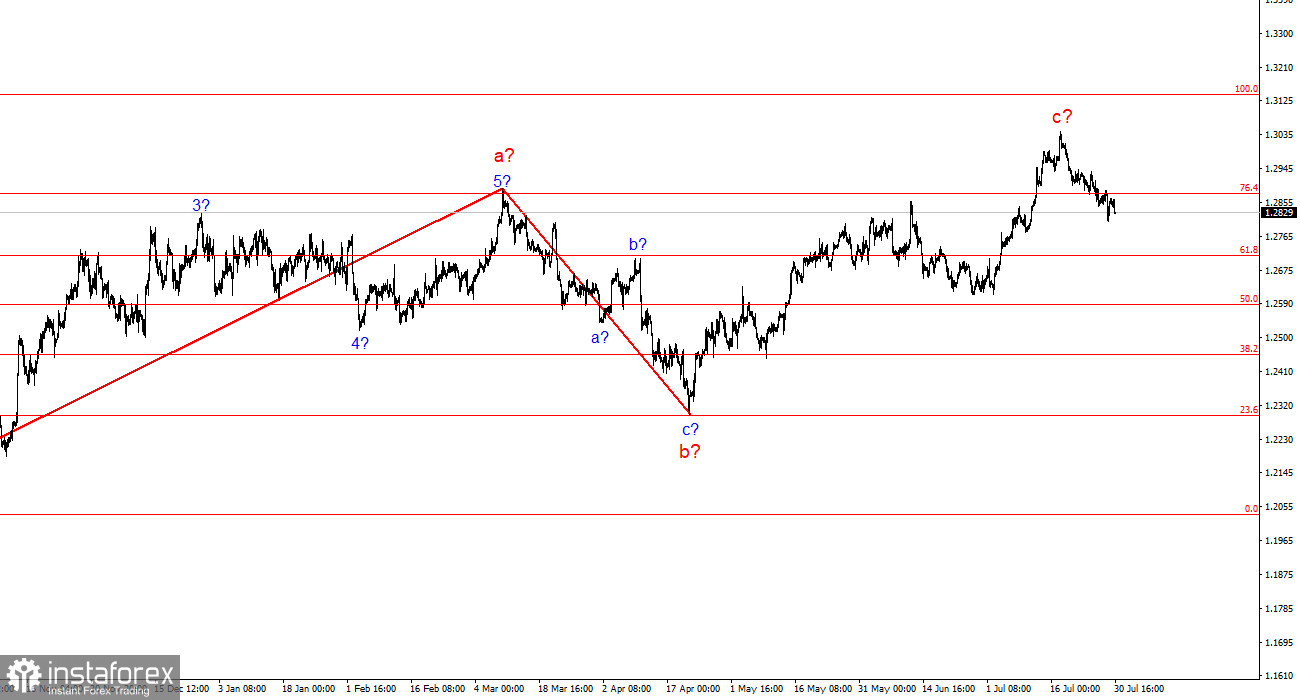

The wave structure for GBP/USD remains quite complex and ambiguous. For a while, the wave pattern seemed convincing and suggested a downward wave set with targets below the 1.2300 level. However, in practice, the demand for the US dollar increased too much for this scenario to materialize.

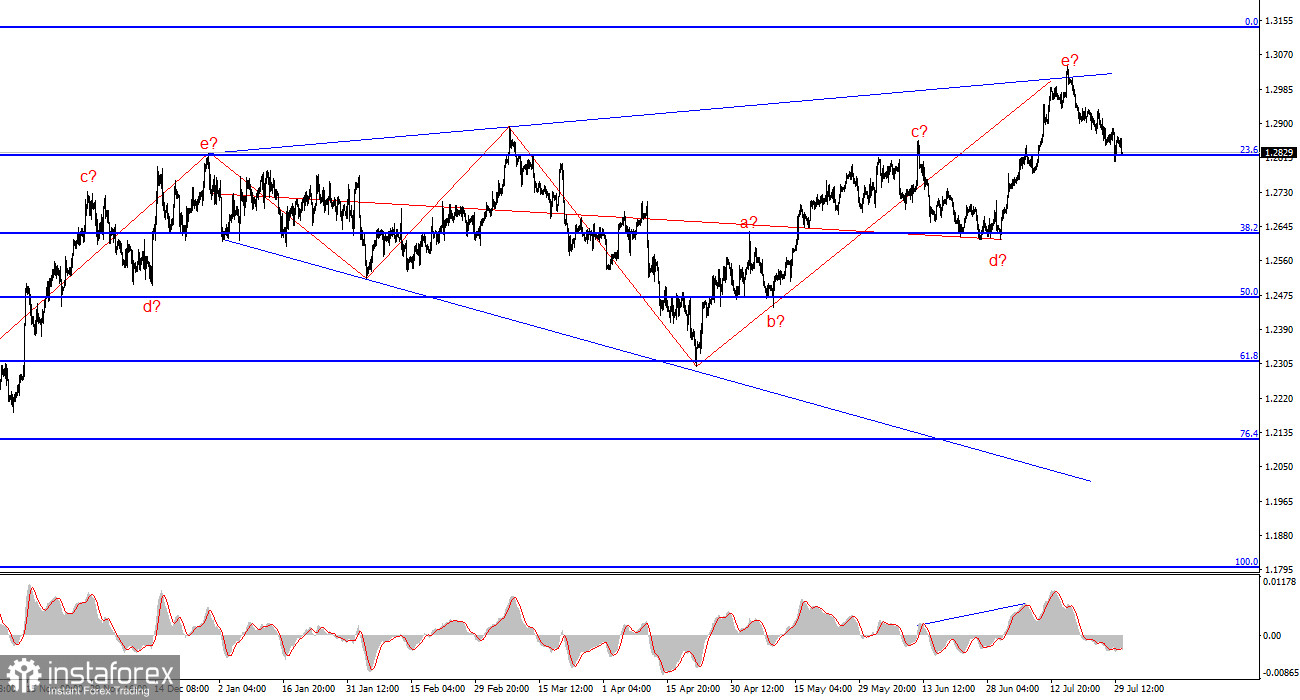

Currently, the wave structure has become entirely unreadable. I prefer to use simple structures in my analysis because complex ones involve too many nuances and ambiguities. Currently, we see an upward wave that has overlapped a downward wave, which in turn overlapped the previous upward wave that overlapped the previous downward wave. The only thing that can be assumed is the formation of an expanding triangle with the upper point around the 1.3000 level and a balancing line around the 1.2600 level. The upper line of the triangle was reached the week before last, and the failed attempt to break through it indicates that the market is preparing for the formation of a downward wave set.

The Pound is Ready to Continue Falling.

The GBP/USD pair declined by 25 basis points on Monday but has continued its slow downward movement for two weeks now. The key moment is the reaction to the upper line of the expanding triangle. I expect the same strong decline in the pound from it as observed a few months ago. The market resolved the issue in its own way, and the wave structure had to be adjusted. However, I did not see reasons for an upward trend in the winter and spring, and I still do not see them now.

Today, there are no significant news events in the UK, and in the US, the first and only JOLTS report on job openings in June will be released in half an hour. I don't think this report will dramatically affect market sentiment. Currently, I expect at least a three-wave downward movement and a performance of the "balancing line" around the 1.2600 level. However, if the JOLTS report does not impact market sentiment, the upcoming FOMC and Bank of England meetings, along with key US statistics to be released later this week, could potentially influence it. Therefore, I do not anticipate a change in sentiment today, but it is quite possible on Wednesday, Thursday, or Friday.

The Bank of England meeting on Thursday is crucial for the pound. If rates are lowered as the market expects, then the demand for the pound will continue to decrease. Overall, even with a negative news background for the US dollar, I expect it to strengthen in the coming weeks. The market needs to take profits on the long positions accumulated over three months. In September, when the Fed might start easing its monetary policy, there could be discussions of a potential new upward phase in the trend.

General Conclusions:

The wave pattern for GBP/USD still suggests a decline. If a new upward phase of the trend started on April 22, it has already taken on a five-wave form. Consequently, a minimum of a three-wave correction should now be expected. The failed attempt to break the upper line of the triangle indicates the market's readiness to form a downward wave set. In my view, it is prudent to consider selling the instrument with targets around 1.2820 and 1.2627, which correspond to the 23.6% and 38.2% Fibonacci retracement levels.

On a larger wave scale, the wave pattern has transformed. We can now assume the formation of a complex and extended upward corrective structure. Currently, it is a three-wave structure, but it could evolve into a five-wave structure, which might take several more months or longer to develop.

Key Principles of My Analysis:

- Wave structures should be simple and understandable. Complex structures are difficult to trade and often involve changes.

- If you are unsure about market movements, it's better not to enter the market.

- There can never be 100% certainty about the direction of movement. Always remember to use protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.