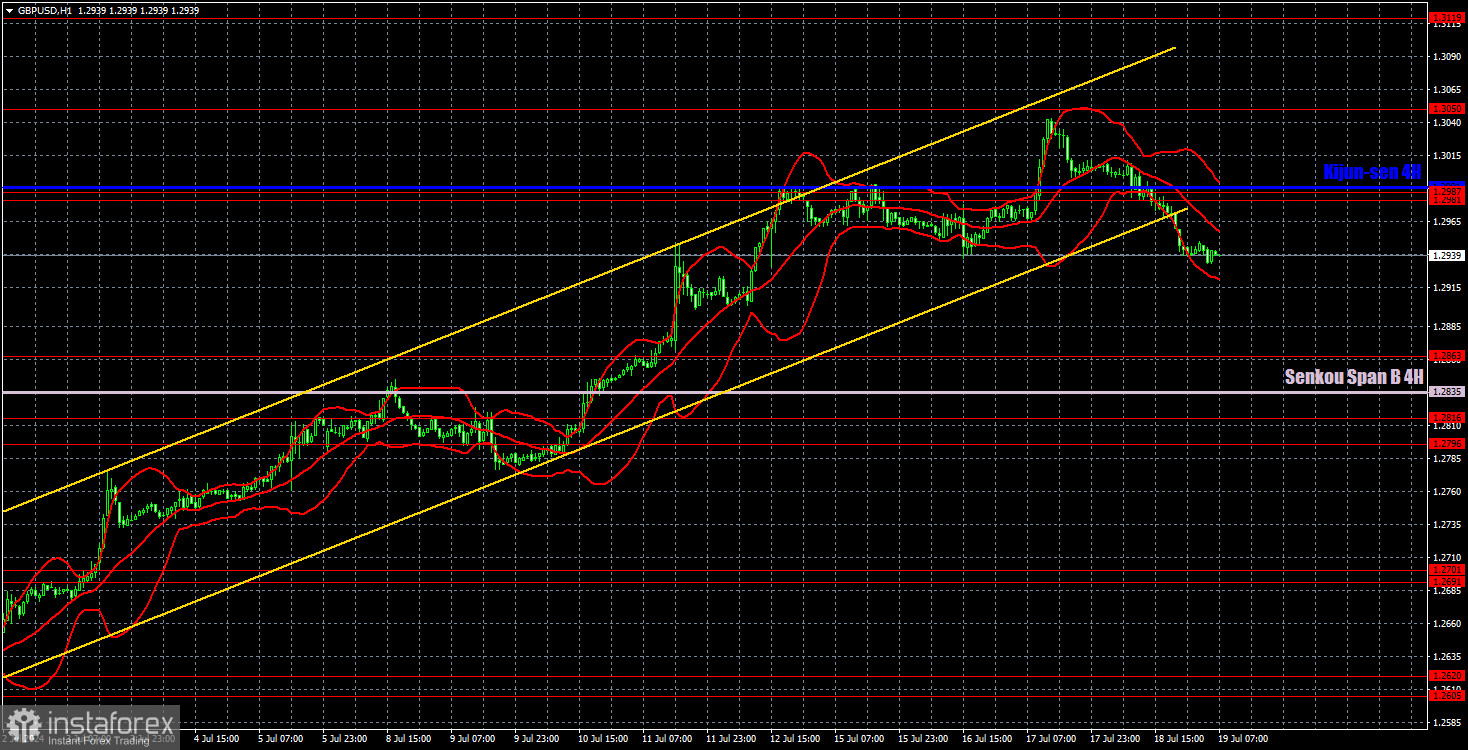

Analysis of GBP/USD 1H

On the 1H chart, GBP/USD has a real chance to end the current local uptrend and start the long-awaited decline. We admit that this time, the pair's downward movement may be weak and short-lived, but at the same time, a decline is the only logical and reasonable scenario. The current technical picture allows for a decline at least to the Senkou Span B line, which lies at the 1.2835 level.

As of July 19, we highlight the following important levels: 1.2215, 1.2269, 1.2349, 1.2429-1.2445, 1.2516, 1.2605-1.2620, 1.2691-1.2701, 1.2796-1.2816, 1.2863, 1.2981-1.2987. The Senkou Span B (1.2835) and Kijun-sen (1.2991) lines can also serve as sources of signals. Don't forget to set a Stop Loss to breakeven if the price has moved in the intended direction by 20 pips. The Ichimoku indicator lines may move during the day, so this should be taken into account when determining trading signals.

The UK will publish a retail sales report, which is unlikely to have any significant impact. If the market intends to start a downward trend, the pound will continue to decline. If this is a correction, the pound will still fall. The U.S. event calendar is empty.

Description of the chart:

Support and resistance levels are thick red lines near which the trend may end. They do not provide trading signals;

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, plotted to the 1H timeframe from the 4H one. They provide trading signals;

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals;

Yellow lines are trend lines, trend channels, and any other technical patterns;

Indicator 1 on the COT charts is the net position size for each category of traders;