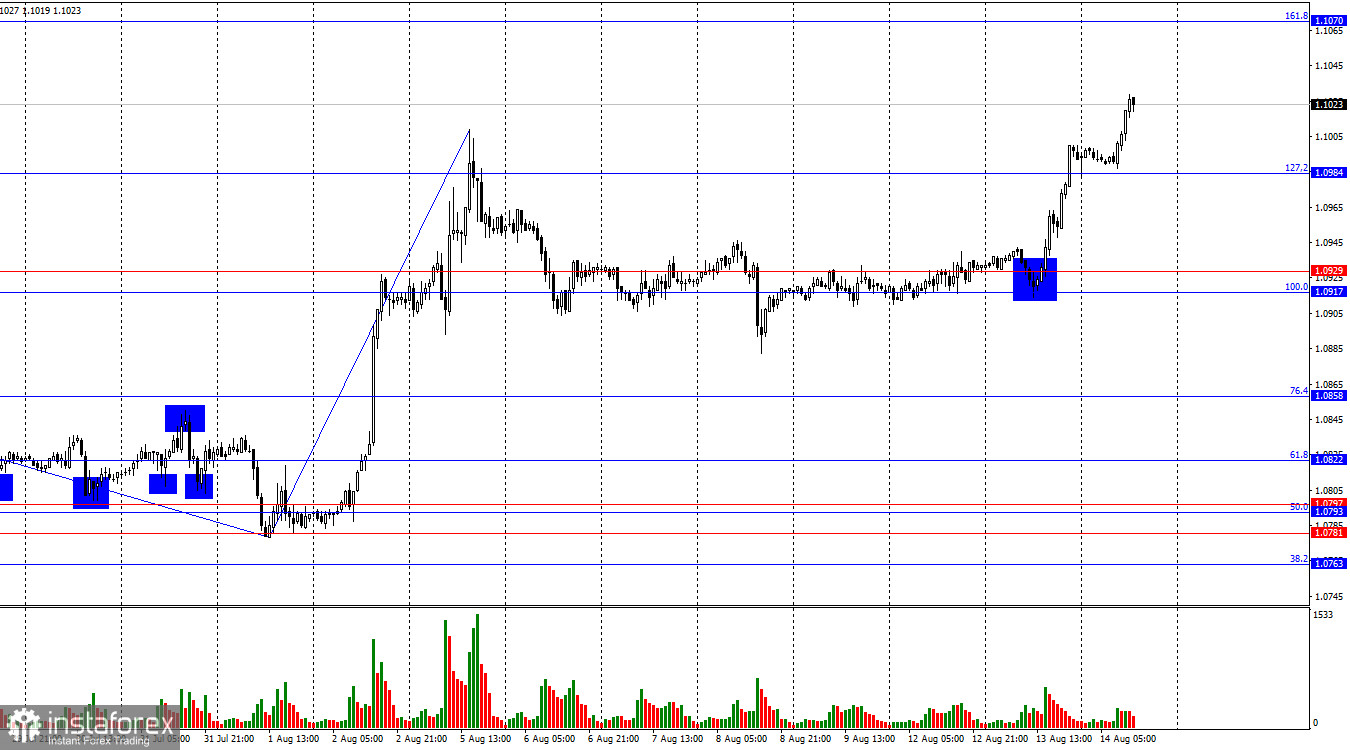

On Tuesday, the EUR/USD pair rebounded from the support zone of 1.0917 – 1.0929, reversed in favor of the European currency, and resumed its upward movement. The pair also managed to break above the 127.2% corrective level at 1.0984, which opens the door for further growth towards the next Fibonacci level of 161.8% at 1.1070. Currently, I don't see any sell signals, but a close below the 1.0984 level could indicate a potential decline in the pair.

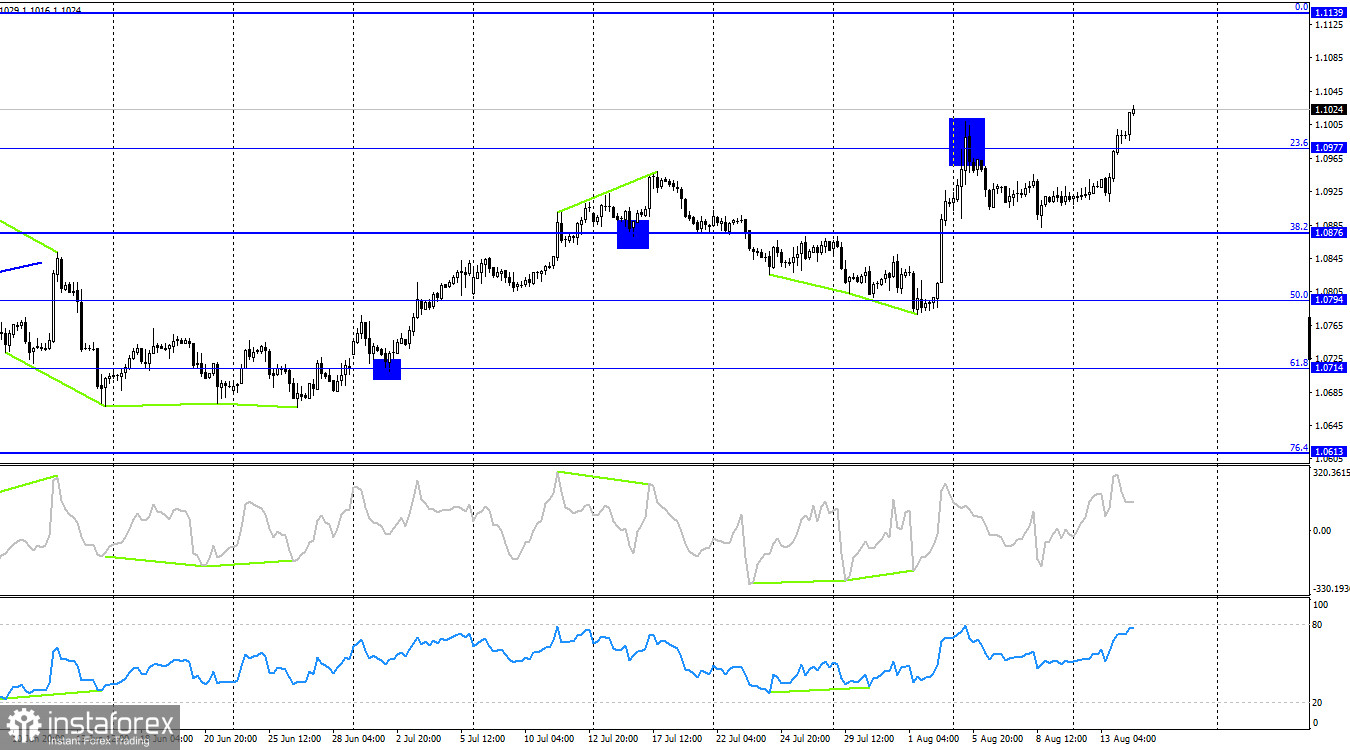

The wave situation has become slightly more complex, but overall it remains understandable. The last completed downward wave did not break below the low of the previous wave, and the new upward wave broke above the peak from August 5. Thus, the "bullish" trend is still intact. For this trend to be invalidated, the bears need to break below the low of the last downward wave, which is around the 1.0882 level.

The information background dealt a blow to the US dollar on Tuesday, and today might be the decisive factor. Yesterday, it was revealed that the Producer Price Index (PPI) dropped to 2.2%, which traders had not anticipated after June's 2.7%. Thus, producer prices slowed down much more than expected, leading traders to logically conclude that inflation could also slow down more than forecasts suggest today. Whether this is true or not, we will find out in just about an hour. In my opinion, yesterday's market reaction to the PPI was exaggerated, and even this morning, the bulls have continued their attacks. And all of this is due to a single report of moderate significance. However, the market remains in a fairly nervous state. Earlier this month, it was revealed that the unemployment rate in the U.S. had risen by 0.2%, and the Nonfarm Payrolls figure came in below market expectations for the fourth or fifth time in a row. Since then, the dollar has been in decline, as the market is fully convinced that the Federal Reserve will begin easing monetary policy in September. Today's inflation report could further reinforce that belief.

On the 4-hour chart, the pair reversed in favor of the European currency near the 38.2% corrective level at 1.0876 and started a new upward movement. The pair's break above the 23.6% Fibonacci level at 1.0977 suggests further growth towards the next corrective level at 0.0% – 1.1139. No impending divergences are observed in any indicators. In my view, the current rise is not fully justified by the information background, but traders are currently inclined to sell the dollar at any convenient opportunity.

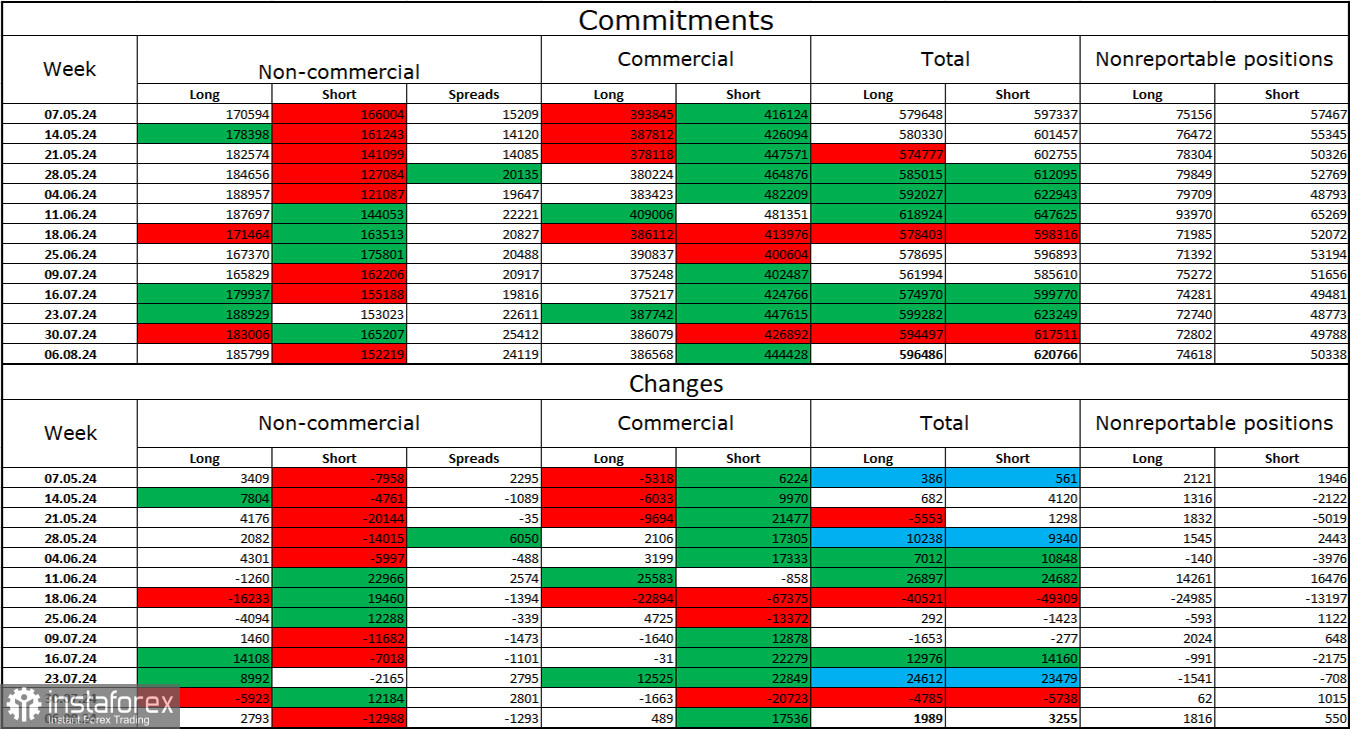

Commitments of Traders (COT) Report:

During the last reporting week, speculators opened 2,793 long positions and closed 12,988 short positions. The sentiment of the "Non-commercial" group shifted to "bearish" several months ago, but currently, the bulls are once again dominating. The total number of long positions held by speculators now stands at 186,000, while short positions amount to 152,000.

I still believe that the situation will continue to shift in favor of the bears. I don't see any long-term reasons to buy the euro, as the ECB has started easing its monetary policy, which will reduce yields on bank deposits and government bonds. In the US, yields will remain high at least until September, making the dollar more attractive to investors. The potential for a decline in the euro looks significant. However, one should not overlook technical analysis, which currently does not support a strong decline in the euro, as well as the information background, which regularly presents obstacles for the dollar.

Economic Calendar for the US and the Eurozone:

- Eurozone – Q2 GDP (09:00 UTC)

- Eurozone – Industrial Production Change (09:00 UTC)

- US – Consumer Price Index (12:30 UTC)

On August 14, the economic calendar includes several important entries. The impact of the information background on trader sentiment today will be strong.

EUR/USD Forecast and Trading Tips:

I wouldn't consider selling the pair today, as the bears are only beginning to retreat from the market. Buying was feasible upon a close or rebound from the support zone of 1.0917 – 1.0929 on the hourly chart, with a target of 1.1008. This target was reached yesterday, and today's target is 1.1070. However, it's important that the inflation report does not show a value above 2.9%. If it does, the dollar could quickly recover the ground it lost earlier this week.

The Fibonacci grids are built between 1.0917 – 1.0668 on the hourly chart and 1.0450 – 1.1139 on the 4-hour chart.