Analysis of macroeconomic reports:

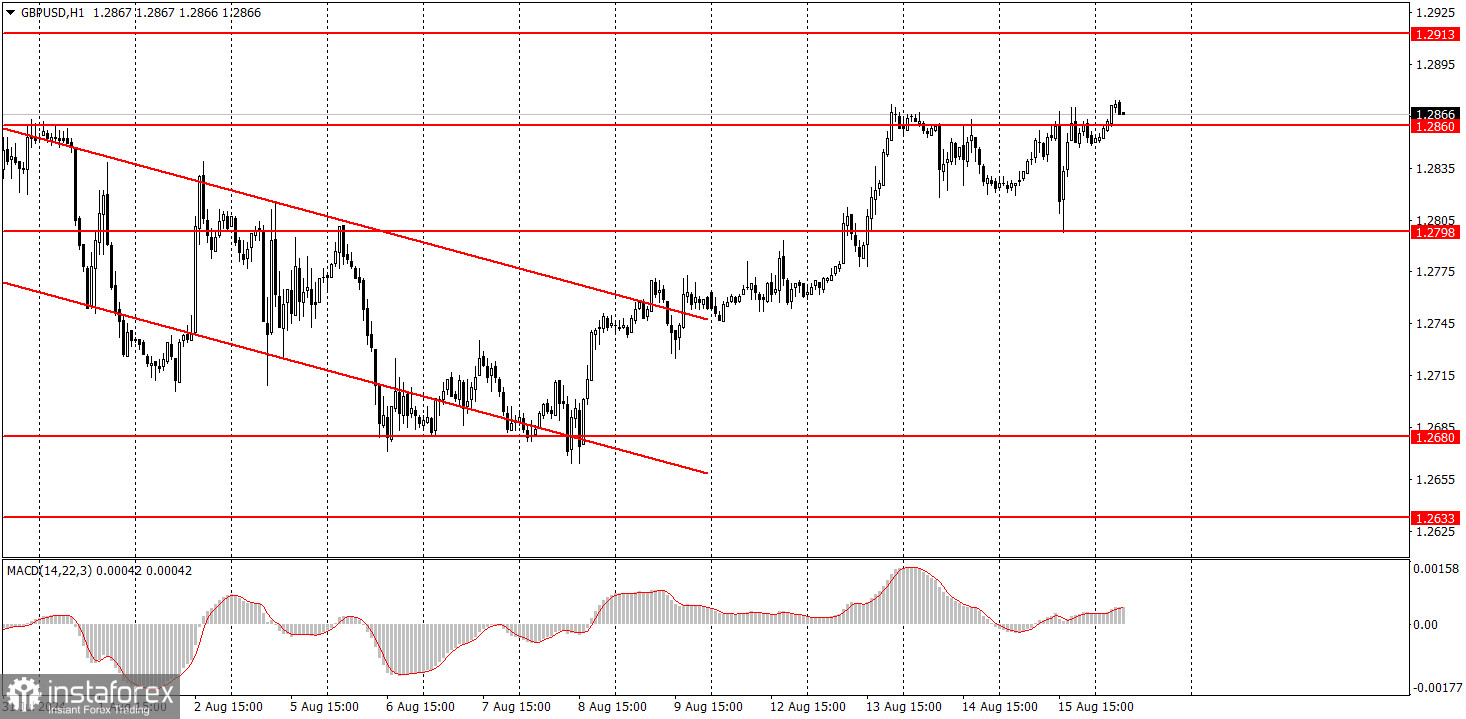

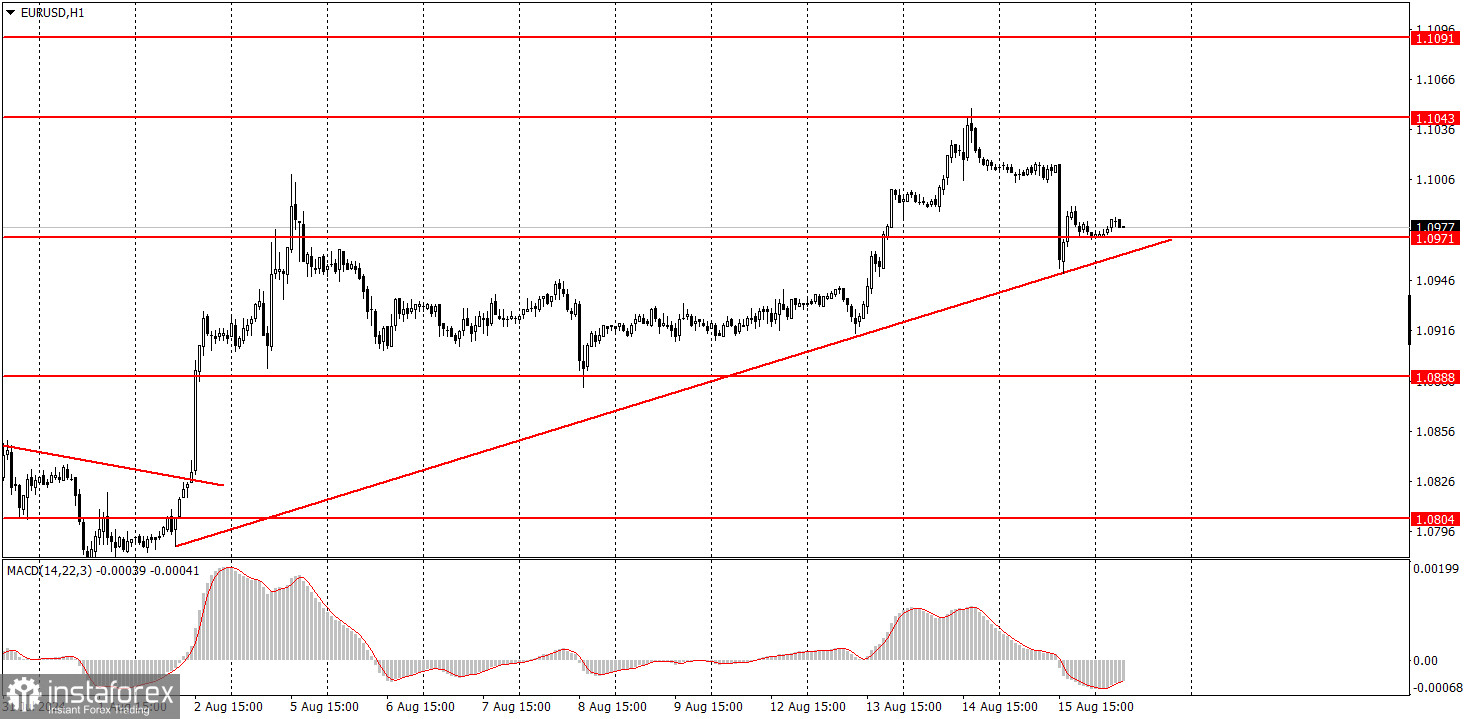

Several macroeconomic events are scheduled for Friday. First and foremost, traders should pay attention to U.S. data, as they remain the most significant for the market. Today, the U.S. will release reports on consumer sentiment from the University of Michigan and the number of approved building permits. These are reports of medium significance but could provoke a market reaction. A retail sales report in the UK will be published, which carries the same weight as the U.S. reports. In general, a decline can be expected from both currency pairs today. The euro might retest the trend line, and if it does not hold above the highs of Thursday and Tuesday, the British pound may also retreat to the downside.

Analysis of fundamental events:

Among the fundamental events for Friday, the only notable one is the speech by Federal Reserve representative Austin Goolsbee. However, after this week's U.S. inflation reports, it is unlikely that Goolsbee will be able to dissuade the market from believing that the Fed has not yet decided on the key rate. The market is confident that the rate will not only be lowered in September but will be reduced by 0.5%. Based on this factor alone, the decline of the U.S. dollar could continue. Of course, it will not fall every day, and today, for instance, it might correct. However, Goolsbee himself expressed concerns about the labor market this week.

General conclusions:

On the last trading day, both currency pairs might slightly retreat. The technical points listed above could indicate a decline. Overall, market sentiment remains bullish, and U.S. data rarely please dollar enthusiasts. Nevertheless, the euro and pound are overbought again and rising much more often than they should.

Basic rules of a trading system:

1) The strength of a signal is determined by the time it took for the signal to form (bounce or level breakthrough). The shorter the time required, the stronger the signal.

2) If two or more trades around a certain level are initiated based on false signals, subsequent signals from that level should be ignored.

3) In a flat market, any currency pair can produce multiple false signals or none at all. In any case, it's better to stop trading at the first signs of a flat market.

4) Trades should be opened between the start of the European session and mid-way through the U.S. session. All trades must be closed manually after this period.

5) In the hourly time frame, trades based on MACD signals are only advisable amidst substantial volatility and an established trend, confirmed either by a trendline or trend channel.

6) If two levels are too close to each other (from 5 to 20 pips), they should be considered as a support or resistance zone.

7) After moving 15 pips in the intended direction, the Stop Loss should be set to break-even.

What's on the charts:

Support and Resistance price levels: targets when opening long or short positions. You can place Take Profit levels near them.

Red lines: channels or trend lines that depict the current trend and indicate the preferred trading direction.

The MACD (14,22,3) indicator, encompassing both the histogram and signal line, acts as an auxiliary tool and can also be used as a source of signals.

Important speeches and reports (always noted in the news calendar) can profoundly influence the price dynamics. Hence, trading during their release calls for heightened caution. It may be reasonable to exit the market to prevent abrupt price reversals against the prevailing trend.

Beginners should always remember that not every trade will yield profit. Establishing a clear strategy, coupled with effective money management, is key to long-term success in trading.