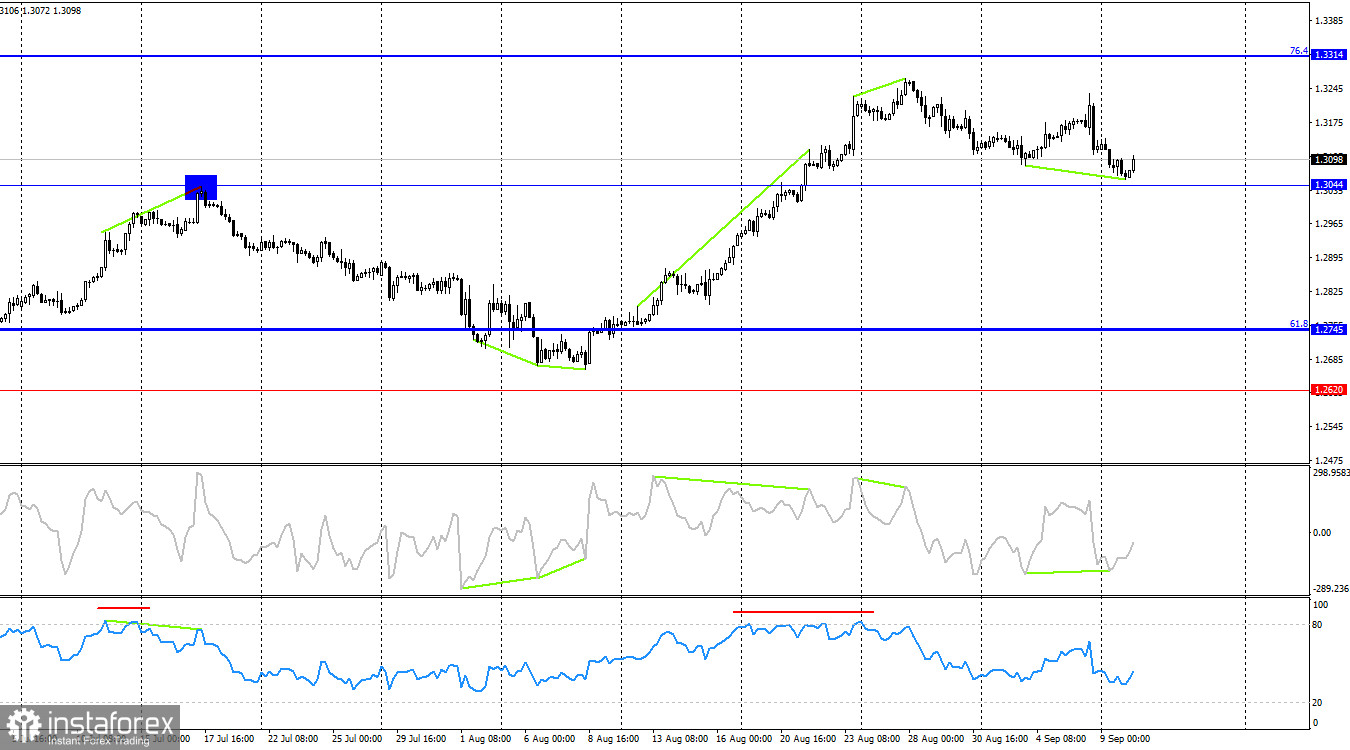

On the hourly chart, the GBP/USD pair continued its decline on Monday towards the 127.2% Fibonacci retracement level at 1.3054. A rebound from this level allows traders to expect a reversal in favor of the pound and some growth towards the 161.8% Fibonacci level at 1.3259. However, I don't think the bulls have the momentum to reach this level again. A close below 1.3054 would signal further decline towards the 1.2931 level.

The wave pattern is clear and leaves no ambiguity. The last completed downward wave did not break the low of the previous wave, but the most recent upward wave also failed to break the peak of the previous wave, which is at 1.3264. Therefore, we are currently seeing a downward trend reversal. The latest, still unfinished, downward wave has broken the previous low. This further confirms the shift to a "bearish" trend.

There was no significant news on Monday, but on Tuesday, three key indicators were released in the UK that halted the pound's decline. The unemployment rate in July dropped from 4.2% to 4.1%, as expected. The average wage growth fell to 4%, slightly better than forecasts. The number of unemployed increased by 23.7k, compared to the expected 95.5k. Overall, this set of statistics can be considered positive for the pound. However, I would like to remind you that the Bank of England remains skeptical about easing monetary policy in the near future, largely due to the high rate of wage growth. Wage growth is slowing even more than the market expected. Therefore, I believe the likelihood of an earlier rate cut amid weak inflation is increasing. As a result, I expect the pound to continue declining. A close below 1.3054 will confirm the bears' intent to continue their attack.

On the 4-hour chart, the pair returned to the 1.3044 level. A rebound from this level, combined with a "bullish" divergence in the CCI indicator, suggests some potential for the pair to rise, but I don't expect it to be significant. I'm more inclined to expect a close below 1.3044, which would signal further decline towards the next retracement level at 61.8% – 1.2745.

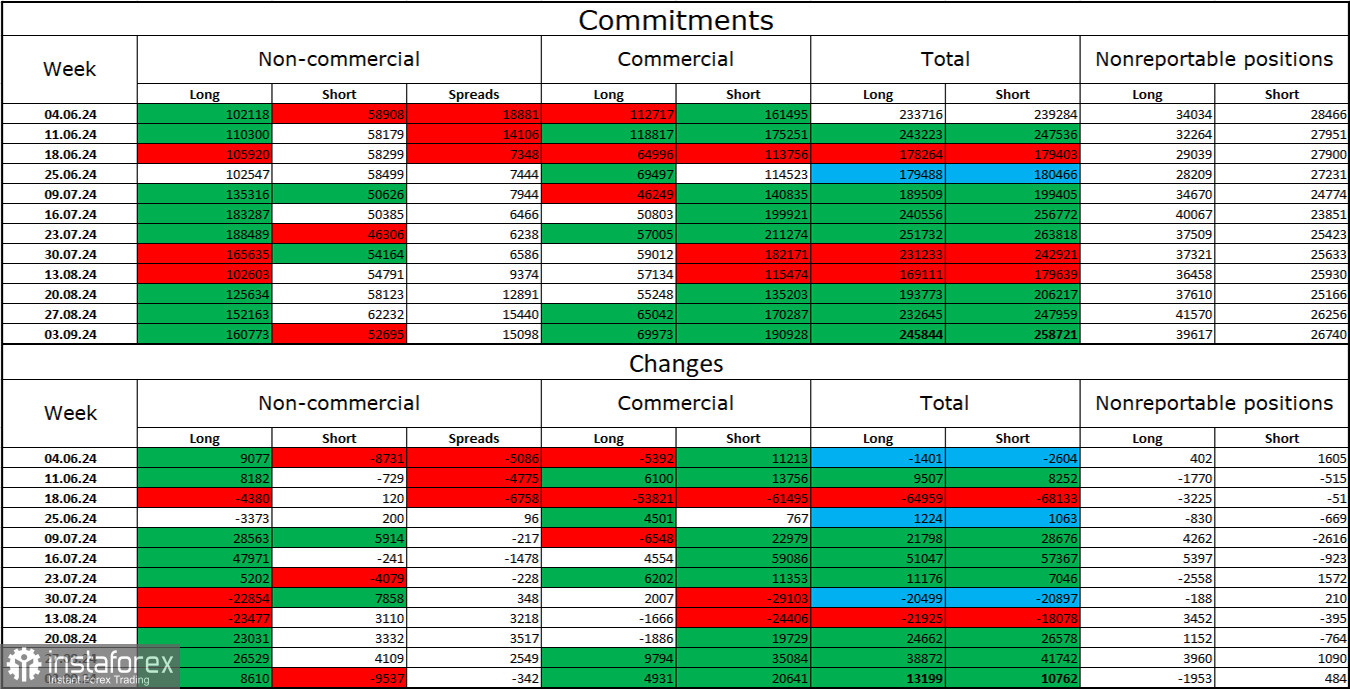

Commitments of Traders (COT) Report:

The sentiment among "Non-commercial" traders became significantly more bullish last week. The number of long positions held by speculators increased by 8,610, while the number of short positions decreased by 9,537. Bulls still hold a strong advantage, with a gap of 108k between long and short positions: 160k long positions vs. 52k short positions.

In my opinion, the pound still faces downward prospects, but the COT reports suggest otherwise. Over the past three months, the number of long positions has increased from 102k to 160k, while short positions have decreased from 58k to 52k. I believe that over time, professional traders will begin reducing their long positions or increasing their short positions, as all potential factors supporting the pound have already been priced in. However, it's important to note that this is just an assumption. Technical analysis suggests a likely decline in the near future, but the overall trend remains decidedly bullish for now.

Economic Calendar for the UK and the US:

- UK – Unemployment Rate (06:00 UTC)

- UK – Average Earnings Growth (06:00 UTC)

- UK – Change in the Number of Unemployed (06:00 UTC)

On Tuesday, the economic calendar includes three important releases, all of which have already been made available to traders. The impact of this news on market sentiment is expected to be minimal for the rest of the trading day.

GBP/USD Forecast and Trading Advice:

It was possible to sell the pair after the rebound from the 1.3258 level on the hourly chart, with a target of 1.3054. The target has been met, as expected. New sales should be considered if the pair closes below 1.3054, with a target of 1.2931. I would not rush into buying even if there is a rebound from 1.3054.

Fibonacci levels are plotted between 1.2892 and 1.2298 on the hourly chart, and between 1.4248 and 1.0404 on the 4-hour chart.