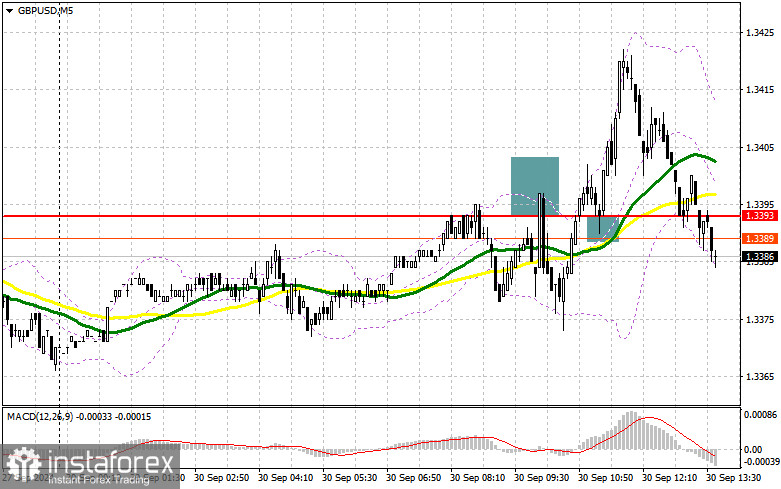

In my morning forecast, I focused on the level of 1.3393 and planned trading decisions around this point. Let's review the 5-minute chart to understand what happened. A rise and subsequent false breakout at this level offered an excellent entry point for selling the pound. However, after a 20-point decline, the pressure on the pair eased. A breakout and retest of 1.3393 provided a buying opportunity, leading to a 30-point rise. The technical outlook was revised for the second half of the day.

Requirements for Opening Long Positions on GBP/USD:

Weak economic data from the UK led to a decline in the pound, but there wasn't a significant sell-off, as the second-quarter figures are now less relevant. A minor downward revision serves as a further reason for the Bank of England to continue lowering interest rates. In the second half of the day, the Chicago PMI index data and a more crucial speech from Federal Reserve Chairman Jerome Powell are expected. His speech will shed light on the Fed's future direction regarding interest rates.

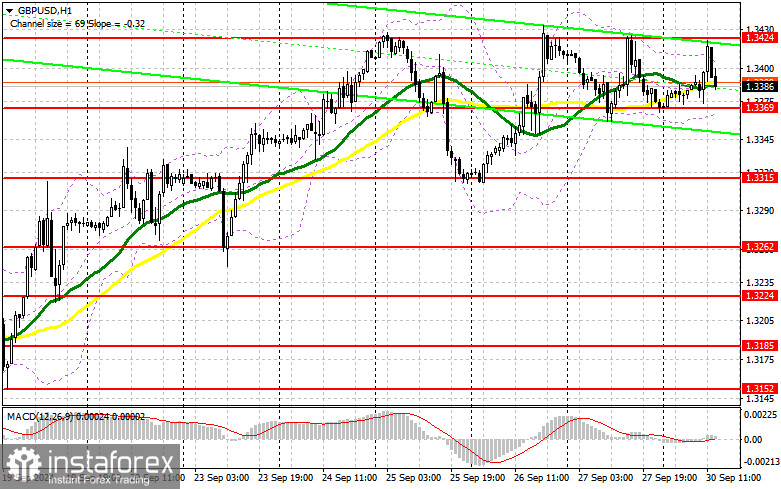

If Powell takes a hawkish stance, the pound may weaken, which I intend to capitalize on. A false breakout near 1.3369 will present an opportunity for a new upward move, aiming for recovery toward the 1.3424 resistance level—aligned with the monthly high. A breakout and retest of this range from top to bottom will strengthen the prospects of an upward trend, triggering sellers' stop-loss orders and providing an ideal entry point for long positions with a target at 1.3468. The ultimate target is 1.3510, where I plan to take profits.

If GBP/USD declines and there is no bullish activity around 1.3369 in the second half of the day—particularly where the moving averages are located—the pressure on the pair will likely intensify, leading to a decline and a retest of the 1.3315 support. Only a false breakout at this level will be a suitable condition for opening long positions. I'll consider buying GBP/USD on a rebound from the 1.3262 low, targeting a 30-35 point intraday correction.

Requirements for Opening Short Positions on GBP/USD:

Sellers attempted to capitalize on weak GDP data but failed to gain momentum. The main objective now is to defend the monthly high and resistance at 1.3424, which will likely be tested if Federal Reserve representatives adopt a dovish stance. A false breakout here will provide an ideal entry point for selling the pound, targeting a correction toward the 1.3369 support—the midpoint of the sideways channel.

A breakout and retest of this range from bottom to top will undermine buyers' positions, triggering stop-loss orders and opening the path to 1.3315. The final target will be the 1.3262 level, where I will take profits. If GBP/USD rises and there's no bearish activity at 1.3424 in the second half of the day—likely in the current bullish trend—buyers will continue pushing the pound higher. Bears will have to retreat to the 1.3468 resistance. I'll only consider selling after a false breakout. If downward momentum is absent, I'll seek short positions on a rebound from 1.3510, aiming for a 30-35 point correction.

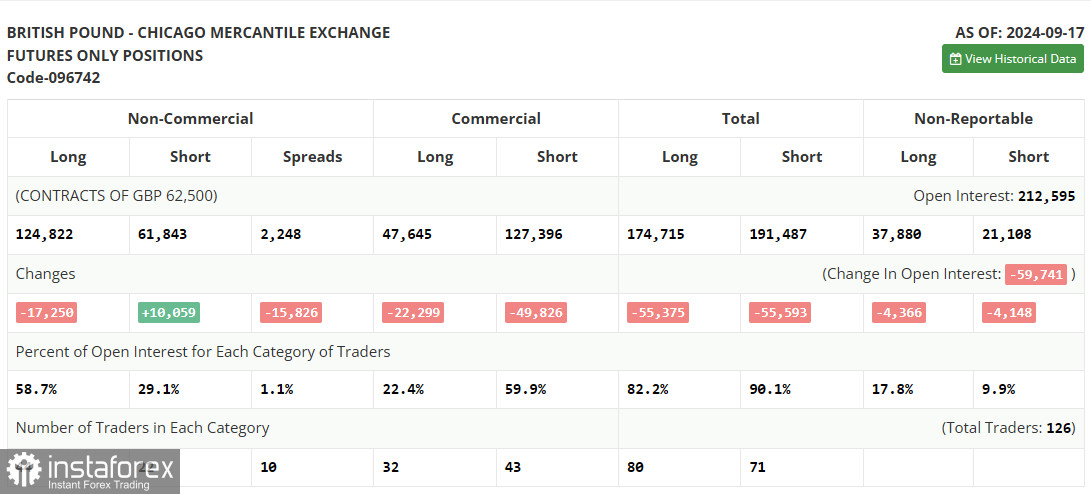

The Commitment of Traders (COT) report from September 17 indicated an increase in short positions and a reduction in long ones. After the Bank of England's decision to maintain monetary policy and the Federal Reserve's rate cut, pound buyers increased, although this is not yet reflected in the current report. Therefore, it shouldn't be given too much weight. The rise in short positions hasn't impacted the medium-term upward trend significantly. Thus, the lower the pound goes, the more it attracts new buyers. The latest COT report showed that long non-commercial positions decreased by 17,250 to 124,822, while short positions increased by 10,059 to 61,843. Consequently, the gap between long and short positions narrowed by 342.

Indicator Signals:

Moving Averages:

Trading is taking place above the 30- and 50-day moving averages, indicating pound growth.

Note: The period and prices of moving averages are based on the H1 hourly chart and differ from the classical daily moving averages on the D1 chart.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator around 1.3369 will act as support.

Indicator Descriptions:

- Moving Average: Smooths volatility and noise to determine the current trend. Period 50, marked in yellow.

- Moving Average: Period 30, marked in green.

- MACD Indicator: Fast EMA period 12, Slow EMA period 26, SMA period 9.

- Bollinger Bands: Period 20.

- Non-commercial traders: Speculators, such as individual traders, hedge funds, and large institutions.

- Long non-commercial positions: Total long open positions held by non-commercial traders.

- Short non-commercial positions: Total short open positions held by non-commercial traders.

- Total non-commercial net position: The difference between short and long positions of non-commercial traders.