Analysis of Trades and Tips for Trading the British Pound

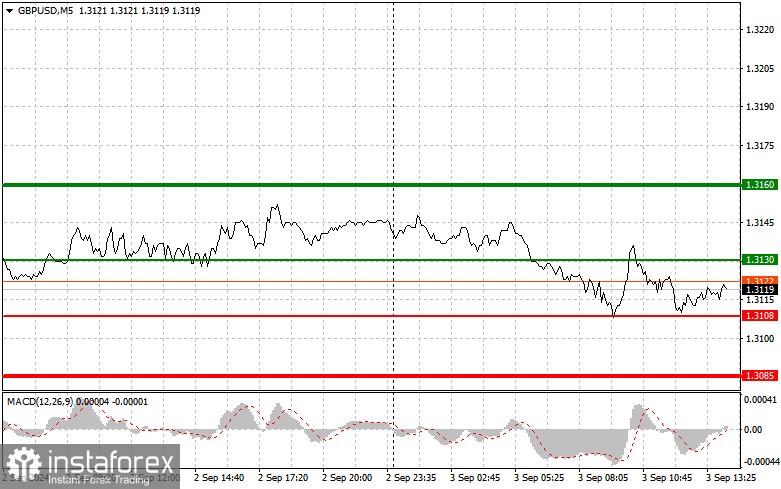

The price test at 1.3127 occurred when the MACD indicator was just starting to move up from the zero mark, which indicated a potentially good entry point for buying the pound. However, as you can see on the chart, there was no significant upward movement. In the second half of the day, figures are expected to be released for the U.S. manufacturing activity index, the more important ISM manufacturing index, and the RCM/TIPP economic optimism index. Only an increase in these indicators to around 50 points, which would signal a shift away from contraction, could strengthen the dollar and lead to a decline in the British pound. Poor reports could trigger a strong rise in the GBP/USD pair. As for intraday strategy, I plan to base my actions on scenarios #1 and #2.

Buy Signal

Scenario #1: I plan to buy the pound today if the price reaches around 1.3130 (green line on the chart) with a target of rising to 1.3160 (thicker green line on the chart). At around 1.3160, I will exit my buy position and sell the pound (targeting a 30-35 point movement from this level). A rise in the pound can be expected following weak U.S. statistics. Important: Before buying, ensure that the MACD indicator is above the zero mark and is just starting to rise from it.

Scenario #2: I also plan to buy the pound today if there are two consecutive tests of the 1.3108 price, when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a reversal upward. We can expect a rise to the opposite levels of 1.3130 and 1.3160.

Sell Signal

Scenario #1: I plan to sell the pound today after the price updates the 1.3108 level (red line on the chart), which will lead to a quick decline in the pair. The key target for sellers will be the 1.3085 level, where I will exit my sell positions and immediately buy the pound (targeting a 20-25 point movement from this level). Sellers are likely to be active if the statistics are strong. Important: Before selling, ensure that the MACD indicator is below the zero mark and is just starting to decline from it.

Scenario #2: I also plan to sell the pound today if there are two consecutive tests of the 1.3130 price, when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a reversal downward. We can expect a drop to the opposite levels of 1.3108 and 1.3085.

On the Chart:

- Thin Green Line: Entry price for buying the trading instrument.

- Thick Green Line: Estimated price where you can set Take Profit or manually take profit, as further rise above this level is unlikely.

- Thin Red Line: Entry price for selling the trading instrument.

- Thick Red Line: Estimated price where you can set Take Profit or manually take profit, as further decline below this level is unlikely.

- MACD Indicator: When entering the market, it is important to consider the overbought and oversold zones.

Important: Beginner traders in the Forex market need to be very cautious when making market entry decisions. It is best to stay out of the market before major economic reports to avoid getting caught in sharp price swings. If you decide to trade during news releases, always set stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you are trading large volumes without proper money management.

And remember, successful trading requires a clear trading plan, like the one presented above. Making spontaneous trading decisions based on the current market situation is generally a less effective strategy for intraday traders.