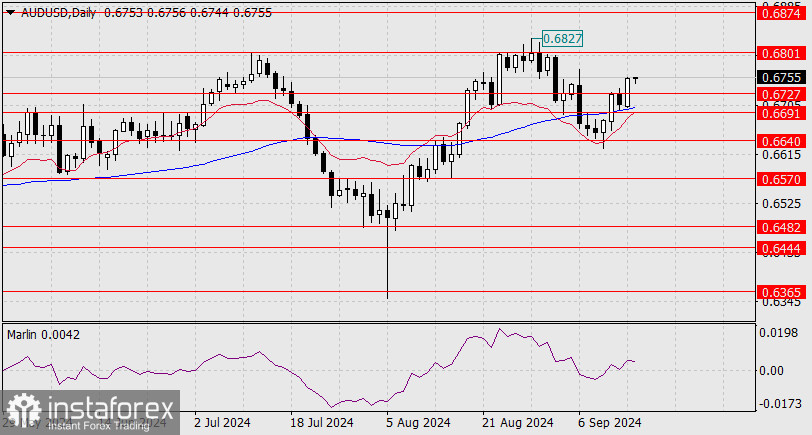

The Australian dollar successfully consolidated above the MACD indicator line on the daily chart, climbed above the 0.6727 level, and is preparing to attack the target resistance at 0.6801. If successful and the price consolidates above this level, it could extend its rise to the next target of 0.6874.

However, the Marlin oscillator isn't as optimistic as it's turning downward. If the price breaks above the August high of 0.6827, it would create a divergence with Marlin, which would be a strong reversal pattern.

The Federal Reserve will likely lower the rate by 0.25% tomorrow. It would be more convenient for the price to face this event while above 0.6727, as the MACD line also supports it from below.

The price and the oscillator have formed a divergence on the four-hour chart. The potential for growth remains high, making a consolidation at the support level of 0.6727 the most optimal scenario for the aussie.