Analysis of GBP/USD 5M

The GBP/USD pair resumed its upward movement on Wednesday. The pair primarily gained momentum after the UK inflation report, which showed that the core inflation rate accelerated. As we mentioned earlier, the Bank of England now emphasizes the core inflation figure more. Since it accelerated, there is no hope for a rate cut today. In the evening, the Federal Reserve also lowered rates by 0.5%, triggering additional US dollar sales. As we can see, everything is still working against the dollar. Hopes that the market had already priced in any dovish move by the Fed were not fulfilled. The market continues to sell the dollar eagerly based on any factor.

The pound may return to its previous levels today since Fed meetings always provoke strong reactions. It doesn't matter in which direction the pair moved immediately after the announcement. However, perhaps the worst-case scenario was realized yesterday evening for the US dollar. Still, the pound has been rising for so long that it's hard to believe its continued strengthening.

In the 5-minute time frame yesterday, several decent signals were formed. After the inflation report, the pair broke above the 1.3175 level and reached 1.3222. Afterward, the market became noticeably nervous and began to change direction frequently. Three false signals were formed near the 1.3222 level. In each case, the price moved 20 pips in the intended direction, so Stop Loss should have been triggered at break-even on all trades. As the Fed meeting approached, the focus should have been on exiting the market rather than entering it.

COT report:

The COT reports for the British pound show that the sentiment of commercial traders has been subject to frequent changes in recent years. The red and blue lines, representing the net positions of commercial and non-commercial traders, constantly intersect and are mainly close to the zero mark. We also see that the last downward trend occurred when the red line was below the zero mark. Therefore, a downturn could be expected around the level of 1.3154, but this assumption will need regular confirmation over time.

According to the latest report on the British pound, the non-commercial group closed 18,700 buy contracts and 900 sell contracts. Thus, the net position of non-commercial traders decreased by 17,800 contracts over the week, but overall, it continues to grow.

The fundamental background still does not provide any grounds for long-term purchases of the pound sterling, and the currency has a real chance to resume the global downtrend. However, an ascending trend line formed in the weekly time frame. Therefore, a long-term decline in the pound should not be expected unless the price breaches this trend line. Despite almost everything, the pound continues to rise. Even when COT reports show that major players are selling the pound, it continues to increase.

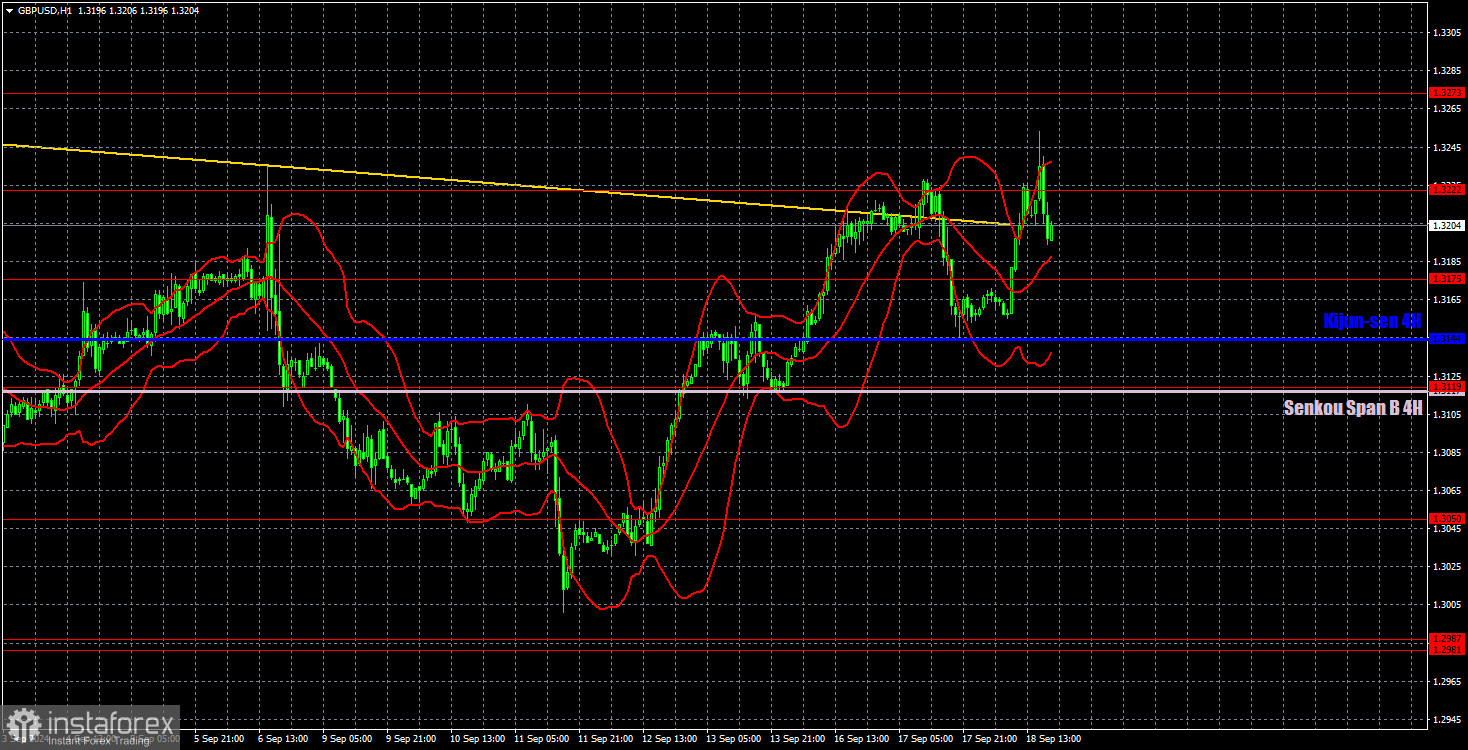

Analysis of GBP/USD 1H

In the hourly time frame, the GBP/USD pair resumed its upward movement, but we still cannot believe in the continuation of the pound's growth. The illogical upward trend of the British currency may continue for some time, but the pair is once again very overbought. Yesterday, there were significant reasons for the pair's rise, but we would like to remind you that the previous days, the pound also rose without apparent reasons. It has become common for the pound to increase with or without justification.

For September 19, we highlight the following key levels: 1.2605-1.2620, 1.2691-1.2701, 1.2796-1.2816, 1.2863, 1.2981-1.2987, 1.3050, 1.3119, 1.3175, 1.3222, 1.3273, 1.3367. The Senkou Span B lines (1.3117) and Kijun-sen (1.3144) can also serve as signal sources. Setting the Stop Loss to break even when the price moves in the intended direction by 20 pips is recommended. The Ichimoku indicator lines may shift during the day, which should be considered when determining trading signals.

The BoE's meeting is scheduled for Thursday, which may trigger additional purchases of the British currency. We still believe that the market has already priced in all the factors driving the pound's growth, so we cannot recommend long positions. There are no significant events in the US. We expect the pair to return to its pre-Fed meeting levels.

Explanation of illustrations:

Support and resistance levels: Thick red lines near which the trend may end. They are not sources of trading signals.

Kijun-sen and Senkou Span B lines: These Ichimoku indicator lines, transferred from the 4-hour timeframe to the hourly chart, are strong lines.

Extreme levels: Thin red lines from which the price previously bounced. These provide trading signals.

Yellow lines: Trend lines, trend channels, and other technical patterns.

Indicator 1 on COT charts: The net position size for each category of traders.