The unexpected acceleration in the growth rate of retail sales in the United States from 2.0% to 2.7%, especially given that a slowdown from 2.3% to 1.8% was anticipated, immediately triggered a significant strengthening of the U.S. dollar. So, after weak labor market data, which led to a prolonged and substantial weakening of the dollar, everyone once again saw the main problem with the euro – U.S. economic reports are significantly better than those in the eurozone. However, the dollar might face pressure again today due to macroeconomic data. A notable decline in the construction sector is expected, particularly concerning new construction projects, projected to decrease by 2.0%.

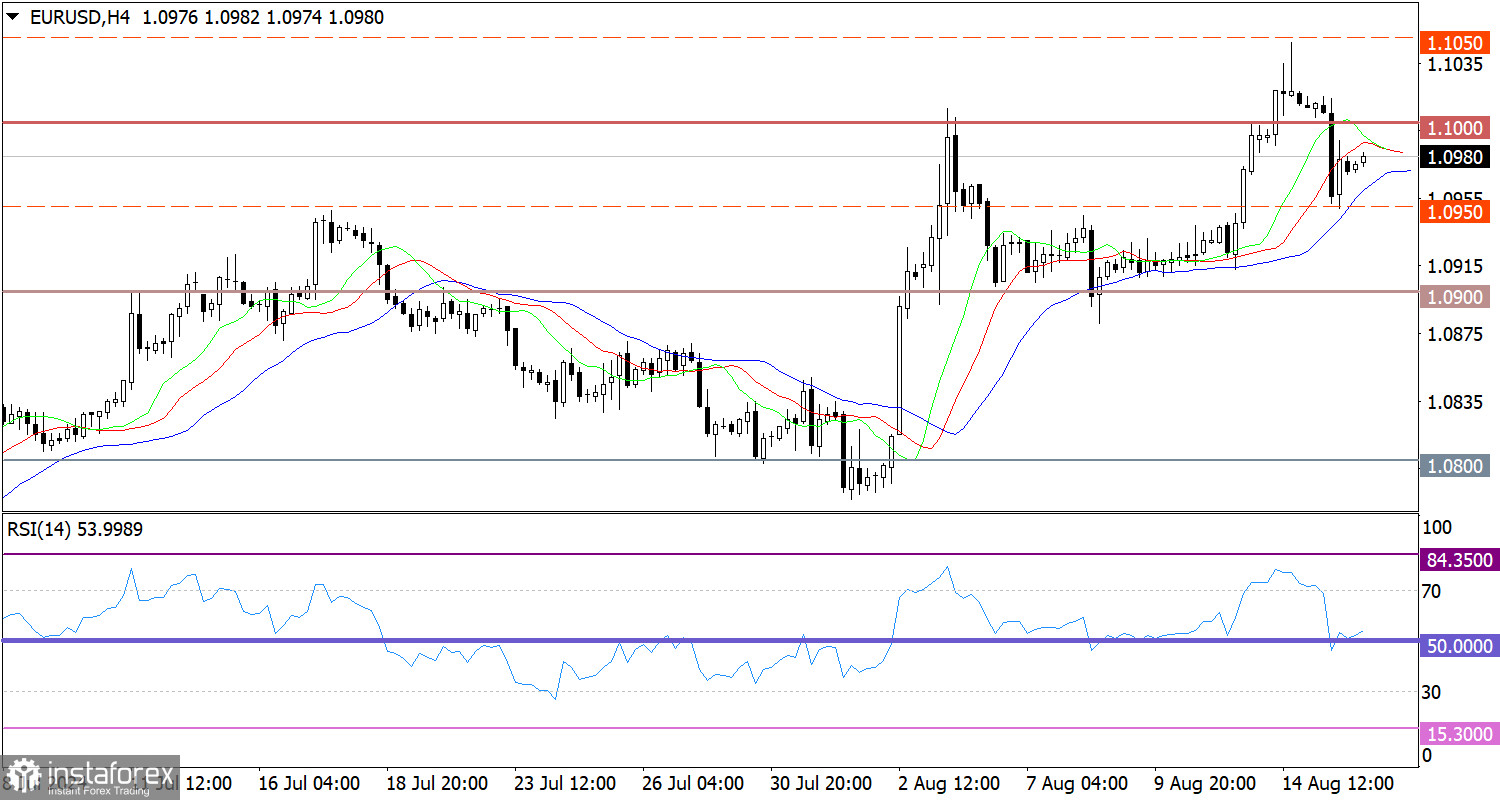

The EUR/USD pair ended a brief stagnation around the 1.1000 level with a bearish rally, during which the quote rapidly fell to 1.0950.

In the 4-hour chart, the RSI technical tool left the overbought zone and touched the 50 mid level due to the sharp price movement. It is worth noting that the indicator did not settle below the mid level, indicating a sustained bullish bias.

Regarding the Alligator indicator in the same time frame, the moving average lines point upwards. The indicators are slightly delayed, meaning the recent surge in short positions has not yet been reflected.

Expectations and Prospects

If we proceed from the boundaries of the psychological level, even despite the local burst of activity of short positions a day earlier, no radical changes are observed. The quote is still oriented to the limits of 1.0950/1.1050. This suggests that price fluctuations within these limits will persist. However, if the quote stabilizes below 1.0950 by the week's end, sellers could receive strong support from short positions, which might increase significantly.

The complex indicator analysis suggests a price retracement in the short-term and intraday periods.