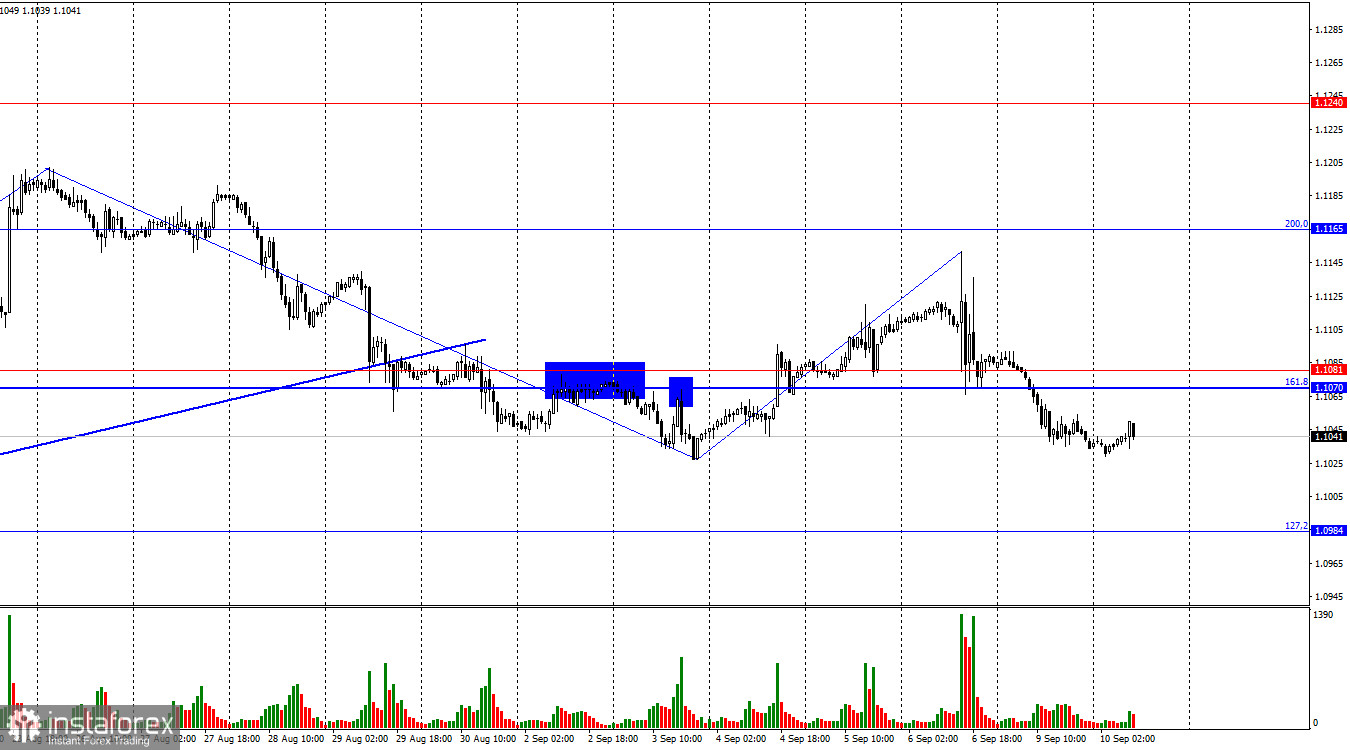

On Monday, the EUR/USD pair consolidated below the support zone of 1.1070–1.1081 and continued its decline towards the 127.2% corrective level at 1.0984. At the moment, the chart suggests the beginning of a new "bearish" trend. I cannot say how long it will last, as the bears are still cautious about U.S. statistics and the potential easing of the Federal Reserve's monetary policy by 0.50% in September.

The wave structure has become a bit more complex but remains clear. The last completed downward wave did not breach the low of the previous wave, and the most recent upward wave did not come close to the peak from August 26. Therefore, the "bullish" trend is now canceled. If the current downward wave breaks the low from September 3, it will further confirm the formation of a "bearish" trend.

There was no significant news on Monday, but the bears capitalized on the absence of bullish activity. Consolidating below the 1.1070–1.1081 zone is very important for the U.S. dollar. This week, the U.S. inflation report is due, which could prompt bullish activity. Therefore, the lower the pair moves before this report, the higher the chances of a continued "bearish" trend. In my opinion, any decision by the Federal Reserve in September is already priced in, which allows bulls to continue taking profits on long positions. I believe the current decline in the pair is mainly due to profit-taking rather than active selling by the bears. Today, the news environment is also weak. The final inflation report for August from Germany was released this morning, but it showed no differences from the preliminary data. No further news is expected from the Eurozone or the U.S. for the rest of the day. Traders may take a break today, but activity could pick up later in the day.

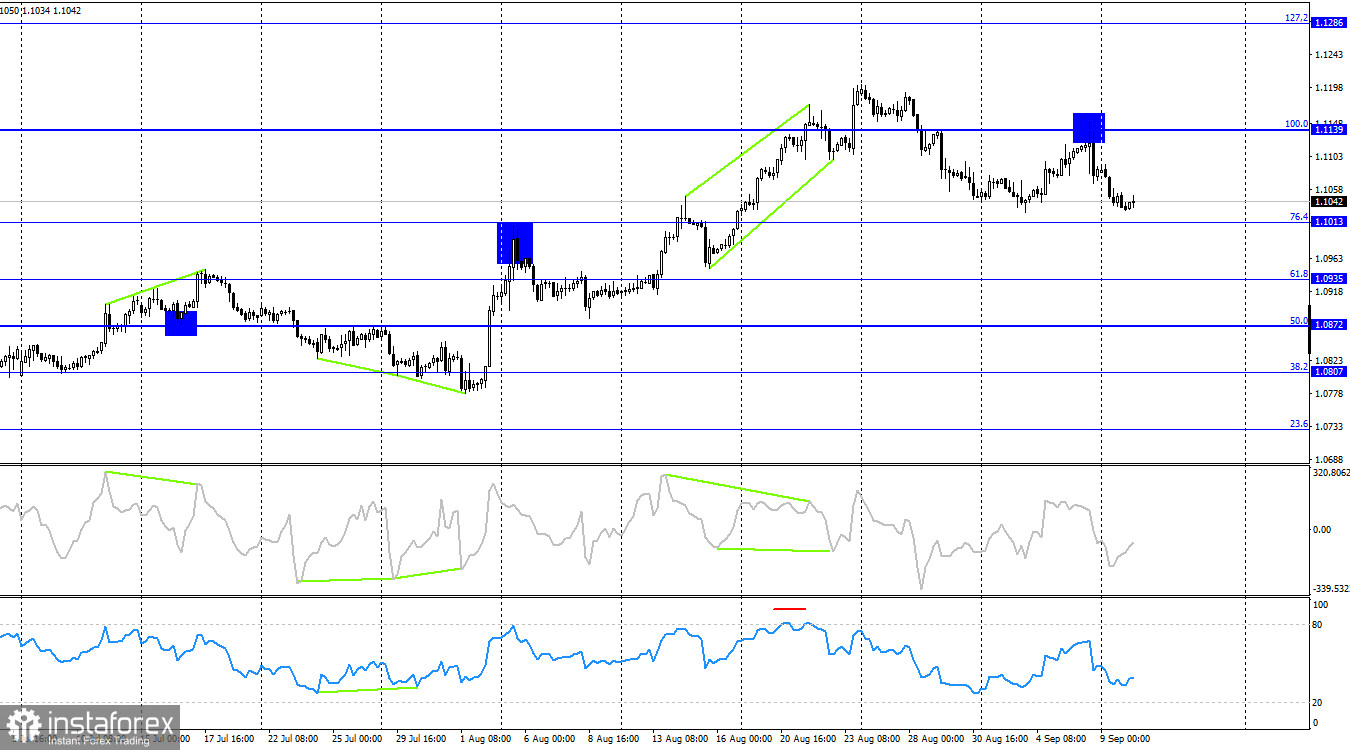

On the 4-hour chart, the pair rebounded from the 100.0% corrective level at 1.1139, turned in favor of the U.S. dollar, and began the decline towards the 76.4% corrective level at 1.1013. The 4-hour chart shows early signs of a new "bearish" trend, but without strong U.S. news, the dollar may struggle to continue rising for an extended period. There are no developing divergences on any indicators today. A rebound from the 1.1013 level may favor the euro and lead to some growth towards 1.1139.

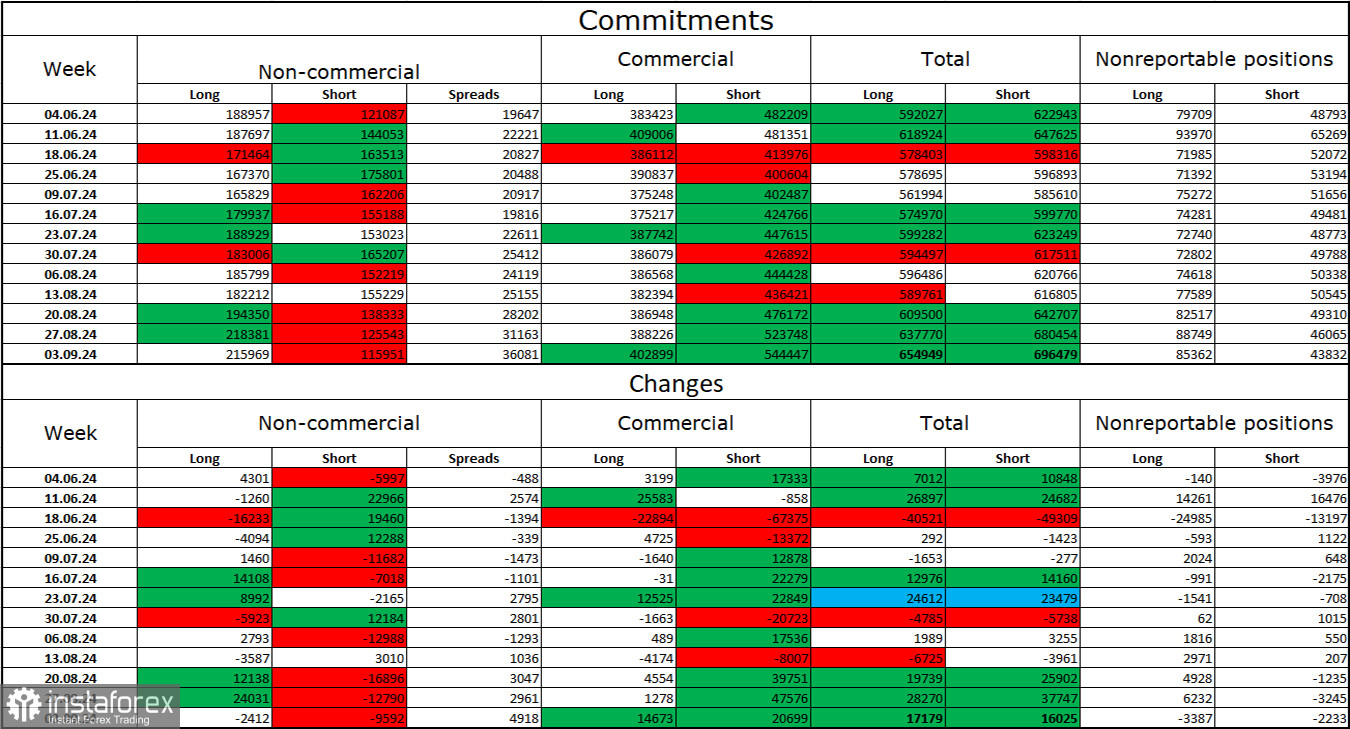

Commitments of Traders (COT) Report:

During the last reporting week, speculators closed 2,412 long positions and 9,592 short positions. The sentiment of the "Non-commercial" group turned "bearish" several months ago, but currently, bulls are still in control. The total number of long positions held by speculators is now 215k, while short positions amount to just 115k.

I still believe the situation will continue to shift in favor of the bears. I don't see any long-term reasons to buy the euro. I also want to note that a Federal Reserve rate cut in September is already 100% priced in. The potential for further euro weakness remains significant. However, we should not forget about technical analysis, which at the moment does not strongly confirm a significant drop in the euro, nor should we overlook the news background, which regularly hinders the dollar's progress.

Economic Calendar for the U.S. and the Eurozone:

- Eurozone – Germany Consumer Price Index (06:00 UTC)

On September 10, the economic calendar contains no significant releases. The news background will have no impact on trader sentiment today.

EUR/USD Forecast and Trading Advice:

Selling the pair was possible after the rebound from the 1.1139 level on the 4-hour chart, targeting 1.1070–1.1081. Yesterday, selling was also possible after closing below the 1.1070–1.1081 zone, targeting 1.0984. These trades can still be held. I would not consider buying at the start of the new week.

Fibonacci levels are plotted between 1.0917 and 1.0668 on the hourly chart and between 1.1139 and 1.0603 on the 4-hour chart.