Analysis of Trades and Tips for Trading the British Pound

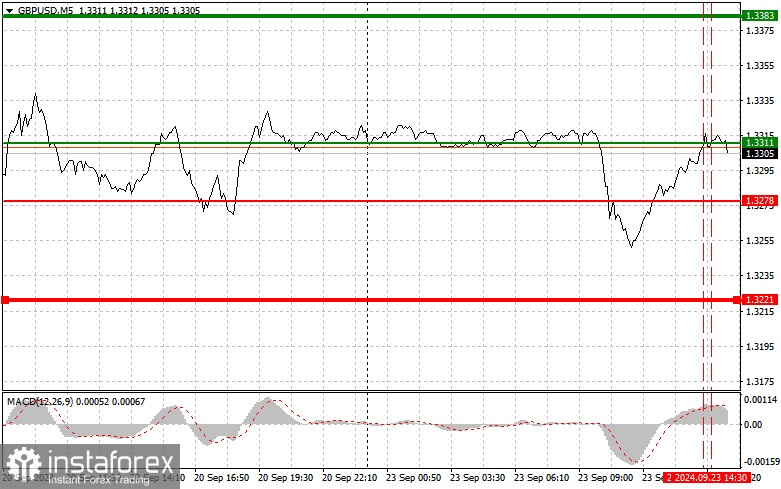

The test of the 1.3311 level occurred when the MACD indicator was significantly above the zero line, limiting the pair's upward potential. For this reason, I refrained from entering the market, especially after the significant sell-off of the pound following the release of PMI data from the UK earlier in the European session. The second test of 1.3311 occurred shortly afterward when the MACD was already in the overbought area, enabling the realization of Scenario #2 for selling the pound. At the time of writing, the pair had moved down by about 10 points. The second half of the day will be crucial for the pair, with the release of data on the U.S. Manufacturing PMI, Services PMI, and Composite PMI for August. Strong figures indicate a strong economy and a strong dollar. As for my intraday strategy, I plan to act based on the realization of Scenarios #1 and #2.

Buy Signal

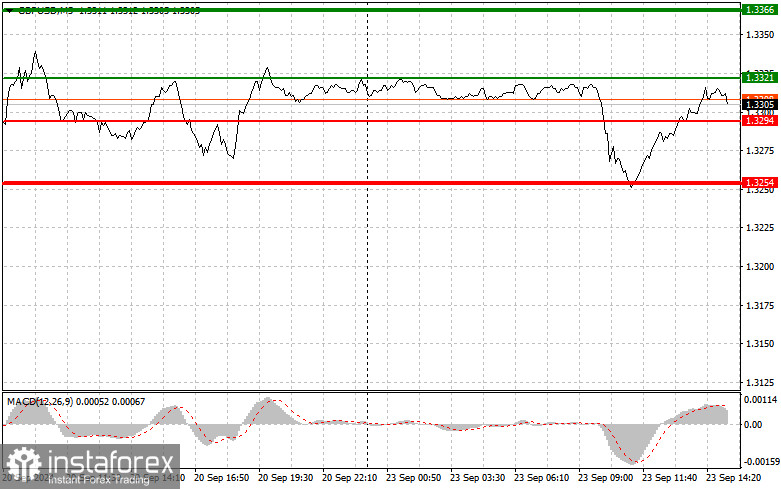

Scenario #1: I plan to buy the pound today at the entry level around 1.3321 (green line on the chart) with a target of 1.3366 (thicker green line on the chart). Around 1.3366, I will exit my long positions and open short ones (expecting a 30-35 point move in the opposite direction). The pound's appreciation today will depend on weaker U.S. economic data. Important: Before buying, ensure that the MACD indicator is above the zero line and has started to rise.

Scenario #2: I also plan to buy the pound if the price tests 1.3294 twice in succession while the MACD indicator is in the oversold zone. This will limit the pair's downward momentum and trigger an upward market reversal. An upward movement towards the target levels of 1.3321 and 1.3366 can be anticipated.

Sell Signal

Scenario #1: I plan to sell the pound today after an update of the 1.3294 level (red line on the chart), leading to a rapid decline in the pair. The key target for sellers will be 1.3254, where I will exit my short positions and immediately open long ones (expecting a 20-25 point move in the opposite direction). Sellers are expected to become more active if strong U.S. data is released. Important: Before selling, ensure that the MACD indicator is below the zero line and is starting to decline.

Scenario #2: I also plan to sell the pound if there are two consecutive tests of the 1.3321 level, with the MACD indicator in the overbought zone. This will limit the pair's upward momentum and lead to a downward market reversal. A decline to the target levels of 1.3294 and 1.3254 can be expected.

Chart Details:

- Thin green line – the entry level where buying the trading instrument is recommended.

- Thick green line – the estimated level where you can set Take Profit or manually secure profits, as further growth beyond this level is unlikely.

- Thin red line – the entry level where selling the trading instrument is recommended.

- Thick red line – the estimated level where you can set Take Profit or manually secure profits, as further declines beyond this level are unlikely.

- MACD Indicator – It's essential to consider overbought and oversold zones when entering the market.

Important Note:

Beginner Forex traders must exercise caution when making entry decisions. It's advisable to stay out of the market before the release of major fundamental reports to avoid sudden price fluctuations. If you choose to trade during news releases, always use stop orders to minimize potential losses. Without stop orders, you risk quickly depleting your entire deposit, especially if you do not implement sound money management practices and trade in large volumes.

Remember, successful trading requires a clear trading plan, as demonstrated above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for intraday traders.