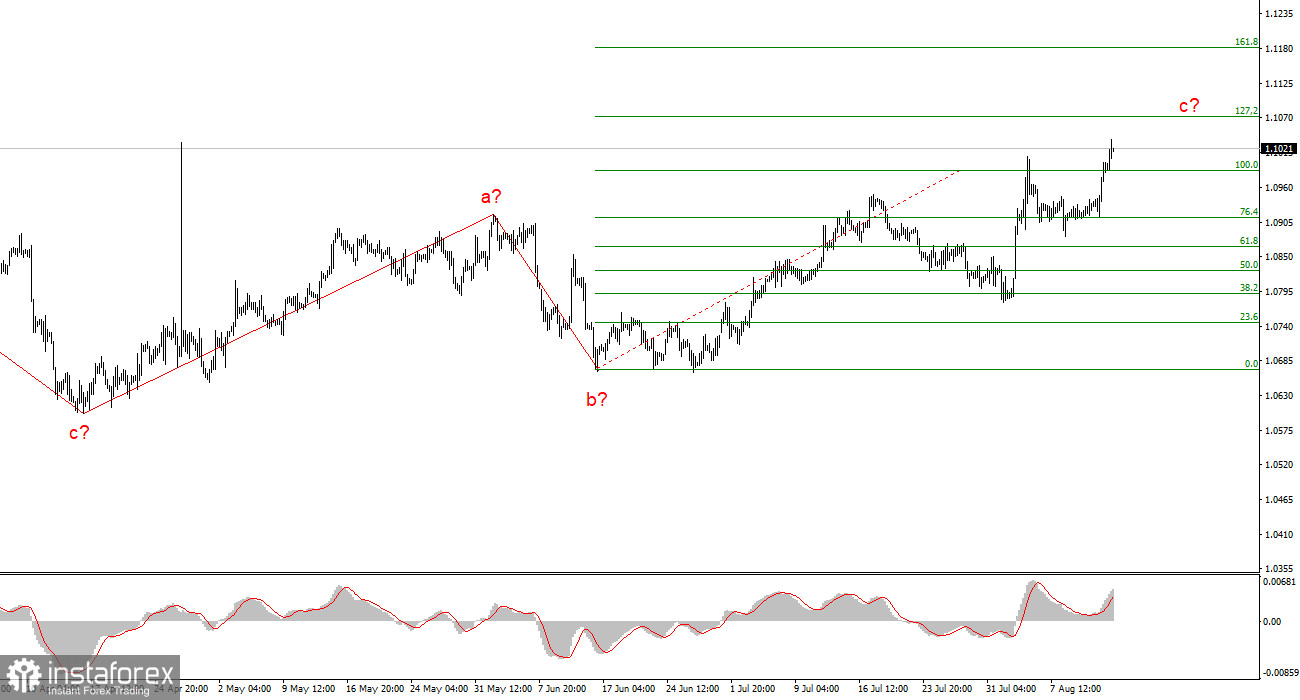

The wave pattern of the EUR/USD pair on the 4-hour chart is becoming increasingly complex. If we analyze the entire trend segment that began in September 2022, when the euro fell to 0.9530, it appears that we are within an upward wave series. However, it is challenging to distinguish even the larger-scale waves within this segment. In other words, there is no clear impulsive trend. Instead, we observe a constant alternation between three- and five-wave corrective structures. Currently, the market has not managed to form a clear downward three-wave structure from the peak reached in July last year. Initially, there was a downward wave that overlapped the lows of previous waves, followed by a deep upward wave. Now, for the seventh consecutive month, the formation remains unclear.

Since January 2024, I have identified only two a-b-c three-wave structures, with a reversal point on April 16. Therefore, the key takeaway is that there is no trend at present. After the completion of the current wave c, a new downward three-wave structure may begin. The trend segment from April 16 could evolve into a five-wave form, but it would also be corrective. Under these circumstances, I cannot anticipate a sustained long-term rise in the euro, although it could continue for several more months.

Producer Price Index Falls More Than Expected

The EUR/USD pair rose by another 30 basis points on Wednesday. Today has been full of paradoxes. Demand for the euro began to grow early in the morning when the Eurozone released rather mediocre statistics on industrial production and GDP. While the Eurozone's economic growth for the second quarter remained unchanged in the second estimate, industrial production decreased by 0.1% month-over-month, against market expectations of +0.5%. Therefore, there was no immediate basis for buying euros in the first half of the day.

However, the reasons for buying are still present. Simply put, the market currently does not need a strong reason to increase demand for the euro. Yesterday, the Producer Price Index (PPI) was released, showing a 0.5% year-over-year slowdown, leading to a sharp decline in demand for the U.S. dollar. Today, the market seems to continue reacting to yesterday's PPI. An hour ago, the inflation report was released, showing a slightly stronger slowdown than the market expected—down to 2.9%. This provides another reason to continue reducing demand for the dollar. Consequently, the U.S. dollar may continue its free fall, complicating the upward wave series for the EUR/USD pair. Meanwhile, the likelihood of a 50 basis point rate cut in September, according to the CME FedWatch tool, continues to decline, now standing at 41% (down from 55% the day before yesterday). However, this does not impact the overall decline of the U.S. dollar.

Conclusions

Based on the analysis of EUR/USD, I conclude that the pair continues to build a series of corrective structures. From the current positions, the upward movement may continue within the framework of a five-wave corrective structure, while the scenario of forming a downward wave d has been temporarily dismissed. Wave c is taking on a more extended form, although the news background casts doubt on the euro's rise above the 10th figure. Nevertheless, the market remains determined, continuing to sell the dollar under any circumstances, factoring in rate cuts by the Federal Reserve in September, November, December, and into 2025.

On the larger wave scale, it is evident that the wave structure is becoming more complex. We are likely to see an upward wave series, but its length and structure are difficult to predict at this time.

Key Principles of My Analysis:

- Wave structures should be simple and understandable. Complex structures are difficult to trade and are often subject to changes.

- If there is no confidence in what is happening in the market, it is better to stay out of it.

- There is never 100% certainty in the direction of movement. Always use Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.