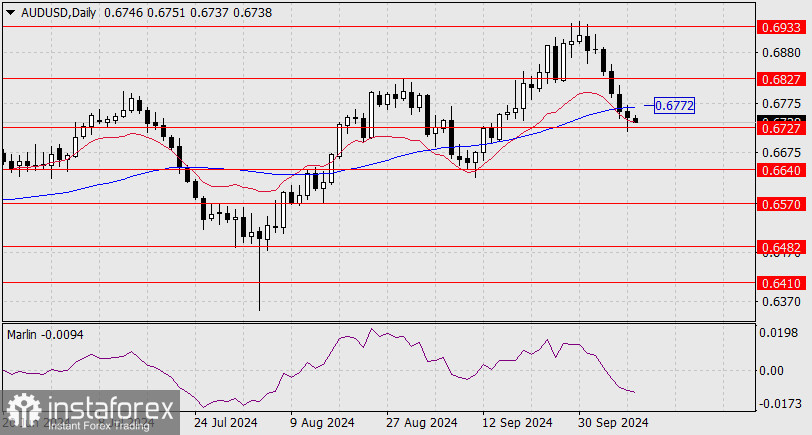

As of yesterday, the Australian dollar settled below the MACD line and tested the support level at 0.6727. The deeper the price moves away from this line, the harder it will be to return if other anti-dollar currencies begin to rise. As long as the price stays above the balance line (red moving average) and above linear support, there is still a good opportunity for the price to rise above the MACD line (0.6772) and consolidate above it.

Today's upward scenario is complicated because the Reserve Bank of New Zealand (RBNZ) lowered its rate from 5.25% to 4.75%, leading to a decline in the New Zealand dollar. From a technical standpoint, the Marlin oscillator isn't even hinting at a reversal. It seems that the potential for a reversal will become more apparent in a day. We are waiting.

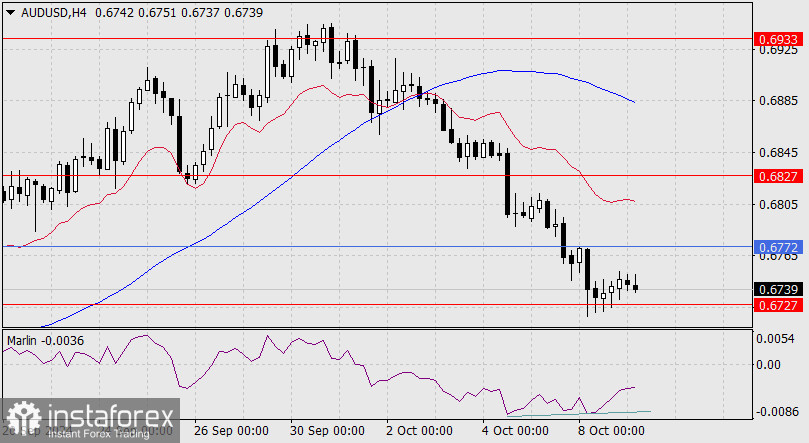

The price and the oscillator have formed a weak divergence on the four-hour chart. This could help prevent the price from falling before Marlin's expected reversal on the daily scale. For additional growth signals, Marlin on H4 must enter the positive zone, and the price should rise above 0.6772 – above the MACD line on the daily scale.