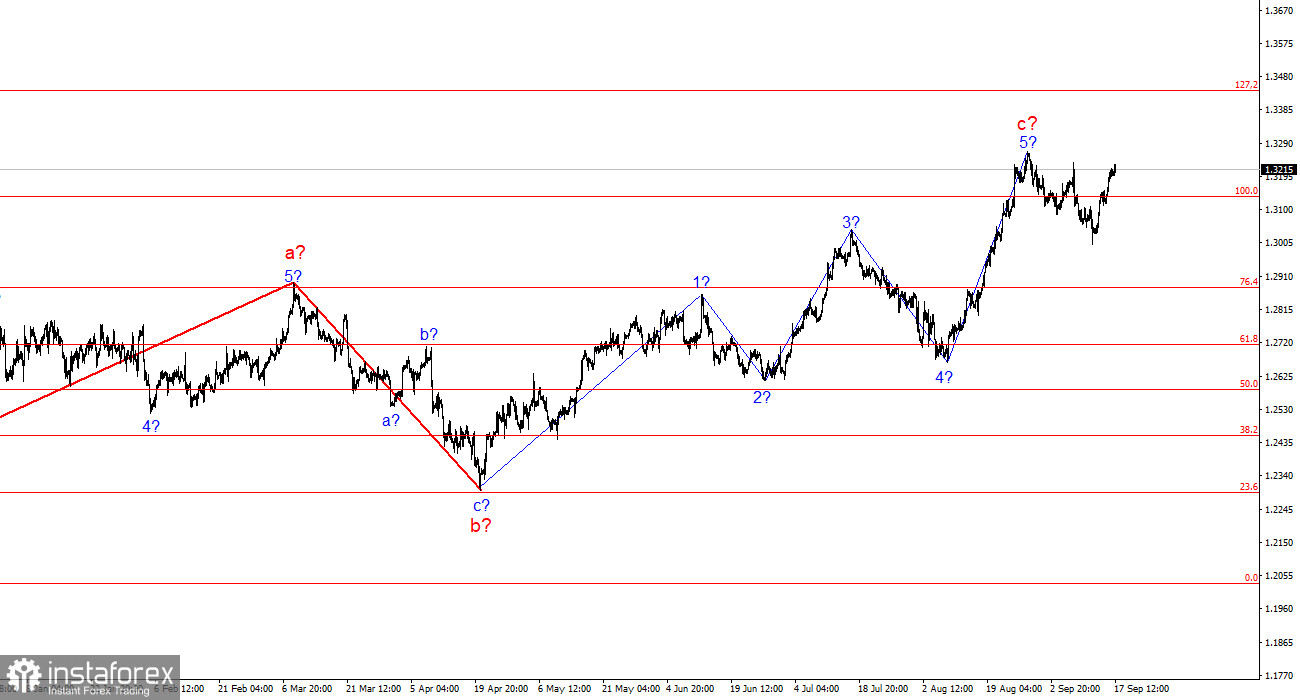

The GBP/USD wave pattern remains quite complex and highly ambiguous. For some time, the wave structure appeared convincing, suggesting the formation of a downward set of waves with targets below the 1.2300 level. However, in practice, demand for the British pound increased too much for this scenario to materialize, and it continues to rise.

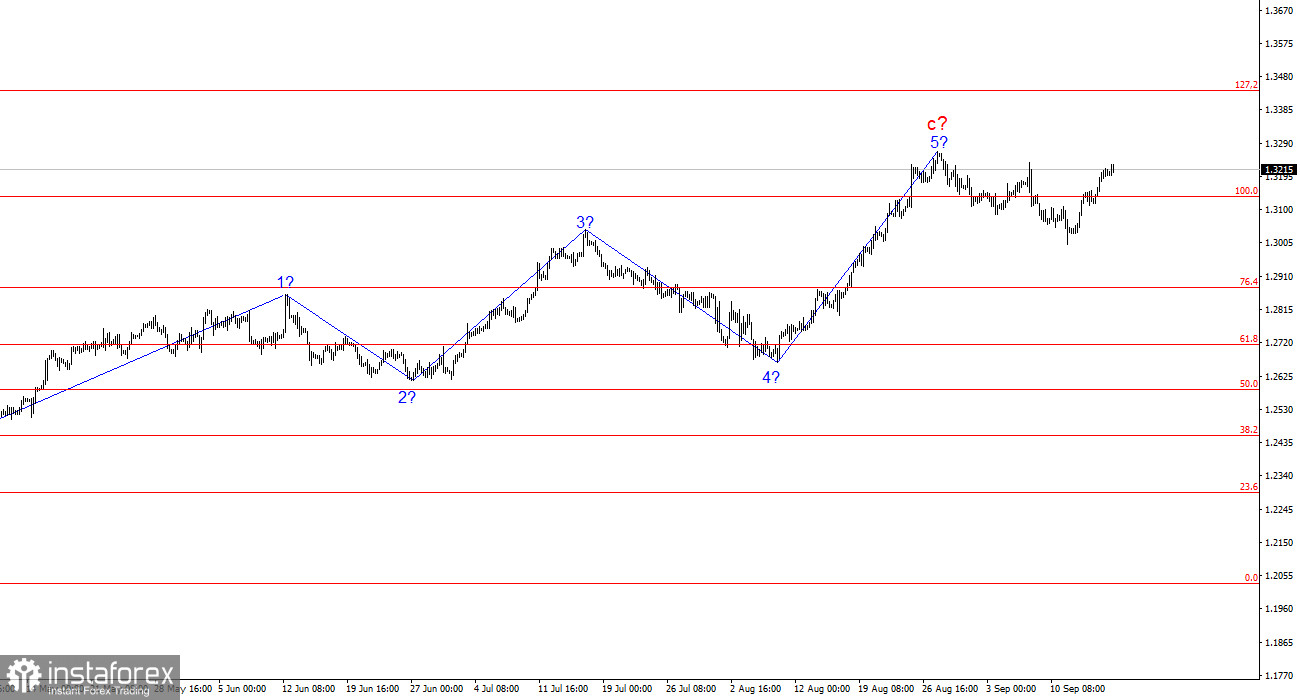

At present, the wave pattern has become quite complex. In my analysis, I aim to use simple structures, as complex ones often come with too many nuances and ambiguities. Recently, we saw another upward wave that caused the instrument to break out of the triangle. The current upward wave set, which presumably started on April 22, could become even more extended, as the market doesn't seem to stabilize until all stages of the Fed's rate cuts have been fully factored in. In recent weeks, we've observed a downward three-wave corrective structure, which may be part of the broader upward trend. If this is true, the rise could extend for several more months.

The GBP/USD exchange rate stayed flat on Tuesday. There was no significant news from the U.K., and a few hours ago, a retail sales report was released in the U.S., showing results roughly in line with market expectations. The U.S. dollar strengthened slightly on weaker data, but this seems temporary. The market continues to raise demand for the British pound ahead of the Bank of England and Federal Reserve meetings. As mentioned earlier, the probability of a Fed rate cut, according to the FedWatch tool, is increasing, leaving little doubt about which scenario the market is pricing in for tomorrow evening. If this assumption holds true, all that's left is to wait for tomorrow evening.

Based on the current wave pattern, the U.S. dollar has few chances of strengthening. The dollar hasn't been this weak for quite some time. It's not just that it's barely rising or even correcting—it's declining purely due to market expectations. According to the "buy the rumor, sell the fact" rule, demand for the U.S. dollar could rise tomorrow, as the market has already priced in a 50 basis point Fed rate cut. However, market sentiment remains bullish for the pound, so a further rise in the pound would not be surprising. The wave structure of the upward trend could become even more extended, with internal waves difficult to identify.

General conclusions.

The GBP/USD wave pattern still suggests a decline. If the upward trend began on April 22, it has already taken a five-wave form. The corrective wave has formed a three-wave structure, but in my view, it's too small to expect the formation of a new upward trend segment at this time. I still find selling the instrument more attractive, but we need clear signals. This week's significant news environment could result in sharp movements in either direction.

On a broader scale, the wave pattern has transformed. We can now expect the formation of a complex and extended upward corrective structure. At the moment, it is a three-wave structure, but it could extend into a five-wave structure, which may take several more months or even longer to complete.

Key principles of my analysis:

- Wave structures should be simple and understandable. Complex structures are difficult to play out and often bring unexpected changes.

- If you're unsure about what's happening in the market, it's better not to enter it.

- There is never 100% certainty in the direction of movement. Don't forget about protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.