Analysis and Trading Tips for the Euro

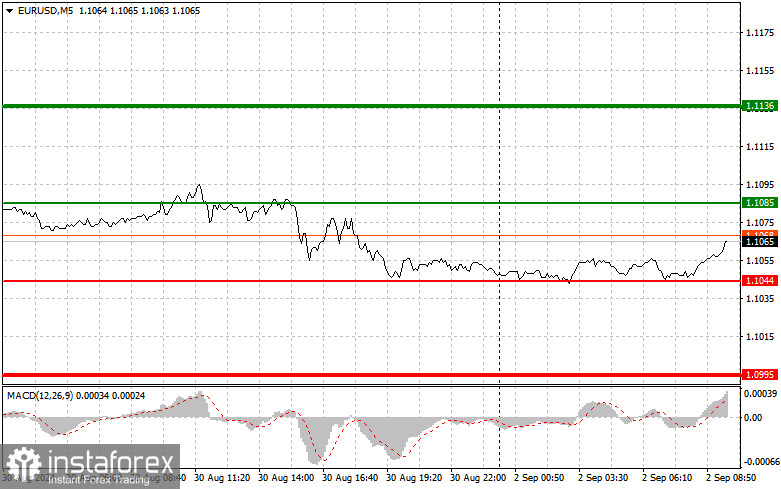

The test of the 1.1070 level occurred when the MACD was just beginning to move downward from the zero line, confirming a correct entry point for selling the euro in the context of a downward correction. As a result, the pair dropped by more than 30 points, though we didn't quite reach the target level of 1.1043. Data from the first half of the day regarding Germany's retail sales, unemployment rate, changes in France's private sector employment, GDP changes, and France's consumer price index helped the euro remain afloat. However, U.S. inflation indicators were slightly disappointed with their restraint, leading to another round of euro selling and dollar buying, even at the end of the week. Today, market negativity may increase following weak reports on Germany's manufacturing PMI, Italy's manufacturing PMI, and other Eurozone countries. Italy's GDP change will be secondary data, so poor manufacturing figures are unlikely to help the euro recover today. If the data is ignored, the pair risks staying in a range-bound channel. For the intraday strategy, I will rely more on Scenario No. 2.

Buy Signal

Scenario No. 1: Consider buying the euro today if the price reaches around 1.1085 (green line on the chart), targeting a rise to 1.1136. At 1.1136, I plan to exit the market and also sell the euro in the opposite direction, targeting a movement of 30-35 points from the entry point. Expecting euro growth in the first half of the day is feasible only if strong Eurozone statistics are reported. Important: Before buying, ensure that the MACD is above the zero line and just beginning its upward movement.

Scenario No. 2: I also plan to buy the euro today if the price tests 1.1044 twice when the MACD is in the oversold area. This will limit the pair's downward potential and lead to a market reversal upward. Expect growth to the levels of 1.1085 and 1.1136.

Sell Signal

Scenario No. 1: I plan to sell the euro after the price reaches 1.1044 (red line on the chart), targeting a level of 1.0995, where I will exit the market and buy immediately in the opposite direction, targeting a movement of 20-25 points from the level. Selling pressure will return if there is a failed attempt at correction in the first half of the day and weak statistics. Important: Before selling, ensure that the MACD is below the zero line and just beginning its downward movement.

Scenario No. 2: I also plan to sell the euro today if the price tests 1.1085 twice when the MACD is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. Expect a decline to the levels of 1.1044 and 1.0995.

Chart Details:

- Thin Green Line: Entry price for buying the trading instrument.

- Thick Green Line: Estimated price where to set Take Profit or lock in profits, as further growth above this level is unlikely.

- Thin Red Line: Entry price for selling the trading instrument.

- Thick Red Line: Estimated price where to set Take Profit or lock in profits, as further decline below this level is unlikely.

- MACD: When entering the market, it's important to consider overbought and oversold zones.

Important: For beginner forex traders, it is crucial to make market entry decisions with great caution. It is best to stay out of the market before important fundamental reports to avoid sharp fluctuations in the exchange rate. If you decide to trade during news releases, always set stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you don't use money management and trade with large volumes.

Remember, successful trading requires a clear trading plan, like the one presented above. Spontaneous trading decisions based on current market conditions are inherently a losing strategy for intraday traders.