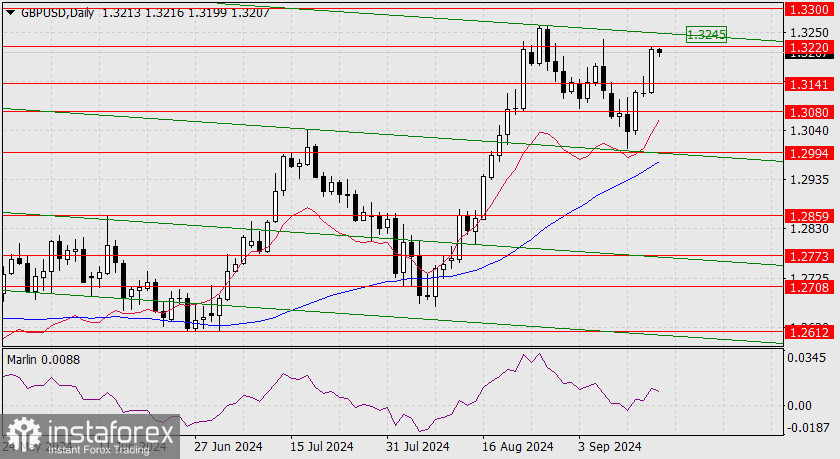

The British pound posted substantial gains on Monday, influenced by renewed expectations that the Bank of England will leave the interest rate unchanged. Market participants are factoring in only a 25% probability of a rate cut, inspired by the rise in housing prices in September from 0.8% y/y to 1.2% y/y. The pound nearly reached the target level of 1.3220, after which the Marlin oscillator slightly turned downward.

Today, the market will have to endure the expected good data on industrial production and retail sales in the US. The pound will likely undergo a downward correction. If the pound can withstand external pressure, it may reach the upper boundary of the price channel near 1.3245.

On the four-hour chart, the price is moving above the balance and MACD indicator lines. The Marlin oscillator is rising in positive territory but is preparing for sideways movement. The price will likely remain under the 1.3220 resistance level until the Federal Reserve meeting.