Analysis of Trades and Tips for Trading the Euro

There were no tests of the levels I outlined in the first half of the day. This was due to the sharp drop in market volatility following the euro's decline, which resulted from very weak European PMI indices. It's now worth focusing on similar statistics but for the U.S. Data is expected for the Manufacturing PMI and Services PMI for the U.S. for August. Both indicators are performing reasonably well. Positive statistics will favor dollar buyers, putting pressure back on the euro. The speeches by FOMC members Raphael Bostic and Neel Kashkari will also be in the spotlight, as their statements can provide insight into what's happening within the Federal Reserve. As for my intraday strategy, I plan to follow Scenarios 1 and 2 to capture potential upward movement.

Buy Signal

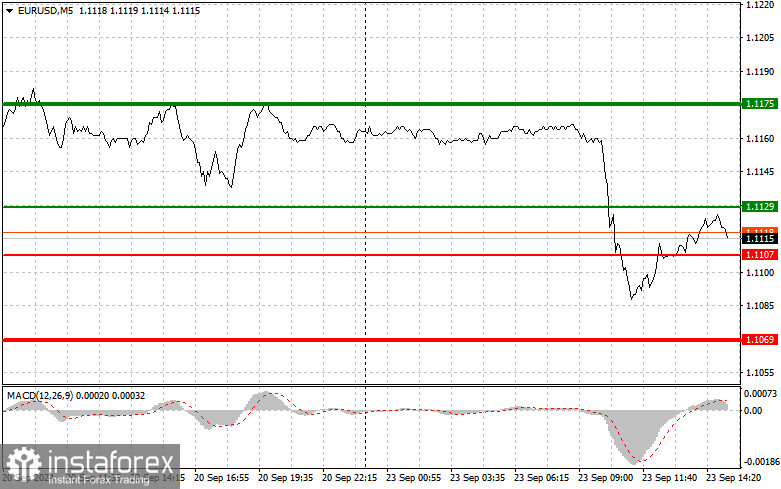

Scenario 1: Today, I intend to buy the euro when the price reaches 1.1129 (green line on the chart), aiming for a rise to the 1.1175 level. At 1.1175, I will exit the market and sell the euro in the opposite direction, aiming for a 30-35 point move from the entry point. A strong upward movement of the euro today can only be expected if the U.S. data is significantly worse than expected. Important: Before buying, ensure the MACD indicator is above the zero line and just beginning to rise.

Scenario 2: I also plan to buy the euro today in the event of two consecutive tests of the 1.1107 price when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a market reversal. A rise to the opposite levels of 1.1129 and 1.1175 can be expected.

Sell Signal

Scenario 1: I will sell the euro after reaching the 1.1107 level (red line on the chart). The target will be 1.1069, where I plan to exit the market and immediately buy the euro, aiming for a 20-25 point move from this level. Pressure on the pair will return if strong U.S. PMI statistics are released. Important: Before selling, ensure that the MACD indicator is below the zero line and just beginning to decline.

Scenario 2: I also plan to sell the euro today in the event of two consecutive tests of the 1.1129 price, when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline to the opposite levels of 1.1107 and 1.1069 can be expected.

What's on the Chart:

- Thin green line – entry price for buying the trading instrument.

- Thick green line – suggested price for placing Take Profit or fixing profit manually, as further growth above this level is unlikely.

- Thin red line – entry price for selling the trading instrument.

- Thick red line – suggested price for placing Take Profit or fixing profit manually, as further decline below this level is unlikely.

- MACD Indicator – When entering the market, it's important to consider overbought and oversold zones.

Important Note:

Beginner traders in the Forex market should make entry decisions cautiously, especially before the release of significant fundamental reports, to avoid sudden exchange rate fluctuations. If you decide to trade during news releases, always set stop-loss orders to minimize losses. Without stop-loss orders, you could quickly lose a significant portion of your deposit, especially if you do not use proper money management techniques.

Remember, successful trading requires having a clear trading plan, like the one presented above. Making spontaneous trading decisions based on the current market situation is usually an unprofitable strategy for an intraday trader.