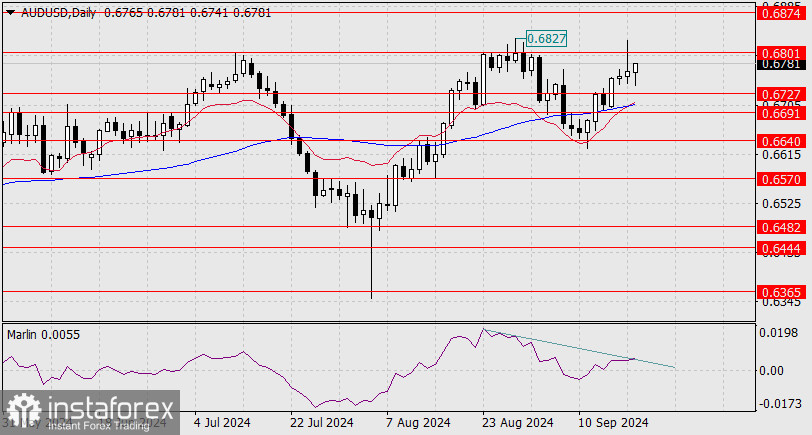

Yesterday, the Australian dollar jumped to the August peak, surpassing the target level of 0.6801, which we had considered in the previous forecast. This morning, employment data from Australia was released, showing slightly better-than-expected results. The unemployment rate remained at 4.2%, and employment increased by 47,500 versus the expected 26,400.

Following the data release, the national currency began to rise, but the growth faces technical pressure, mainly due to divergence in the daily time frame. The pair's main task is to break through the support range of 0.6691-0.6727, where the MACD line is located. Breaking 0.6691 opens the way not only to the nearest level of 0.6640 but also to 0.6570.

On the four-hour chart, the price is freely "wandering" within the 0.6727-0.6801 range. Consolidation above this range's upper boundary opens the prospect of growth to 0.6874, but declining commodity markets hinder this. The Marlin oscillator is lingering at the neutral zero line. In the main scenario, we expect the price to target the MACD line around the key support at 0.6691.