In my morning forecast, I highlighted the level of 1.1047 and planned to base my market entry decisions on it. Let's now examine the 5-minute chart to analyze what happened. The rise, followed by a false breakout around 1.1047, provided a sell signal for the euro. However, after moving down 15 points, the pressure on the pair eased. The technical outlook for the second half of the day remains unchanged.

To open long positions on EUR/USD:

The reports related to service sector activity in the Eurozone countries did not disappoint overall, which is a positive sign. This raises hope that the delayed response by the European Central Bank in cutting interest rates will support the Eurozone economy, which has recently experienced a downturn after a strong first half of the year. In the second half of the day, we expect similar reports for the U.S. services PMI and the composite PMI for September. These reports are not expected to bring any particularly positive news, so the euro still has potential for recovery. The U.S. initial jobless claims report will also be released, along with speeches by FOMC members Raphael Bostic and Neel Kashkari. Recently, their statements have supported the dollar. If there is a bearish reaction to their speeches and strong U.S. data, a false breakout around 1.1007 could provide a good opportunity to open new long positions, targeting a return to 1.1047—resistance that remained unbroken in the first half of the day. A breakout and retest of this range could push the pair toward 1.1081. The most distant target will be the 1.1113 high, where I plan to take profits. In the event of a EUR/USD decline and minimal activity around 1.1007 in the second half of the day, which is more likely, the pressure on the pair will increase, leading to another significant sell-off. In this case, I will only enter after a false breakout around the next support at 1.0979. I plan to open long positions immediately on a rebound from 1.0952, targeting a 30-35 point upward correction within the day.

To open short positions on EUR/USD:

Sellers have a chance to push the euro lower, especially after actively defending the 1.1047 level in the first half of the day. If no sharp upward movement occurs after the U.S. data, I will focus on defending the 1.1047 resistance level. A false breakout there, similar to what I described earlier, will provide a good opportunity to open short positions, targeting a correction toward the 1.1007 support level. I expect new and fairly active buyer reactions at this level. However, a breakout and consolidation below 1.1007, followed by a retest, will provide another selling opportunity, targeting a move toward 1.0979. The most distant target will be the 1.0952 level, which would establish a new bearish trend. I plan to take profits at that level. If EUR/USD rises and bears fail to defend 1.1047, where the moving averages also support the sellers, bulls will try to regain control of the market. In this case, I will delay selling until the next resistance at 1.1081. I will also sell there, but only after a failed consolidation. I plan to open short positions immediately on a rebound from 1.1113, targeting a 30-35 point downward correction.

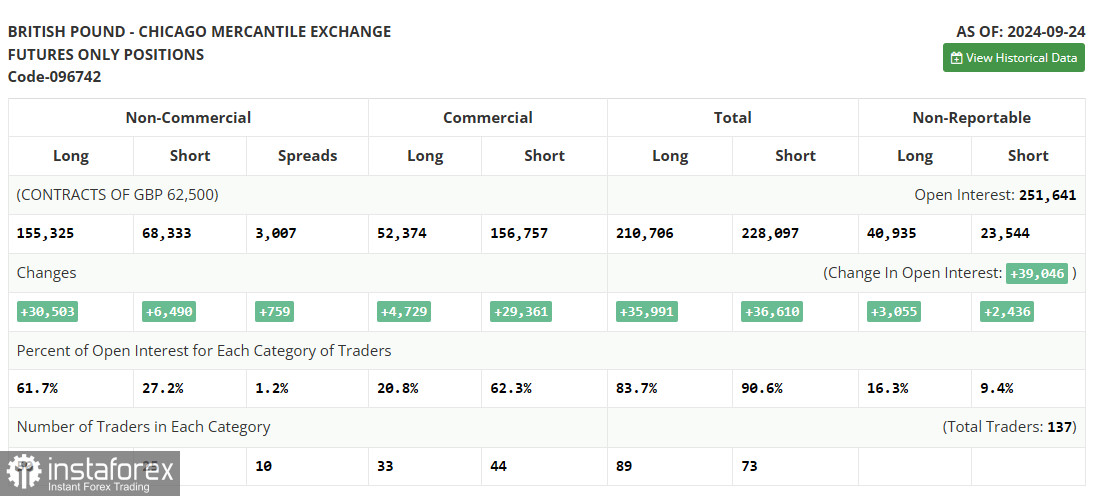

The COT (Commitment of Traders) report for September 24 showed a small increase in both long and short positions, maintaining the balance of power on the side of risk asset buyers. Clearly, the Federal Reserve's decision to cut rates by 0.5% continues to attract new euro buyers while prompting the selling of the dollar, as the chances of more aggressive easing in November remain high. The Fed's future actions will depend on the upcoming labor market data, with many reports expected soon. I will base my strategy on these. However, this does not negate the medium-term upward trend for the pair, and the lower the pair goes, the more attractive it becomes for buying. The COT report indicated that long non-commercial positions increased by 5,514 to 187,795, while short non-commercial positions grew by 3,462 to 116,097. As a result, the gap between long and short positions widened by 1,960.

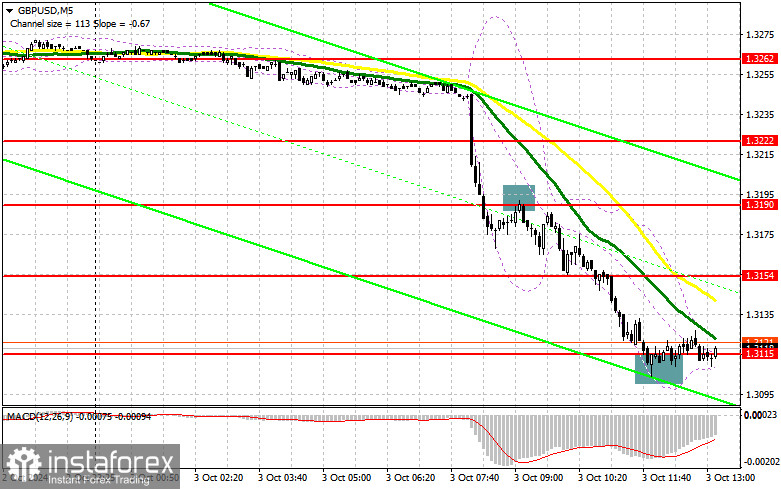

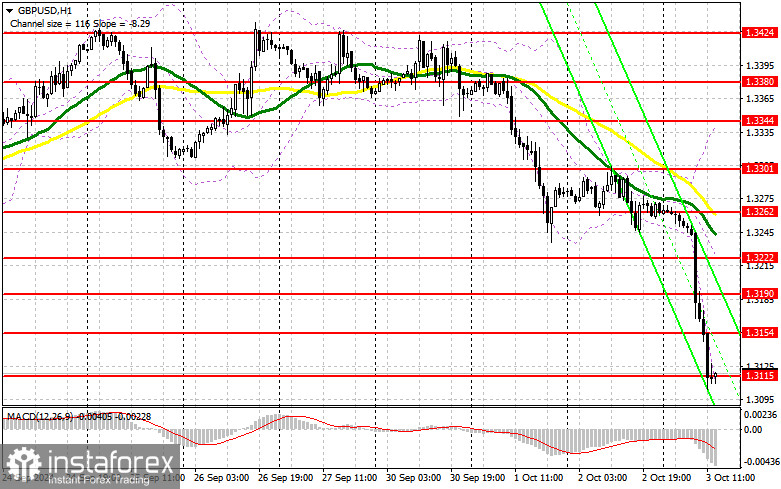

Indicator Signals:

Moving Averages

Trading is currently below the 30 and 50-day moving averages, indicating a decline in the euro.

Note: The moving averages' periods and prices are based on the H1 hourly chart, as viewed by the author, and differ from the general definition of classical daily moving averages on the D1 daily chart.

Bollinger Bands

In case of a decline, the lower boundary of the indicator near 1.1030 will act as support.

Indicator Descriptions:

- Moving average: Determines the current trend by smoothing volatility and noise. Period 50. Marked in yellow on the chart.

- Moving average: Determines the current trend by smoothing volatility and noise. Period 30. Marked in green on the chart.

- MACD Indicator: Moving Average Convergence/Divergence. Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands: Period 20.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet specific requirements.

- Long non-commercial positions: The total long open position of non-commercial traders.

- Short non-commercial positions: The total short open position of non-commercial traders.

- Total non-commercial net position: The difference between short and long positions of non-commercial traders.