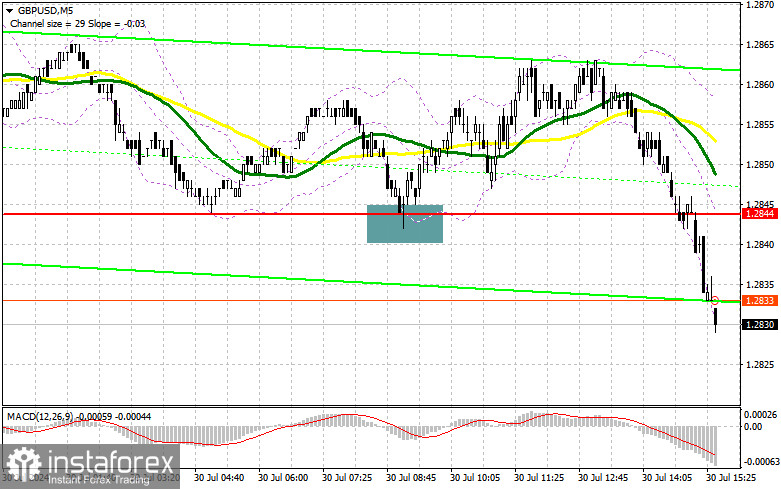

In my morning forecast, I focused on the level of 1.2844 and planned to make market entry decisions based on it. Let's look at the 5-minute chart to understand what happened. The decline and the formation of a false breakout there led to a buy signal for the pound, which resulted in the pair rising by over 25 points. The technical picture for the second half of the day remains unchanged.

To Open Long Positions in GBP/USD:

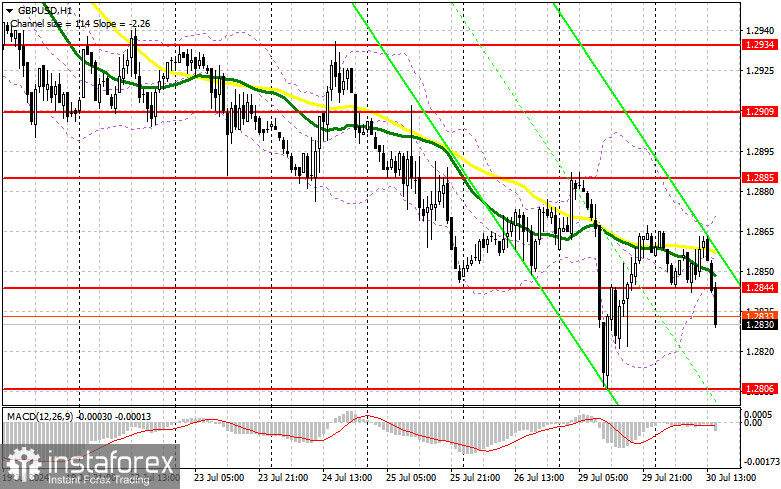

Given the pound's continued decline, exercise caution when buying today. Only significantly poor data on the U.S. Consumer Confidence Index, the S&P/Case-Shiller 20-City Home Price Index, and the Housing Price Index will lead to an upward correction of the pair, similar to what we observed during the U.S. session yesterday. Otherwise, the pound will likely continue to fall. In this case, I plan to enter around the larger support level of 1.2806, as the 1.2844 level offers little hope. A false breakout formation will provide an entry point with the target of returning to 1.2844, where the moving averages are located, which favors sellers. A breakout and retest from top to bottom of this range will restore the chances for the pound to rise, leading to an entry point for long positions with the possibility of reaching 1.2885 – the daily high. The furthest target will be the 1.2909 area, where I plan to take profit. If GBP/USD continues to decline and there is no bullish activity at 1.2806 in the second half of the day, as this level has already been tested once today, it will lead to a decline and update the next support at 1.2778, increasing the chances of a more significant drop at the beginning of the week. Therefore, a false breakout formation will be the only suitable condition for opening long positions. I plan to buy GBP/USD immediately on a rebound from the 1.2756 low, targeting a correction of 30-35 points within the day.

To Open Short Positions on GBP/USD:

Sellers have shown their strength, and now their crucial task will be to defend the new resistance level of 1.2844. Only a false breakout formation there amid weak U.S. statistics will provide an opportunity to open new short positions, continuing the bearish trend with the target of updating the support at 1.2806. A breakout and retest from the bottom to the top of this range will strike a blow to buyers' positions, leading to the triggering of stop orders and opening the path to 1.2778. The furthest target will be the 1.2756 area, where I will take profit. Testing this level will only strengthen the new bearish trend. If GBP/USD rises and there is no bearish activity at 1.2844 in the second half of the day, buyers will have a good chance to establish market equilibrium. In this case, I will postpone sales until a false breakout at 1.2885. If there is no downward movement, I will sell GBP/USD immediately on a rebound from 1.2909, but only expecting a correction of the pair downward by 30-35 points within the day.

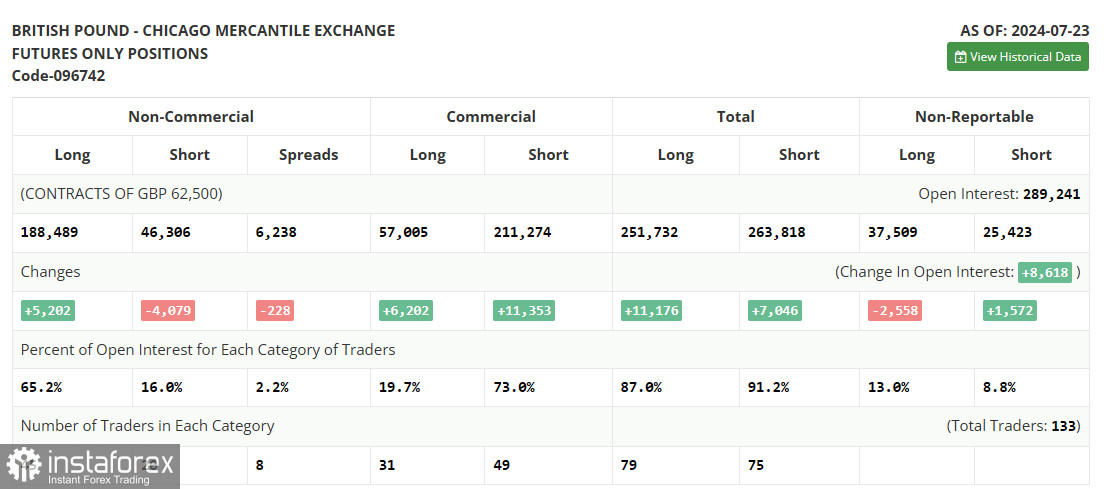

In the Commitment of Traders (COT) Report for July 23, there was an increase in long positions and a decrease in short positions. The focus is on the Federal Reserve meeting, where rates will certainly not change, but investors hope to hear more arguments in favor of lowering rates in September this year. On the other hand, the Bank of England's decision, which will also be published soon, could create a lot of noise. Economists expect the British regulator to cut rates this summer, which theoretically should weaken the British pound against the U.S. dollar even more, so hoping for a return to the bullish market observed in June is clearly not realistic in the near future. The latest COT report states that long non-commercial positions rose by 5,202, reaching 188,489, while short non-commercial positions fell by 4,079, to 46,306. As a result, the spread between long and short positions decreased by 228.

Indicator Signals:

Moving Averages: Trading is below the 30 and 50-day moving averages, indicating a possible continuation of the pair's decline.

Note: The period and prices of the moving averages are considered by the author on the hourly H1 chart and differ from the general definition of classical daily moving averages on the D1 chart.

Bollinger Bands: In case of a decline, the lower boundary of the indicator, around 1.2844, will act as support.

Indicator Descriptions:

- Moving Average: Determines the current trend by smoothing volatility and noise. Period – 50. Marked in yellow on the chart;

- Moving Average: Determines the current trend by smoothing volatility and noise. Period – 30. Marked in green on the chart;

- MACD (Moving Average Convergence/Divergence): Fast EMA – period 12. Slow EMA – period 26. SMA – period 9;

- Bollinger Bands: Period – 20;

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements;

- Long non-commercial positions: Represent the total long open position of non-commercial traders;

- Short non-commercial positions: Represent the total short open position of non-commercial traders;

- Total non-commercial net position: The difference between the short and long positions of non-commercial traders.